Photo: Flickr.com/Jack Snell

About Chevron

Chevron, formerly the Standard Oil Company of California, pioneered the concept of “service stations”.

Photo from Chevron’s history website.

Chevron, headquartered in San Ramon, California, is the 2nd largest integrated energy company in the United States, with a production capacity of 2.6 million oil-equivalent barrels per day (75% of which comes from outside the United States) and global refining capacity of 1.96 million barrels of oil per day. In addition to oil and natural gas exploration and production, Chevron also transports and refines petroleum products for delivery to retail, commercial, industrial and marine customers through a network of pipelines, ships, refineries and service stations. Chevron also participates in alternative energy projects, including major geothermal operations in Asia, and has a stake in the Chevron Phillips Chemical Company, which creates chemicals that are used as ingredients for fibers and plastics products. Chevron employs over 64,000 people worldwide.

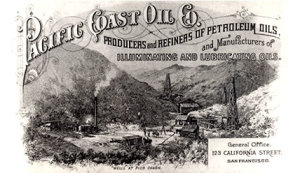

The logo of The Pacific Coast Oil Company, predecessor to Chevron, showed the earliest oil strike in California, at a location North of Los Angeles.

Image from Chevron’s history website.

Chevron’s legacy dates back to a successful oil strike in the Santa Susana Mountains north of Los Angeles in September 1876, shortly after the country’s centennial. Three years later, the Pacific Coast Oil Company was formed to organize the oil exploration business. The company grew and in 1900 was acquired by Standard Oil Company’s western subsidiary Standard Oil Company (Iowa). The California operations were later split off as a subsidiary of Iowa Standard – the Standard Oil Company (California). Eleven years later in a landmark anti-trust Supreme Court decision, Standard Oil Company was split up and Standard Oil Co. (California) was separated from its parent company.

Broken off from Standard Oil, California Standard pressed forward on its own path. The company expanded to selling directly to the end-user, opening its first “service station” in the early 1910s and aggressively expanding from there, to 218 service stations by 1919 and 735 by 1926. California Standard’s service stations not only gave customers a place to buy the company’s gasoline but also to have tires and headlights replaced and to take a break from the road.

1926 also marked the first of the company’s many acquisitions. Standard Oil Co. (California) acquired Pacific Oil Co. and renamed itself the Standard Oil Co. of California, or “Socal”.

Socal expanded to oil exploration across the planet. In June 1932 the company, under the auspices of its subsidiary Bahrain Petroleum, found oil overseas for the first time with a successful strike in Bahrain. Separately, Socal was negotiating with Saudi Arabia and in November 1932 signed an agreement with that country’s government that gave exploration and production rights to Socal’s subsidiary, California Arabia Standard Oil Co., which would later become Aramco (Arabian American Oil Co).

The company spent the next 50 years growing by further developing already productive fields and by expanding into new areas, including Iran. In 1984, Socal merged with Gulf Oil Company and renamed the new entity Chevron Corporation. In 2001, Chevron merged with Texaco (formerly The Texas Fuel Company) to form ChevronTexaco Corporation, but in 2005 shortened the name back to Chevron Corporation and acquired Unocal Corporation.

The company is a member of the S&P 500 index and trades under the ticker symbol CVX.

Chevron’s Dividend and Stock Split History

Chevron started increasing dividends in 1988 and met the Dividend Aristocrat criteria of 25 consecutive years of increasing regular dividend payments in 2012. Chevron’s dividend increases have been erratic, but last year the company announced its annual dividend in July, with the stock going ex-dividend in August.

Chevron has compounded its payout at an average rate of 2.9% over the last 5 years and 5.9% over the last 10 years.

Since beginning its record of annual dividend increases in 1988, Chevron has split its stock 4 times, each time 2-for-1. These occurred in February 1991, August 1995, August 1997 and, most recently, February 1999. Prior to this, Chevron split its stock 5 times: in September 1963, September 1967, February 1982, January 1983, and May 1985. Each of these splits were also 2-for-1.

Chevron’s Direct Purchase and Dividend Reinvestment Plans

Chevron has both direct purchase and dividend reinvestment plans. Investors interested in participating in either of these plans can find information at ComputerShare’s Investment Center website. The dividend reinvestment plan allows you to reinvest dividends in full or in part; you can also choose to have the dividends directly deposited into your checking account.

From your perspective as an investor, Chevron’s plan is pricey when it comes to fees, especially when compared to other dividend growth stocks. As with all ComputerShare plans, there’s a $10 fee for new investors to set up an account. If you’re interested in directly investing in Chevron stock, you’ll have to spend at least $250, either in a single purchase or in 5 consecutive monthly automatic purchases of at least $50. For any direct purchases, you’ll pay $2 per transaction for automatic debits or $4 per transaction for purchases by check. When reinvesting dividends, Chevron pays the transaction fee if you own less than 200 shares. Otherwise, you’ll pay a transaction fee of 5% of the amount reinvested. Regardless of whether you’re buying shares directly or by reinvesting dividends, you’ll pay 5 cents per share purchased.

When you sell your shares in the plan, you’ll pay 10 cents per share sold plus a transaction fee of between $15 and $25, depending on the type of sell order. You’ll also pay $5 to have the sale proceeds directly deposited to your account.

Helpful Links

Chevron’s Investor Relations Website

Current quote and financial summary for Chevron (finviz.com)

Information on the direct purchase and dividend reinvestment plans for CVX