Photo: Flickr.com/Fredrick Rubensson

About Colgate-Palmolive

This 1957 ad is almost as old as Colgate-Palmolive’s dividend growth history, but not quite – Colgate’s dividend growth began in 1964.

Photo courtesy SenseiAlan/flickr.com.

Colgate-Palmolive manufactures pet nutrition, and personal, oral and home care products for customers in over 200 countries around the world. Major company brands include Colgate dental products (toothbrushes and toothpaste), Palmolive and AJAX cleaners, Speed Stick deodorant, Irish Spring and Softsoap soaps, Murphy’s Oil Soap wood cleaner, and Tom’s of Maine personal care products.

Colgate-Palmolive’s heritage dates back over 200 years to 1806, 30 years after the British Colonies in North America declared independence from King George III. That year, William Colgate started a starch, soap and candle business on Dutch Street in what is now lower Manhattan in New York City. 14 years later, Colgate expanded to Jersey City, New Jersey where he built a starch factory. He continued his business through the years, reorganizing in 1857 as Colgate & Company. The Colgate Company introduced toothpaste in jars in 1873 and the collapsible toothpaste tube in 1896. By its 100th anniversary, Colgate had over 800 products for sale in the United States.

Colgate went international in 1914 and established a subsidiary in Canada. During the 1920s, Colgate established operations in Europe, Asia, Latin America and Africa. In 1928, Colgate merged with the Palmolive-Peet Company (which itself had been formed two years earlier by a merger of the Palmolive and Peet Soap Companies) to form the Colgate-Palmolive-Peet Company.

The Colgate-Palmolive-Peet Company was listed on the New York Stock Exchange on March 13, 1930 and in 1953 changed its name to Colgate-Palmolive Company. In 1956, Colgate-Palmolive moved the corporate headquarters to its current location at 300 Park Avenue in New York City. Before and since then, Colgate-Palmolive has grown through both organic development and acquisitions. In 1947, the company introduced AJAX cleaner and in 1966 introduced Palmolive dishwashing liquid. Colgate-Palmolive acquired Hill’s Pet Nutrition in 1976, the Softsoap liquid soap business from Minnetonka Corporation in 1987, Murphy Oil Soap in 1991, Mennen Company in 1992, and Tom’s of Maine in 2006.

The company is a member of the S&P 500 index and trades under the ticker symbol CL.

Colgate-Palmolive’s Dividend and Stock Split History

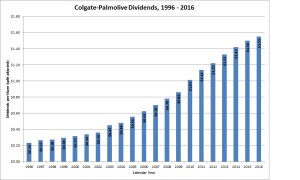

Colgate-Palmolive has paid regular dividends since 1895 and increased dividends annually since 1964. Colgate-Palmolive met the Dividend Aristocrat criteria of 25 consecutive years of increasing regular dividend payments in 1988. Since 2005, Colgate-Palmolive announces dividend increases in March, with the stock going ex-dividend in the middle of April.

Colgate-Palmolive has compounded its payout at an average rate of 5.4% over the last 5 years and 8.6% over the last 10 years.

Since beginning its record of dividend growth in 1964, Colgate-Palmolive has split its stock six times, most recently in March 2013. That was a 2-for-1 stock split and is one of four 2-for-1 stock splits since 1964 – the others were in June 1999, May 1997 and May 1991. The company also split its stock 3-for-1 in May 1973 and 3-for-2 in July 1965. You would now have 72 shares of Colgate-Palmolive stock for each share purchased in 1964.

Colgate-Palmolive’s Direct Purchase and Dividend Reinvestment Plans

Colgate-Palmolive has both direct purchase and dividend reinvestment plans. Investors interested in participating in either of these plans can find information at ComputerShare’s Investment Plan site. There is a cost of $10 to establish a direct purchase and dividend reinvestment plan account with ComputerShare and allows you to participate in all the plans that ComputerShare administers. If you’re interested in directly purchasing Colgate-Palmolive stock, the minimum purchase is $500 whether investing by check or automatic debit. Once you start participating in the plan, the minimum purchase is $50.

There is a full suite of fees associated with investing in Colgate-Palmolive through the plans. When you buy shares directly, you’ll pay 3 cents per share plus a transaction fee of $1 if paying by bank debit or $2.50 if paying by check. When reinvesting dividends, you’ll pay 3 cents per share plus a transaction fee of 5% of the reinvested dividends, up to a maximum of $1.25.

When you sell your shares in the plan, you’ll pay 10 cents per share sold plus a transaction fee of $10 for a batch order sale or $25 for a market order or limit order sale. There’s an additional transaction fee of $15 if you place your sell order by phone. ComputerShare will deduct the fees from the proceeds of the sale.

Helpful Links

Colgate-Palmolive’s Investor Relations Website

Current quote and financial summary for Colgate-Palmolive (finviz.com)

Information on the direct purchase and dividend reinvestment plans for CL