Archer Daniels Midland Company processes cocoa, corn, oilseeds and wheat into ingredients used by food manufacturers around the world. Photo: Flickr.com/Gotham Nurse

About The Archer Daniels Midland Company

Illinois-based Archer Daniels Midland Company is one of the largest agricultural processors in the world. The company has 31,000 employees and nearly 270 plants that “Connect Harvest to Home” in over 140 countries by processing agricultural products – specifically corn, oilseeds, wheat and cocoa – into products used as ingredients in common foods.

Archer Daniels’ primary business segments are Oilseeds Processing, Corn Processing, and Agricultural Services:

- The Oilseeds Processing segment is responsible for processing soybeans and soft seeds (such as cottonseed, sunflower seeds, canola and flaxseed) into vegetable oils and protein meals, along with processing cocoa beans into cocoa liquor, cocoa butter, cocoa powder and other ingredients used in the production of chocolate.

- The Corn Processing segment is responsible for corn milling activities that produce ingredients including sweeteners, ethanol, animal feeds, citric and lactic acids, xantham gum, and other food products.

- The Agricultural Services segment is responsible for providing storage, cleaning and transport services for a variety of agricultural commodities and finished products from farms to Archer Daniels’ processing facilities and from those processing facilities to its customers.

The history of Archer Daniels Midland dates back to 1902 when John W. Daniels began his linseed crushing business. A year later George A. Archer joined Daniels and in 1905 the two changed the name of the company to the Archer Daniels Linseed Company. The company acquired the Midland Linseed Products Company in 1923 and renamed itself the Archer-Daniels-Midland Company. The company began paying dividends in 1931 and has continued to do so since.

Over the subsequent 80 years, ADM expanded its reach in agricultural products through both organic growth and acquisitions. The company’s grain division was formed in 1927 when ADM bought The Armour Grain Company. In response to the 1973 Arab oil embargo and at the direct request of President Carter, ADM began producing ethanol. ADM invented textured vegetable protein in the 1960s, which led to the introduction of veggie burgers nearly 3 decades later.

The company is a member of the S&P 500 index and trades under the ticker symbol ADM.

Archer Daniels Midland’s Dividend and Stock Split History

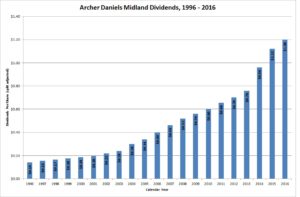

Archer Daniels Midland has compounded its dividend growth more than 10% a year over the last 19 years.

ADM has paid dividends since 1931 and increased them since 1962. Archer Daniels Midland traditionally increases its annual dividend in the 1st quarter of the year, with the stock going ex-dividend in February after announcing the increase earlier in the month.

Air Products has compounded its payout at an average rate of 12.8% over the last 5 years and 10.8% over the last 10 years.

Over the last 42 years, Archer Daniels Midland has split its stock twice and paid multiple stock dividends. The stock split 2-for-1 in September 1963 and 3-for-2 in December 1994. The company paid 5% stock dividends to investors annually from September 1995 to September 2001.

Archer Daniels Midland’s Direct Purchase and Dividend Reinvestment Plans

You can invest in Archer Daniels Midland through the company’s direct purchase and dividend reinvestment plans. Investors interested in participating in either of these plans can find information at ComputerShare’s Investment Plan site. There is a cost of $10 to establish a direct purchase and dividend reinvestment plan account with ComputerShare. If you’re interested in directly purchasing AbbVie stock, the minimum purchase is $250 when investing by check or 10 monthly purchases of $25 when investing by automatic debit.

The dividend reinvestment plan does not allow for partial dividend reinvestment – you must choose either to reinvest all the dividends or none of the dividends.

You’re subject to some fees when purchasing shares through the direct purchase plan. You’ll pay 12 cents per share plus a transaction fee that varies, depending on how you purchase the shares. For purchases by check the transaction fee is $5, while it decreases to $3.50 for one time purchases by bank debit and $2 per purchase for ongoing purchases by bank debit. When reinvesting dividends, Archer Daniels Midland pays all the fees.

When you go to sell your shares in the plan, you’ll pay a transaction fee of 12 cents per share. There’s an additional fee of $25 if you request that your shares be sold in a market order instead of a batch order. The plan administrator deducts the fees from the proceeds of the sale.

Helpful Links

The Archer Daniels Midland Company’ Investor Relations Website

Current quote and financial summary for Archer Daniels Midland (finviz.com)

Information on the direct purchase and dividend reinvestment plans for ADM