RenaissanceRe underwrites catastrophic reinsurance and insurance. Photo credit: freeimages.com/Palmer W. Cook.

About RenaissanceRe Holdings

RenaissanceRe Holdings provides reinsurance and insurance coverage, and related services to customers around the world. The company was founded in 1983 in Bermuda and employs 281 people worldwide. RenaissanceRe sells products to its customers through reinsurance brokers; 3 particular brokers handled 90% of RenaissanceRe’s business in 2014. The company also is part of the Lloyd’s of London insurance market through its Syndicate 1458 subsidiary.

Like nearly all insurance companies, RenaissanceRe derives most of its revenues from two sources: premiums from the sale of policies and income from investments. The company also derives a small portion of its revenues from advisory services, joint ventures and other items. Conversely, RenaissanceRe’s expenses are primarily claims paid out and related expenses, and the costs to acquire new policies.

RenaissanceRe reports results across three business segments: Catastrophe Reinsurance, Specialty Reinsurance and Lloyd’s. It also reports investment income in the “Other” segment and its various joint ventures under the “Joint Ventures” segment.

The Catastrophe Reinsurance segment covers protection against large natural catastrophes like earthquakes, hurricanes and floods. This segment also invests in insurance-linked securities – fixed income securities where at least a part of the repayment of the principal is linked to catastrophic events. This segment provided more than 60% of RenaissanceRe’s total gross premiums.

The Specialty Reinsurance segment provided 22% of the company’s total gross insurance premiums in 2014. The segment generates revenue through reinsurance on particular types of businesses: aviation, crop, financial and terrorism reinsurance are some examples of the markets in which this segment operates.

The Lloyd’s segment covers the operations of RenaissanceRe subsidiary Syndicate 1458, which operates in the Lloyd’s of London insurance marketplace. The Syndicate underwrites a range of property and casualty insurance and reinsurance products, and also covers certain specialty products like medical malpractice, liability and professional indemnity insurance. This segment generated slightly more than 17.3% of the company’s total gross premiums in 2014.

In 2014, RenaissanceRe wrote a total of $1.56 billion in premiums across all its operations, which was down 3.4% from 2013. Net income was $686.3 million, down 18.5% from 2013. Most of the drop in premiums written and net income was due to a drop in business in the Catastrophe Reinsurance segment. The book value of the company was up 12.3% to $90.15 on December 31, 2014 and the shareholders’ equity was roughly flat at $3.87 billion. More than half of the insurance premiums written in 2014 were in the United States and the Caribbean.

The company is making a concerted effort to balance its portfolio and reduce the relative amount of catastrophic reinsurance/insurance business it holds. As part of this effort, RenaissanceRe acquired Platinum Underwriters Holdings Ltd at the end of 2014 for $1.9 billion in cash and stock. The acquisition of Platinum adds to RenaissanceRe’s U.S. casualty and specialty reinsurance and insurance business. While the company indicated that it expects the acquisition to add to earnings in 2015, it did not indicate by how much.

RenaissanceRe has an active share repurchase program and in November 2014 authorized $500 million for share repurchases after repurchasing 5.4 million shares in 2014. The new program is equivalent to roughly 4.76 million shares, which represents more than 10% of the company’s outstanding shares.

The company is a member of the S&P Mid Cap 400 index and trades under the ticker symbol RNR.

RenaissanceRe Holdings’ Dividend and Stock Split History

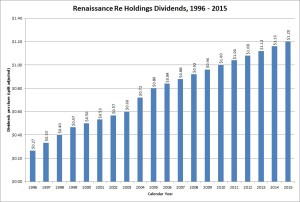

RenaissanceRe has increased dividends since 1996. The company traditionally increases the dividend in the 1st quarter of the calendar year, with the announcement in mid-February and the stock going ex-dividend in mid-March. In February 2015, RenaissanceRe announced a 3.5% increase in its dividend to an annualized rate of $1.20. The company should announce its 21st year of dividend growth in February 2016.

For the last 11 years, RenaissanceRe has increased its quarterly dividend by a penny a share, resulting in 5 and 10-year dividend growth rates of 3.71% and 4.14% respectively. Since beginning its record of annual dividend growth in 1996, RenaissanceRe has compounded the dividend at 8.24%. The bulk of this growth came from double-digit increases in 1997 – 1999 and 2004 – 2005.

Since its founding in 1983, RenaissanceRe has split its stock once – 3-for-1 in May 2002.

Over the 5 years ending on December 31, 2014, RenaissanceRe stock appreciated at an annualized rate of 14.45%, from a split-adjusted $49.07 to $96.37. This outperformed the 13.0% annualized return of the S&P 500 index, but slightly underperformed the 14.9% annualized return of the S&P Mid Cap 400 index over the same period.

RenaissanceRe Holdings’ Direct Purchase and Dividend Reinvestment Plans

RenaissanceRe does not have a direct purchase or dividend reinvestment plan. In order to invest in RenaissanceRe, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

RenaissanceRe Holdings’ Investor Relations Website

Current quote and financial summary for RenaissanceRe Holdings (finviz.com)