American States Water provides utility service to the city of Big Bear and the surrounding areas. Photo of Big Bear Lake courtesy erenemre/flickr.com.

About American States Water Company

American States Water Company has subsidiaries that provide utility services to portions of 10 counties in southern California, and to military bases in certain parts of the United States. The company has its headquarters in San Dimas, California and employs over 700 people.

Through its Golden State Water Company (GSWC) subsidiary, American States provide water and wastewater services to 75 communities in California and electric services to the city of Big Bear Lake and portions of San Bernardino County in southern California. GSWC was incorporated in California in 1929 and at the end of 2014 served over 250,000 water utility customers and 23,000 electric customers.

The American States Utility Services subsidiary provides water and wastewater services to various military installations through its subsidiaries. The subsidiaries are on 50-year firm, fixed price contracts with the Government; the contract prices are subject to redetermination every 3 years. The military installations include Fort Bliss, TX; Andrews AFB, MD; Fort Lee, Fort Eustis, Fort Story, VA; Fort Jackson, SC; and Fort Bragg, Pope Army Airfield and Camp Mackall, NC.

American States Water has three reportable segments: water utilities, electric utilities and contracted services. In 2014, 74% of the company’s EPS came from the water utilities segment, 4% came from the electric utilities segment and 20% came from the contracted services segment. (The remaining 2% came from other earnings, like earned interest.)

In 2014, American States Water earned $61.1 million of income on $466 million. These numbers were each down less than 3% from 2013’s figures, but income was up more than 12% from 2012. EPS in 2014 was $1.57, down 2.5% from 2013. Given the current annualized dividend rate of 89.6 cents a share, the company’s current payout ratio is 57.1%.

In addition to the annual dividend, American States Water also has an active share repurchase program. In March 2014, the company authorized the repurchase of 1.25 million shares, to be completed by June 30, 2016. By the end of 2014, there were 705,000 shares remaining to be repurchased.

The company is a member of the S&P Small Cap 600 and Russell 2000 Small Cap indices and trades under the ticker symbol AWR.

American States Water Company’s Dividend and Stock Split History

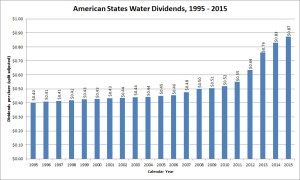

American States Water has accelerated its dividend growth recently, compounding its dividend at at rate of nearly 11% over the last 5 years.

American States Water Company has paid dividends every year since 1931 and has increased them since 1955. Until 2012, American States would increase dividends on an irregular schedule, sometimes going up to 8 quarters without increasing dividends. (Because the dividend increases occurred in the middle of the year, dividends still increased year-over-year.) In 2012, American States began to increase the dividend in the 3rd quarter of the calendar year, with the stock going ex-dividend in mid-August. Most recently, American States increased their dividend by 5.41% to an annualized rate of 89.6 cents. I expect American States to increase their dividend for the 62nd consecutive year in mid-August 2016.

Since introducing the regular pattern of increasing dividends annually in the 3rd quarter, American States has grown dividends very nicely for a utility. Dividend growth from 2011 – 2012 and 2012 – 2013 exceeded 15% each year. Prior to 2012, dividend growth was very sluggish and usually in the low single digits. Over the 5 years ending in 2014, American States compounded its dividend at a rate of 10.92%. For the 10 and 20 years ending in 2014, the company compounded its dividends at 6.85% and 3.96%, respectively.

In the last 25 years, American States Water has split its stock 3 times, most recently 2-for-1 in September 2013. American States Water also split its stock in October 1992 (2-for-4) and June 2002 (3-for-2). For each share of American States Water stock purchased prior to October 1993, you would now have 6 shares.

Over the 5 years ending on December 31, 2014, American States Water Company stock appreciated at an annualized rate of 19.79%, from a split-adjusted $15.10 to $37.25. This greatly outperformed the 13.0% annualized return of the S&P 500 index, the 15.9% annualized return of the S&P Small Cap 600 index, and the 14.0% compounded return of the Russell 2000 Small Cap index over the same period.

American States Water Company’s Direct Purchase and Dividend Reinvestment Plans

American States Water Company has both direct purchase and dividend reinvestment plans. You do not need to be a current investor to participate in the plans. New investors can join by purchasing a minimum of $500 of American States Water stock upon enrollment. Note that you’ll be charged an enrollment fee of $10 to join. Also, the dividend reinvestment plan can be used only if you agree to reinvest dividend on at least 15 shares of stock. If you own less than 15 shares, your dividends will be paid to you by check.

If you already participate in the dividend reinvestment plan, you can purchase additional shares with a minimum investment of $100.

The plans’ fee structures are favorable for investors, with the company picking up all costs on stock purchases. When you sell your shares, you’ll pay a transaction fee of $15, plus a sales commission of 12 cents per share. All fees are deducted from the sales proceeds.

Helpful Links

American States Water Company’s Investor Relations Website

Current quote and financial summary for American States Water Company (finviz.com)

Information on the direct purchase and dividend reinvestment plans for American States Water Company