Analog Devices manufactures high-performance chips used in a variety of applications, including automobile air bag sensors and deployment systems. Photo: Flickr.com/Adam Bartlett

About Analog Devices

Analog Devices designs, manufactures and markets high-performance analog and digital signal processing integrated chips, software and subsystems. Analog Devices’ products are used automated and industrial systems across a wide variety of markets including healthcare, defense, automotive and communications. The company was founded in 1965 in Massachusetts and its headquarters remains there today, in the town of Norwood outside Boston.

Analog Devices generates about 60% of its annual revenues outside the U. S.; the company has more than 100,000 customers worldwide. The company also has more than 30 design facilities worldwide, with manufacturing facilities in Massachusetts, Ireland and the Philippines.

Analog’s operations are divided into two business groups: the Industrial and Healthcare Business Group, and the Communications and Automotive Business Group. Examples of how the company’s products are used include – in the automotive industry – advanced driver assistance system (e.g., radar used to avoid collisions) and crash sensors in airbag systems. In the consumer and communications industries, Analog Devices’ products are used in smart phones and tablets, and in basestations for cell networks. The company’s sales and marketing operations are integrated into the two business areas.

Competition comes from Broadcom Corporation, Freescale Semiconductor, Maxim Integrated Products and Microchip Technology, among others.

The company is a member of the S&P 500 index and trades under the ticker symbol ADI.

Analog Devices’ Dividend and Stock Split History

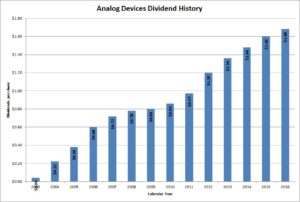

Analog Devices has grown dividends every year since 2003. The company generally announces dividend increases in February, with the stock going ex-dividend later in the month. In February 2016, Analog Devices announced a 5.0% increase to its payout to an annual rate of $1.68 per share.

Analog Devices has a good record of dividend growth, with a compounded growth rate of 11.61% over the last 5 years and 10.84% over the last decade. Since the first full year of dividends in 2004, the company has compounded dividends at 18.46% annually.

Analog Devices split its stock 2-for-1 in April 1979. The company also offered a 15% stock dividend in March 1978 and 5% stock dividends in March 1975, March 1976 and March 1977.

Over the 5 years ending on December 31, 2015, Analog Devices stock appreciated at an annualized rate of 11.11%, from a split-adjusted $54.11 to $31.95. This slightly outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Analog Devices’ Direct Purchase and Dividend Reinvestment Plans

Analog Devices does not have a direct purchase or dividend reinvestment plan. In order to invest in Analog Devices’ stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Analog Devices’ Investor Relations Website

Current quote and financial summary for Analog Devices (finviz.com)