Badger Meter develops meters for measuring fluid flow for municipal water utilities and industrial customers. Photo: Freeimages.com/Caroline Koolschijn

About Badger Meter

Badger Meter develops, manufactures and markets flow measurement, control and communications products and systems worldwide. Badger Meter’s products are used to measure the amount of water, oil, chemicals and other fluids through pipes and pipelines. The company has its headquarters in Milwaukee, Wisconsin and employs about 1,500 people.

Although the company operates its business in one segment, there are two categories of products that Badger Meter develops. The first covers water meters and related technologies to municipal water and wastewater utilities. This covers both mechanical and electronic meters, along with the technologies used to remotely read these meters via wireless (i.e., radio frequency) signals. The bulk of these products are sold in the United States due to countrywide standards. This category of products generates about 70% of company revenues.

The second category of products is developed for industrial customers to track and measure fluids movement through pipes and pipelines. These products are used in multiple applications like water and wastewater; HVAC; oil & gas; chemical and petrochemical; the automotive aftermarket; and the concrete construction process. This category of products generates about 30% of company revenues.

The bulk of company sales are in the United States and most international sales are in Canada and Mexico.

The company is a member of the Russell 2000 Small Cap index and trades under the ticker symbol BMI.

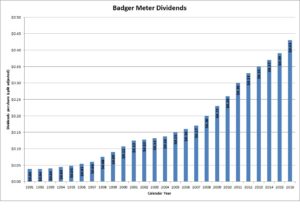

Badger Meter’s Dividend and Stock Split History

Badger Meter has grown dividends every year since 1992. The company pays dividends in March, June, September and December and generally announces annual dividend increases in August, with the stock going ex-dividend at the end of the month. In August 2016, Badger Meter announced a 15.0% increase to its payout to an annual rate of $0.46 per share.

Badger Meter has a good record of dividend growth. Dividend increases cycle between 4 – 5 periods of 10%+ increases and 4 – 5 year periods of slower growth. This results in a 5-year dividend growth rate of 7.47% and a 10-year dividend growth rate of 10.39%.

Badger Meter has split its stock four times, most recently in September 2016. The company also split its stock in April 1997, November 2004 and February 2006. All stock splits were 2-for-1, meaning that the stock has split 16-for-1 cumulatively since 1997.

Badger Meter’s Direct Purchase and Dividend Reinvestment Plans

Badger Meter has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to enroll in the plans. The minimum initial investment is $100 and the minimum for additional investments is $50. The dividend reinvestment plan allows only full reinvestment of dividends.

The plans are favorable for investors. The only fees assessed on stock purchases is a transaction fee of $2.50 and a commission of 10 cents per share on direct purchases. There are no fees on shares purchased through dividend reinvestment. When you go to sell your shares, you’ll pay a transaction fee of $15 and a commission of 10 cents per share. All fees will be deducted from the sales proceeds.

Helpful Links

Badger Meter’s Investor Relations Website

Current quote and financial summary for Badger Meter (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Badger Meter