California Water Service Group provides water and wastewater services to over 275,000 customers in the Greater San Francisco area. Photo courtesy Wilson Lam/flickr.com.

About California Water Services Group

California Water Service Group is a holding company with six operating subsidiaries that provide regulated and non-regulated water utility service to nearly 500,000 customers in four states. The regulated subsidiaries are California Water Service Company (Cal Water), New Mexico Water Service Company, Washington Water Service Company, and Hawaii Water Service Company. Non-regulated services – like billing and meter reading services, and leasing antenna sites to telecommunications companies, are provided by the CWS Utility Services and HWS Utility Services subsidiaries. The company dates back to the formation of Cal Water in 1926.

California Water Service Group organizes all of its business into a single segment. Nearly all (94%) of the company’s customers and revenues come from business conducted in California. More than half of the California customers are in the greater San Francisco Bay area; the rest of the customers are in locations throughout the rest of the state. The Hawaii Water Services and HWS Utility Services subsidiaries serve 4,300 customers on the islands of Maui and Hawaii. The Washington Water Services subsidiary serves 16,300 customers in the Tacoma and Olympia areas, and the New Mexico Water Services subsidiary serves 7,600 customers in three communities between Albuquerque and Las Cruces, NM.

In 2014, California Water Services Group earned $56.7 million on revenues of $597.5 million. These figures were up 20.0% and 2.3%, respectively from 2013. The increase in net income was due to the approval of a 9.2% rate increase by the California Public Utilities Commission (CPUC). The CPUC has approved future rate increases of 1.9% in 2015 and 1.8% in 2016. Earnings per share were up in 2014 as well, by 16.7% to $1.19. With the current annualized dividend rate of 67 cents per share, the company’s payout ratio is 56.3%. The company has stated that it targets a payout ratio of 60%, giving the company a bit more room to grow the dividend.

The company is a member of the Russell 2000 index and trades under the ticker symbol CWT.

California Water Services Group’s Dividend and Stock Split History

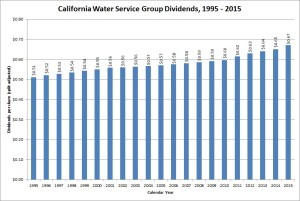

California Water Service Group has grown its dividends slowly, compounding them at a rate of less than 2% over the last quarter century.

California Water has paid dividends since 1945 and increased them since 1968. The company regularly announces increases at the end of January, with the stock going ex-dividend towards the middle of February. In January 2015, California Water announced a 3.08% increase in its dividend to an annualized rate of 68 cents per share. California Water should announce its 49th annual dividend increase in January 2016.

Like many public utilities, California Water has grown its dividend very slowly over its history. Since 2001, the largest increase in the quarterly dividend has been half a cent, resulting in a 5-year dividend growth rate of 2.40%. Longer term, the dividend growth rates are even slower, with the company posting a 25-year dividend growth rate of 1.74%.

The company has split its stock six times. The first split, 4-for-1, occurred in 1940. The next split occurred in March 1959 and was 2-for-1. It would be another 25 years until the stock split again – in May 1984 the company split the stock 2-for-1 again. The remaining three splits were also 2-for-1 and occurred in October 1987, January 1998 and, most recently, in June 2011.

Over the 5 years ending on December 31, 2014, California Water Service stock appreciated at an annualized rate of 9.21%, from a split-adjusted $15.62 to $24.27. This underperformed the 13.0% compounded return of the S&P 500 and the 14.0% compounded return of the Russell 2000 Small Cap indices over the same period.

California Water Services Group’s Direct Purchase and Dividend Reinvestment Plans

California Water Service has both direct purchase and dividend reinvestment plans. You do not need to be a current investor in California Water Service to participate in the plans. The minimum investment amount is $250 for new investors and $25 for existing shareholders. The dividend reinvestment plan does allow for partial reinvestment of dividends.

The plans’ fee structures are favorable to investors, with the company picking up all costs on stock purchases, both directly and through dividend reinvestment. When you go to sell your shares, you’ll pay a transaction fee of $15 plus a commission of 10 cents per share. All fees will be deducted from the sales proceeds.

Helpful Links

California Water Services Group’s Investor Relations Website

Current quote and financial summary for California Water Services Group (finviz.com)

Information on the direct purchase and dividend reinvestment plans for California Water Services Group