Among the core brands that Church & Dwight owns are Arm & Hammer and Oxiclean. Photo courtesy Mike Mozart/flickr.com.

About Church & Dwight

Church & Dwight manufactures a range of household and personal products around the world. The company markets its products under multiple brands, including several known worldwide: Arm & Hammer; Trojan; Oxiclean; Spinbrush; Orajel; and Nair. The company has its headquarters in New Jersey, its primary manufacturing facilities in Wyoming and Ohio and employs 4,200 people.

Church & Dwight’s history dates back to 1846 when John Dwight formed John Dwight and Company to manufacture and sell “aerated salt”. A year later, Austin Church formed Church & Company to produce baking soda. The two became brothers-in-law when Austin Church married John Dwight’s sister. In 1896, the descendents of the two men consolidated their businesses under the name Church & Dwight Co., Inc.

The company has three reportable business segments: Consumer Domestic, Consumer International and Specialty Products. Both the Consumer Domestic and Consumer International segments focus on household and personal care products, while the Specialty Products Division produces a range of grades and granulations of sodium bicarbonate for industrial, institutional and other applications. The Consumer Domestic segment provided 75% of total company sales in 2014, while the Consumer International segment provided 16% of 2014 sales for Church & Dwight. Specialty Products provided the remaining 9% of company sales.

Church & Dwight relies on supplies of soda ash as a primary material to manufacture baking soda. The company’s obtains most of its soda ash supply from the mining of trona (that’s trisodium hydrogendicarbonate dihydrate for the chemists among us) in southeastern Wyoming. In its 2014 Annual Report, Church & Dwight noted that it has access to supplies of soda ash “for the foreseeable future”.

The company competes with several other dividend growth stocks in the personal products and cleaning products segment. Procter & Gamble, Clorox and Colgate-Palmolive are S&P Dividend Aristocrats that, along with Sun Products Corporation and S. C. Johnson & Son, represent Church & Dwight’s primary competition.

Church & Dwight posted sales of $3.3 billion and earned $413.9 million in 2014. These figures were up 3.2% and 4.9%, respectively, from 2013. Earnings per share were $3.01, up 7.9% year-over-year, giving the company a payout ratio of 45.2% (using the 2015 dividend of $1.36. The debt to capitalization ratio increased from 26% to 34% in 2014. For 2015, the company has stated it expects organic sales growth of about 3%, and that earnings per share will be up 7 – 9%.

The company also has an active share repurchase program. In January 2014, Church & Dwight allocated $500 million to repurchase stock on the open market. At the end of 2014, $107.2 million remained on the program that, at current prices, would allow the company to buy back less than 1% of its outstanding shares.

The company is a member of the S&P 500 index and trades under the ticker symbol CHD.

Church & Dwight’s Dividend and Stock Split History

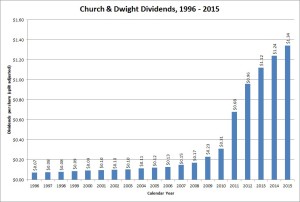

Church & Dwight has rapidly increased its payout over the last 5 years, more than quadrupling its dividend since 2010.

Church & Dwight has increased dividends since 1997 and paid regular quarterly dividends since 1901. The company announces annual dividend increases at the end of January, with the stock going ex-dividend in the first half of February. In January 2015, the company announced an 8.1% increase to an annualized rate of $1.34. I expect Church & Dwight to announce its 20th year of dividend increases in January 2016.

The company has accelerated its dividend growth in recent years, and has built a 5-year compounded dividend growth rate of 34.4% and a 10-year growth record of 27.5%. Since 1995, Church & Dwight has compounded its dividend at an average rate of 15.7%.

Since beginning its record of dividend growth, Church & Dwight has split its stock 3 times: in September 1999 (2-for-1), September 2004 (3-for-2) and in June 2011 (2-for-1). Prior to that the company split its stock 2-for-1 in March 1986. A single share purchased prior to this would have split into 12 shares.

Over the 5 years ending on December 31, 2014, Church & Dwight stock appreciated at an annualized rate of 23.08%, from a split-adjusted $27.57 to $77.88. This significantly outperformed the 13.0% compounded return of the S&P 500 index over the same period.

Church & Dwight’s Direct Purchase and Dividend Reinvestment Plans

Church & Dwight Inc. has both direct purchase and dividend reinvestment plans. You do not need to already be an investor in Church & Dwight to participate in the plans. For new investors, the minimum initial investment is $250 or $50 if you sign up for at least 5 months of automatic investments. Follow on direct investments have a minimum of $50. The dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans’ fee structures are not very favorable for investors. There is a fee of $10 when opening an account in the plan and the purchase fees are steep, compared to other companies’ plans. For direct purchases of stock, you’ll pay a transaction fee of $5 and a commission of 5 cents per share. When reinvesting dividends, you’ll pay a transaction fee of $3 and the same commission of 5 cents per share.

When you sell your shares in the plan, you’ll pay a transaction fee of between $15 – $25 and a commission of 12 cents per share. If you request help from support staff on the phone, you’ll pay an additional $15. All fees will be deducted from the sales proceeds.

Helpful Links

Church & Dwight’s Investor Relations Website

Current quote and financial summary for Church & Dwight (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Church & Dwight

Update: Edited to reflect the addition of Church & Dwight to the S&P 500 index on December 28th, 2015.