There are over 625 Cracker Barrel stores around the country. Photo: Flickr.com/Mike Mozart

About Cracker Barrel Old Country Store

Cracker Barrel Old Country Store operates 637 restaurants across 42 states. All of these stores are company-owned; none are franchised. The restaurants serve “home style” and “country cooking” food, like country ham, chicken and dumplings, and meatloaf. Over 80% of Cracker Barrel restaurants are located near interstate highways, while the others are concentrated around vacation and tourist spots. The typical restaurant has seating for 177 guests and serves an average of 6,700 customers per week.

In addition to food, Cracker Barrel restaurants also sell company branded apparel and accessories. These products account for roughly 30% of revenues. The company also licenses its name to food products sold through supermarkets and other retail outlets, which are sold under the “CB Old Country Store” brand.

The company is a member of the Russell 2000 index and trades under the ticker symbol CBRL.

Cracker Barrel’s Dividend and Stock Split History

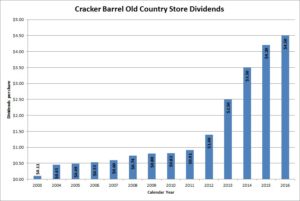

Cracker Barrel has paid dividends since at least 1982 and grown them since 2003. The company generally announces dividend increases at the beginning of June, with the stock going ex-dividend in mid-July. In June 2016, the company announced a 4.5% increase to its payout to an annualized rate of $4.60.

Cracker Barrel has an outstanding record of dividend growth, led by double digit increases from 2011 – 2015. Over the last 5 and 10 years, the company’s annual dividend growth rates averaged 37.7% and 23.9%, respectively.

From 1983 – 1993, Cracker Barrel split its stock 3-for-2 7 times. These splits occurred in July 1983, March 1987, February 1990, April 1990, March 1991, March 1992, and March 1993. You’d now have 17.1 shares of Cracker Barrel stock for each share purchase prior to 1983.

Over the 5 years ending on December 31, 2015, Cracker Barrel Old Country Store stock appreciated at an annualized rate of 21.74%, from a split-adjusted $45.40 to $121.41. This dramatically outperformed the 10.20% compounded return of the S&P 500 index and the 7.44% compounded return of the Russell 2000 over the same period.

Cracker Barrel’s Direct Purchase and Dividend Reinvestment Plans

Cracker Barrel has both direct purchase and dividend reinvestment plans. You do not need to already be an investor in the company to participate in the plans. For new investors, the minimum initial investment is $250. Follow on direct investments have a minimum of $25. The dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans are very favorable for investors, as the fees for purchases and sales are minimal. There are no fees when you purchase shares through the plan, either directly or through dividend reinvestment. When you sell your shares in the plan, you’ll pay a fee of $15 per sell order along with a 10 cent per share commission. These fees will be deducted from the sales proceeds.

Helpful Links

Cracker Barrel Old Country Store’s Investor Relations Website

Current quote and financial summary for Cracker Barrel Old Country Store (finviz.com)