CSX operates one of the nation's largest rail networks, with most of its operations east of the Mississippi. Photo: Flickr.com/Eli Christman

About CSX Corporation

CSX Corporation operates one of the nation’s largest rail networks, with a 21,000 mile rail network serving 23 states east of the Mississippi River, the District of Columbia, and the Canadian provinces of Ontario and Quebec. The company’s network includes access to more than 70 ocean, river and lake port terminals to serve domestic and export markets, along with track connections to about 240 short-line and regional railroads. CSX, which dates back to the chartering of The Baltimore and Ohio Railroad Company in 1827, employs 29,000 people including 24,000 union members.

CSX’s primary operating subsidiary is CSX Transportation, Inc., which has three primary business lines: (1) merchandise business, which carries about 40% of the company’s volume and generates roughly 60% of the company’s revenue; (2) coal business, which carries about 15% of CSX’s volume and generates about 20% of CSX’s annual revenue; and (3) intermodal business, which carries about 40% of the company’s freight volume but only generates 15% of the company’s revenue.

The company is a member of the S&P 500 index and trades under the ticker symbol CSX.

CSX Corporation’s Dividend and Stock Split History

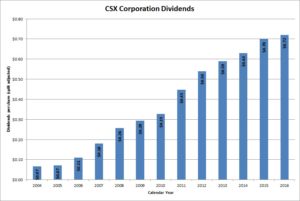

CSX Corporation has paid and grown dividends since 2004. The company generally announces dividend increases in mid-April, with the stock going ex-dividend in May. However, the company skipped its dividend increase in 2016.

CSX Corporation has a modest record of dividend growth, although the dividend growth has slowed recently. Although the company has compounded dividends at 20.67% over the last decade, over the last 5 years the dividend growth has slowed to half that at 10.02% annually.

CSX Corporation has split its stock twice since beginning its record of dividend growth in 2004. In August 2006, CSX split its stock 2-for-1. Five years later, in May 2011 CSX split its stock 3-for-1. A single share of stock purchased prior to August 2006 would now be 6 shares of stock.

Over the 5 years ending on December 31, 2015, CSX Corporation stock appreciated at an annualized rate of 5.99%, from a split-adjusted $19.12 to $25.58. This significantly underperformed the 10.20% compounded return of the S&P 500 index over the same period.

CSX Corporation’s Direct Purchase and Dividend Reinvestment Plans

CSX Corporation has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in either plan. For new investors, the minimum initial investment is $200. Follow on direct investments have a minimum of $25 for electronic transfers and $50 for investments by check. The dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans are somewhat favorable for investors, as the fees for purchases and sales are nominal. The only fee you’ll pay when purchasing shares through the direct purchase plan is $5 if you invest by check. In addition, you’ll also pay a 10-cent per share commission when purchasing shares electronically, by check or through reinvested dividends. When you sell your shares in the plan, you’ll pay a fee of $15 per sell order along with a 10 cent per share commission. These fees will be deducted from the sales proceeds.

Helpful Links

CSX Corporation’s Investor Relations Website

Current quote and financial summary for CSX Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for CSX Corporation