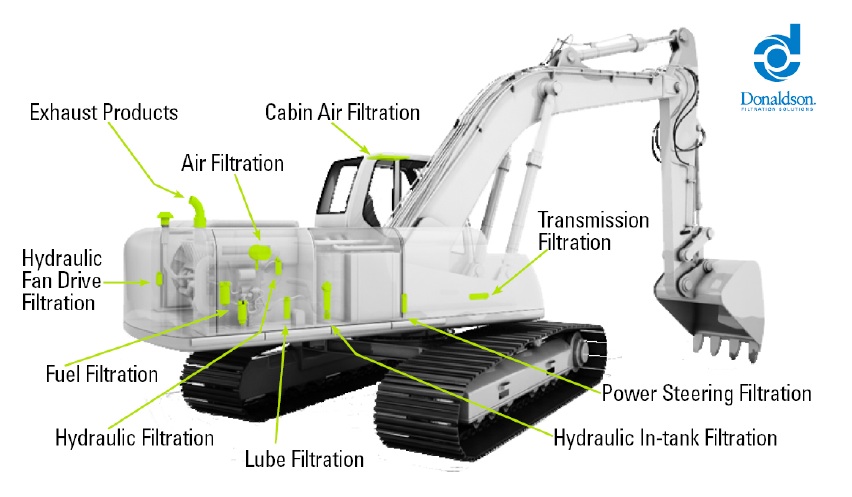

Multiple Off-Road filtration products from Donaldson are used in a given vehicle. Image from Donaldson Company June 2015 Investor Presentation.

About Donaldson Company

Donaldson Company manufactures filtration systems and replacement parts worldwide. The company was founded in 1915, employs 12,500 people and is headquartered in Minneapolis, Minnesota. The company owns multiple trademarks and brands including the Donaldson, PowerCore and Ultra-Web lines of filtration systems.

Donaldson organizes its business into two business segments: Engine Products and Industrial Products. The Engine Products segment manufactures and sells filtration systems, exhaust and emissions systems and replacement filters to independent distributors, original equipment manufacturers (OEMs) and OEM dealer networks, and large equipment fleets in a variety of markets including the construction, mining, agricultural, truck, aerospace and defense markets. The bulk of segment sales came from aftermarket products (i.e., replacement parts to OEM customers); these products provided over 40% of segment sales. The Engine Products segment provided about 64% of total company sales and earnings.

The Industrial Products segment serves industrial dealers, distributors, OEMs and end-users with specialized air and gas filtration systems, compressed air filtration systems, and dust, fume and mist collectors. Applications for these products include hard disk drives and semi-conductor manufacturing. This segment provides the remainder of Donaldson’s sales and earnings.

Donaldson saw modest growth in fiscal year 2014 (ended July 31, 2014). From FY 2013 to 2014, Donaldson sales and earnings were up 1.5% to $2.5 billion and up 5.2% to $260.2 million, respectively. The company had earnings per share of $1.76, resulting in a payout ratio of 39% – right in the middle of Donaldson’s target of 35 – 45%. And as a worldwide company with 39 manufacturing plants around the world, foreign currency effects impacted the company as sales were reduced by $11.4 million and earnings by $1.0 million. The increase in sales came mainly from aftermarket sales of replacement filters. This offset a large decrease in gas turbine sales as Donaldson’s customers continued to absorb the electrical generation capacity that the company delivered in 2013.

Geographically, sales in Europe and in the Americas were up, which were partially offset by a decrease in sales to Asian customers. Overall, customers in Europe and the Asia-Pacific region each provided about a third of Donaldson’s 2014 net income, while customers in the United States provided roughly 20% of net income.

Looking forward to 2015 results, Donaldson has repeatedly lowered full year estimates as the company has reported quarterly results. Donaldson initially estimated FY2015 EPS of $1.81 – $2.01. The company lowered the estimate to $1.77 – $1.97 when it reported 1st quarter results, to $1.65 – $1.85 when it reported 2nd quarter results and finally to $1.53 – $1.59 when it reported 3rd quarter results. A stronger than expected dollar is causing much of the reduction. The current estimate assumes an exchange rate of 1 Euro to $1.12 and 119 Yen to the dollar; both of these are currently optimistic for the company. The currency effects are also impacting total sales. The current FY2015 sales estimate is $2.35 billion, down from the original estimate of $2.57 – $2.67.

Donaldson has 8.5 million shares remaining on its current share repurchase program. The company has stated that it intends to continue share repurchases and expects to repurchase at least 4% of the company’s outstanding shares this fiscal year.

The company is a member of the S&P Mid Cap 400 index and trades under the ticker symbol DCI.

Donaldson Company’s Dividend and Stock Split History

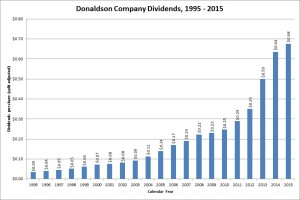

Donaldson Company has increased dividends since 1986 and paid quarterly dividends since 1956. Since 2011, Donaldson has announced a dividend increase at the end of May, with the stock going ex-dividend in mid-June. In 2013, the company announced a second dividend increase in November.

Donaldson announced its most recent dividend increase – a 3.0% increase to an annualized rate of 68 cents – in May 2015. I expect Donaldson to announce its 30th annual dividend increase in May 2016.

Despite the current headwinds that the company is now facing, Donaldson is one of a few companies that has doubled its dividend every 5 years on average over the last quarter century. Donaldson has compounded its dividend at an average of nearly 16% for the last 25 years. Over the last 5 and 10 years, Donaldson has compounded the dividend at 22.2% and 17.0%, respectively.

Over the last 40 years Donaldson has split its stock 7 times. The most recent split was a 2-for-1 split executed in March 2012. Prior to that, Donaldson split its stock in August 1978 (3-for-2), May 1988 (2-for-1), July 1992 (3-for-2), April 1994 (2-for-1), January 1998 (2-for-1), and March 2004 (2-for-1). A single share of stock purchase prior to August 1978 would now be 72 shares.

Over the 5 years ending on December 31, 2014, Donaldson Company stock appreciated at an annualized rate of 14.04%, from a split-adjusted $19.85 to $38.28. This outperformed the 13.0% annualized return of the S&P 500 index but underperformed the 14.9% annualized return of the S&P Mid Cap 400 index over the same period.

Donaldson Company’s Direct Purchase and Dividend Reinvestment Plans

Donaldson Company has both direct purchase and dividend reinvestment plans. You must already be an investor in Donaldson to participate in the plans. The minimum amount for the direct purchase plan is $10. The dividend reinvestment plan does not allow for partial reinvestment of dividends.

The plans’ fee structures are favorable for investors, with the company picking up all costs on stock purchases. When you sell your shares, you’ll pay a sales commission of between $15 and $30, depending on the type of sell order you request. There’s an additional $5 fee to have the proceeds directly deposited to your account. All fees are deducted from the sales proceeds.

Helpful Links

Donaldson Company’s Investor Relations Website

Current quote and financial summary for Donaldson Company (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Donaldson Company