Eversource Energy provides natural gas and electricity service to portions of New England, including Northampton, MA, pictured here. Photo: flickr.com/6SN7

About Eversource Energy

Eversource Energy provides electrical and natural gas service to more than 3 million customers across New England. The company, which was called Northeast Utilities until April 2015, is a holding company for The Connecticut Light and Power Company (CL&P), NSTAR Electric Company (NSTAR-E), NSTAR Gas Company (NSTAR-G), The Public Service Company of New Hampshire (PSNH), Yankee Gas Services Company (Yankee Gas) and The Western Massachusetts Electric Company (WMECO). Eversource and its subsidiaries have nearly 8,000 employees; Eversource is headquartered jointly in Boston, Massachusetts and Hartford, Connecticut.

Eversource has three reportable business segments: Electric Distribution, Electric Transmission, and Natural Gas Distribution. The Electric Distribution segment covers the more than 1,140 MW in generation capacity from PSNH and WMECO. The Electric Transmission segment is composed of the transmission businesses in CL&P, NSTAR-E, PSNH, and WMECO. Finally, the Natural Gas Distribution segment covers the gas businesses of NSTAR-G and Yankee Gas.

Geographically and in terms of reach, the various subsidiaries vary in their number of customers. CL&P provides electricity to 1.2 million customers across the state; NSTAR-E delivers electricity to 1.2 million customers in eastern Massachusetts; PSNH generates and distributes electricity to 503,000 customers in parts of New Hampshire; WMECO distributes electricity to 209,000 customers across Massachusetts; and NSTAR-G and Yankee Gas provide natural gas service to customers in Massachusetts and Connecticut, respectively.

The company is a member of the S&P 500 index and trades under the ticker symbol ES.

Eversource Energy’s Dividend and Stock Split History

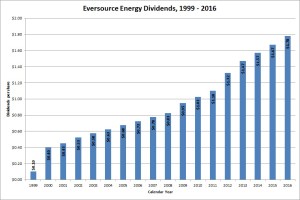

Eversource Energy and before that, Northeast Utilities, has grown dividends since 1999. Prior to 1999, Northeast had paid dividends since at least 1985 but suspended the dividend payout in mid-1997 and then restored it at the end of 1999. The company announces annual dividend increases in early February, with the stock going ex-dividend at the end of February. Most recently, in February 2016, Eversource increased its dividend by 6.6% to an annualized $1.78.

Eversource has a good record of dividend growth, with 5-year and 10-year compounded growth rates of 10.10% and 9.40%, respectively. Since 2000 – the company’s first full year of dividends since beginning to grow the dividend payout – the company has compounded dividends at a rate of 9.78%.

Eversource Energy has not split its stock in its history.

Over the 5 years ending on December 31, 2015, Eversource Energy stock appreciated at an annualized rate of 13.63%, from $26.96 to $51.07. This outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Eversource Energy’s Direct Purchase and Dividend Reinvestment Plans

Eversource Energy has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. If you don’t currently own stock in the company, you can enroll with a minimum initial investment of $500, either at one time or in 10 monthly installments of at least $50. Once enrolled, you can purchase additional shares with a minimum investment of $50. The dividend reinvestment plan allows for full and partial dividend reinvestment.

The plans’ fees are fairly large as compared to other companies’ plans. When you enroll, you’ll pay an initial enrollment fee of $10. When buying stock, you’ll pay a fee of $5 on purchases by check and $2.50 on purchases by automatic debit, plus a commission of 5 cents per share. The 5-cent commission also applies to dividend reinvestments. When you sell your shares, you’ll pay a transaction fee of $15 or $25 (depending on the type of sell order you place) plus a commission of 10 cents per share.

Helpful Links

Eversource Energy’s Investor Relations Website

Current quote and financial summary for Eversource Energy (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Eversource Energy