Expeditors International provides worldwide logistics solutions for its customers, including coordinating ocean shipments of cargo. Photo courtesy Peter Kaminski/flickr.com.

About Expeditors International of Washington, Inc.

Expeditors International of Washington is a global logistics service company with operations in 63 countries. The company does not own any aircraft or ships; rather, it purchases cargo space in volume from carriers and then resells it to smaller volume customers at prices better than those customers could obtain on their own. The company also provides various shipping services including consolidating smaller volume shipments into standard ocean vessel containers, providing documentation for clearing customs, and arranging for the payment of customs and other taxes. The company has over 14,000 employees – less than half of whom are located in the United States – and is headquartered in Seattle, Washington.

The company has three primary business lines. The Ocean Freight and Ocean Services business contracts with ocean shipping lines for transport of full and partial container loads, acts as an agent of the freight owner when they contract directly with a shipping company, and performs container management services where Expeditors International will arrange cargo from multiple suppliers at a particular origin and consolidate shipments into the fewest number of containers to minimize costs. Expeditors International operates Expeditors International Ocean, Inc., a Non-Vessel Operating Common Carrier to provide the shipping contracting service for its customers.

The Airfreight Services business resells cargo space on airlines to its customers and can also act as an agent of an airline to receive and coordinate individual shipments. As noted above, the company does not own any cargo aircraft due to the operating expenses and risks involved.

Finally, the Customs Brokerage business assists its customers by preparing the required documentation, and arranging for required inspections and the payment of taxes, to ensure shipments clear customs in a timely manner.

Expeditors International has no debt and grows nearly exclusively through organic growth. Generally speaking, the company does not enter into acquisition agreements with other companies.

As an international logistics company, Expeditors International is exposed to currency risks. The other major risk the company is exposed to is a slowdown in the global economy, resulting in a drop in trade and a resultant drop in demand for its services.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol EXPD.

As a member of the S&P 500, once Expeditors International has increased dividends for 25 consecutive years S&P will classify the company as an S&P Dividend Aristocrat. Given that the company has made a conscious effort to increase the dividend each year for 22 years straight, I expect them to continue to do so. This would put them on track to become a Dividend Aristocrat at the beginning of 2020.

Expeditors International’s Dividend and Stock Split History

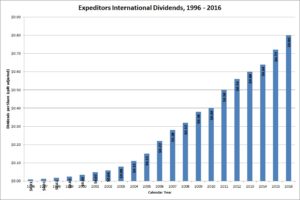

Expeditors International has compounded its dividend at an average rate of 11% for the last 5 years.

Expeditors International has raised dividends since 1995. Unlike most companies, Expeditors International pays dividends semi-annually. Dividend announcements are made in May and November, with the stock going ex-dividend at the beginning of June and December. The annual dividend increase is made with the June dividend payment; in June 2016 Expeditors International increased the dividend by 6.7% to an annualized rate of 80 cents per share. I expect Expeditors International to announce its 23rd annual dividend increase in May 2017.

In the decade and a half prior to 2010, the company had increased dividends no less than 14% a year, and in some cases as much as 40% a year. Since then, dividend growth has slowed. From 2011 to 2016, Expeditors International increased its dividend from 50 cents to 80 cents a share, resulting in a 5-year compounded annual growth rate of nearly 10%. Over the last 10 and 20 years respectively, the growth rates have been an outstanding 13.78% and 10.96%.

Expeditors International has split its stock 2-for-1 five times – in November 1993, December 1996, June 1999, June 2002, and June 2006. You would now have 32 shares of Expeditors International stock for each share of stock you purchased before fall 1993.

Over the 5 years ending on December 31, 2015, Expeditors International stock depreciated at an annual rate of -2.58%, from a split-adjusted $50.97 to $44.73. This dramatically underperformed the 10.2% annualized return of the S&P 500 during this time.

Expeditors International’s Direct Purchase and Dividend Reinvestment Plans

Expeditors International does not have a direct purchase or dividend reinvestment plan. In order to invest in Expeditors International stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Expeditors International’s Investor Relations Website

Current quote and financial summary for Expeditors International (finviz.com)