Photo: Freeimages.com/bugdog

About Fastenal Company

Fastenal Company is a supplier of industrial hardware to the manufacturing and non-residential construction industries. The company generates revenues with sales through storefront locations – Fastenal has over 2,600 stores worldwide, with over 98% of them in North America – and from sales through over 55,000 industrial vending machines. Most of Fastenal’s sales are business-to-business, although the company does see a small amount of revenue from walk-in retail business. Fastenal stores range from traditional storefronts to stores co-located with large customers. The company is headquartered in Winona, Minnesota and employs over 20,000 people.

Fastenal began in 1967 as a partnership that supplied threaded fasteners to customers in small and medium-sized cities that were underserved by the larger industrial suppliers. The company was incorporated in 1968 and since its public offering in 1987 has expanded its product offerings rapidly. Today, while 90% of Fastenal’s products are part of the fasteners line (including bolts, nuts, screws and washers), they generate only about 40% of company sales. In addition to fasteners, the company offers miscellaneous supplies like wire rope and metal framing systems and over the years has added tools, supplies and material handling equipment. The company also added “private label” brands to its offerings; these brands provide about 11% of total company sales.

To supply its stores and maintain inventory control, Fastenal operates 14 distribution centers in North America, including 11 in the United States, 2 in Canada and 1 in Mexico. The distribution centers are located to allow for surface shipments to customers that are not served by in-plant stores.

The company plans to continue to open new stores, as it believes that there is sufficient potential to support at least 3,500 locations in North America.

The company is a member of the S&P 500 index and trades under the ticker symbol FAST.

As a member of the S&P 500, once Fastenal Company has increased dividends for 25 consecutive years S&P may classify the company as an S&P Dividend Aristocrat. Given that Fastenal has made a conscious effort to increase the dividend each year since 1999 straight, I expect them to continue to do so. This would put them on track to become a Dividend Aristocrat at the beginning of 2024.

Fastenal Company’s Dividend and Stock Split History

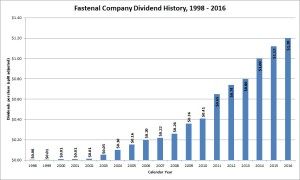

Fastenal has grown dividends year-over-year since 1999 and paid dividends each year since 1991. Since 2014, the company has announced annual dividend increases in the middle of January with the stock going ex-dividend at the end of January. Fastenal’s most recent dividend increase (its 18th straight year) was just announced in January 2016 – a 7.1% increase to an annualized $1.20.

Fastenal has established an excellent dividend growth record. The company moved from annual dividend payments to semi-annual payments in 2003 and then to quarterly payments in 2011. Fastenal’s dividend growth rate over the 5 and 10 years ending in 2015 averaged 13.05% and 19.62% respectively. Since 1998 (the last year the company did not increase the dividend), Fastenal has compounded its dividend payouts at 40.92%.

Since beginning its record of dividend growth in 1999, Fastenal has split its stock 3 times. The most recent split – 2-for-1 – was in May 2011. The other two splits (also 2-for-1) were in April 2002 and November 2005. Prior to 1999, Fastenal had split its stock 4 other times: there was a 3-for-2 split in September 1988, and 2-for-1 splits in February 1990, March 1992 and March 1995. A single share of Fastenal stock purchased in 1999 would have split into 8 shares while a share of Fastenal stock purchased prior to September 1988 would now have split into 96 shares.

Over the 5 years ending on December 31, 2015, Fastenal stock appreciated at an annualized rate of 8.84%, from a split-adjusted $20.90 to $57.98. This underperformed the 10.20% compounded return of the S&P 500 index over the same period.

Fastenal Company’s Direct Purchase and Dividend Reinvestment Plans

Fastenal does not have a direct purchase or dividend reinvestment plan. In order to invest in Fastenal stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Fastenal Company’s Investor Relations Website

Current quote and financial summary for Fastenal Company (finviz.com)