FedEx Corporation provides shipping services worldwide. Photo: Flickr.com/Mike Mozart

About FedEx Corporation

FedEx Corporation provides delivery and logistics services to more than 220 countries and territories worldwide. The company started in 1973 when Federal Express Corporation invented express delivery; FedEx Corporation serves as a holding company for its subsidiary companies. The company is headquartered in Memphis, Tennessee and employs more than 325,000 employees.

FedEx reports operating results in four business segments:

The FedEx Express segment provides time-specific delivery worldwide and includes FedEx Trade Networks, which provides international trade services to the company’s customers. This segment provides 35 – 40% of FedEx’s total company operating income.

The FedEx Ground segment provides small package ground delivery services, including the consolidation and delivery of high volumes of small, less time-critical packages. This segment has the highest margins of all the segments and provides between 50 – 55% of total company operating income.

The FedEx Freight segment provides less-than-truckload freight services. The segment generates about 10% of the company’s operating income.

Finally, the FedEx Services segment provides sales, marketing, information technology and back-office support to the other subsidiary companies.

The company is a member of the S&P 500 index and trades under the ticker symbol FDX.

FedEx’s Dividend and Stock Split History

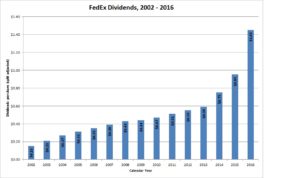

FedEx Corporation began increasing dividends in 2002. The company announces dividend increases in early June, with the stock going ex-dividend about a week later. In June 2016, FedEx Corporation announced a 60% increase to an annualized rate of $1.60. I expect FedEx Corporation to announce its 16th year of dividend increases in June 2017.

FedEx has built an outstanding record of dividend growth. Year-over-year dividend growth has been in the double digits, except for the years 2009 – 2013. The massive dividend increase in 2016 powered the 5-year dividend growth to an average of 23.72% and the 10-year dividend growth to 15.27% annually.

FedEx has split its stock 5 times, each time 2-for-1. The stock splits occurred in September 1978, October 1980, October 1983, October 1996, and April 1999. A single share of FedEx stock purchased prior to September 1978 would have split by now into 32 shares.

Over the 5 years ending on December 31, 2015, FedEx Corporation stock appreciated at an annualized rate of 10.39%, from a split-adjusted $90.74 to $148.73. This was in line with the 10.20% compounded return of the S&P 500 index over the same period.

FedEx’s Direct Purchase and Dividend Reinvestment Plans

FedEx has both direct purchase and dividend reinvestment plans. You do not need to already be an investor in FedEx Corporation to participate in the plans. For new investors, the minimum initial investment is $1000. Follow on direct investments have a minimum of $50. The dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans’ fee structures are not particularly favorable for investors. New investors will have to pay a one-time enrollment fee to establish a ComputerShare account. When reinvesting dividends, you’ll pay a fee of 5% of the amount invested up to $3, plus 3 cents per share. When purchasing shares through the direct purchase plan by check or a single debit purchase, you’ll pay a fee of $5 plus a commission of 3 cents per share. If you establish a recurring investment through direct debit, the fee is $2 plus the 3 cent per share commission.

When you go to sell your shares, what you pay depends on how you request the sell order be processed. For batch orders (where your shares are consolidated with the shares of other investors to be sold), you’ll pay a fee of $15 plus a commission of 9 cents per share. For other types of sell orders (market, day limit or good-till-cancelled limit), you’ll pay a fee of $25 plus a commission of 12 cents per share. Furthermore, sell orders processed by a customer service representative over the phone are assessed an additional transaction fee of $15.

Helpful Links

FedEx’s Investor Relations Website

Current quote and financial summary for FedEx Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for FedEx Corporation