TastyKake is one of Flowers Foods' well-known brands. Photo: Flickr.com/Ezra Wolfe

About Flowers Foods

Flowers Foods is the 2nd largest producer and marketer of packaged bakery goods in the United States. The company’s brands include Nature’s Own, Wonder and pastry brands TastyKake and Mrs. Freshley’s. The company has 49 bakeries across 18 states. Flowers Foods dates back to 1919 when William Howard and Joseph Hampton Flowers opened the Flowers Bakery Company in Thomasville, Georgia; the company still has its headquarters there. The company went public on the over-the-counter market in 1968 and changed its name to Flowers Industries. The following year the company was listed on the American Stock Exchange and in 1982 the company was listed on the New York Stock Exchange. In 2001, the company changed its name to Flowers Foods.

The company dramatically expanded its national coverage in the early 2000s – in 2003, Flowers Foods products were available to only 38% of the U.S. population. By 2015, that had grown to more than 85%.

The company divides operations into two business segments: the Direct-Store-Delivery (DSD) segment and the Warehouse Delivery (WD) segment. The DSD segment controls 39 bakeries that produce bakery goods that are sold directly to small retail and foodservice customers across the United States. The segment generates 84% of Flowers Foods’ total annual sales. The WD segment operates 10 bakeries that manufacture baked goods for vending machines and national retail chains. These products are generally delivered to the warehouses of large retail customers.

Flowers Foods is heavily reliant on sales to Walmart and Sam’s Club, which generates nearly 20% of the Flowers’ sales. Furthermore, the largest 10 customers represent nearly 45% of Flowers Foods’ annual sales. The company also operates more than 275 discount bakery stores that sell returned and surplus products.

The company is a member of the S&P Mid Cap 400 index and trades under the ticker symbol FLO.

Flowers Foods’ Dividend and Stock Split History

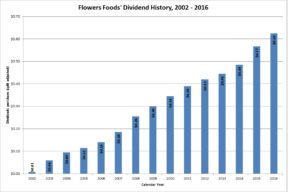

Flowers Foods paid dividends from 1987 through 2000. It suspended dividends in 2001, but reintroduced them at the end of 2002 and has increased them since then. The company announces dividend increases at the end of May or beginning of June, with the stock going ex-dividend at the beginning of June. In May 2016, Flowers Foods announced a 10.3% increase in the quarterly dividend to an annualized rate of 64 cents a share. I expect the company to announce its 16th straight year of dividend increases in late May 2017.

Flowers Foods has a good record of dividend growth. After restoring its dividend at the end of 2002, most annual dividend increases have been in the double digits. Over the last 5 and 10 years, Flowers Foods has compounded its dividend by 9.95% and 16.08%, respectively.

Since December 2001, the company has split its stock 6 times, each time 3-for-2. The most recent stock split occurred in June 2013. Prior splits occurred in December 2001, June 2003, June 2005, June 2007, and June 2011. A single share purchased prior to the first stock split would now be 11.4 shares.

Over the 5 years ending on December 31, 2015, Flowers Foods stock appreciated at an annualized rate of 15.33%, from a split-adjusted $10.35 to $21.13. This outperformed the 10.2% compounded return of the S&P 500 index and the 9.0% compounded return of the S&P Mid Cap 400 index over the same period.

Flowers Foods’ Direct Purchase and Dividend Reinvestment Plans

Flowers Foods has both direct purchase and dividend reinvestment plans. You do not need to already be an investor in Flowers Foods to participate in the plans. For new investors, the minimum initial investment is $500 or $50 if you sign up for 10 months of automatic investments. Follow on direct investments have a minimum of $50. The dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans’ fee structures are somewhat favorable for investors – the company picks up the fees on dividend reinvestments, but if you purchase shares through the direct purchase plan, you’ll pay a transaction fee of $5 for one-time purchases or a transaction fee of $2.50 for automatic debits, plus a commission of 5 cents per share.

When you go to sell your shares, you’ll pay a transaction fee of $15 or $25 depending on the type of sell order plus a commission of 12 cents per share. All fees will be deducted from the sales proceeds.

Helpful Links

Flowers Foods’ Investor Relations Website

Current quote and financial summary for Flowers Foods (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Flowers Foods