Photo: Flickr.com/US Fish & Wildlife Service Southeast Region. (Note: Use of this photo does not imply U.S. Government endorsement of Franklin Electric Company.)

About Franklin Electric Company

Franklin Electric Company designs, manufactures and markets water and fuel pumping systems used in water, wastewater and fuel distribution systems. These products include submersible pumps, motors, electronic controls, and related parts and equipment. The company has manufacturing and distribution facilities in 15 countries and sells to customers worldwide. Franklin Electric is headquartered in Indiana and employs about 4,900 people.

The company has two reporting segments: Water Systems and Fueling Systems. Both serve a variety of industries, including the energy and mining industries.

The Water Systems segment is responsible for designing and manufacturing water pumping systems, motors, drives, and monitoring devices which are used in a variety of residential, agricultural and industrial applications. Included in the segment are products for what the company calls the “artificial lift” market – pumping groundwater and hydrocarbon liquids out of oil and gas wells. This is a new market for the company; test units were deployed across the world in 2014 and the first operational units began functioning in 2015. Over three-quarters of the company’s sales and two-thirds of the company’s net income in 2014 came from the Water Systems segment.

The Fueling Systems segment is responsible for designing and manufacturing fuel pumping systems, fuel containment systems, and monitoring and control systems. These systems and the related parts are primarily used in submersible fueling system applications. The remaining one-quarter of Franklin Electric’s 2014 sales and one-third of net income came from this segment.

The company faces competition in the markets that it serves, and they state so in their 10-K filing. Among their competitors are two S&P Dividend Aristocrats – Pentair in the Water Systems segment and Dover Corporation in the Fueling Systems segment.

In 2014, Franklin Electric had net income of $69.8 million. This was down nearly 15% from 2013 and was due to a 20% drop in the Water System’s segment net income. Sales were up in both segments, resulting in an 8.5% gain to $1.05 billion. Earnings per share were $1.41, down 16.1% from 2013, giving the company a current payout ratio of 27.7% (based on the current annualized dividend rate of 39 cents). The decrease in net income was due to higher raw materials, marketing and selling costs, along with the company’s decision to transition its focus away from groundwater pumping equipment to surface water pumping equipment, which further increased costs. Research and development expenses also rose from $16.8 million in 2013 to $19.3 million in 2014.

Franklin Electric has a modestly active share repurchase program. As of January 3, 2015, the company had authorization remaining to purchase nearly 870,000 shares on its current program, which represents 1.8% of Franklin Electric’s outstanding shares. Between April 2007 and January 2015, the company had repurchased 1.43 million shares.

The company is a member of the Russell 2000 and S&P Small Cap 600 indices and trades under the ticker symbol FELE.

Franklin Electric’s Dividend and Stock Split History

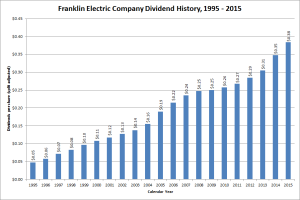

Franklin Electric has compounded dividends at 8.2% over the last 5 years and 7.3% over the last 10 years.

Franklin Electric began increasing dividends in 1993. The company traditionally announces annual dividend increases at the beginning of May, with the stock going ex-dividend in the middle of May. In 2015, Franklin Electric announced an 8.3% increase to an annualized rate of 39 cents. I expect Franklin Electric to announce its 24th year of dividend increases in May 2016.

Franklin Electric has a solid history of dividend increases. Over the last 5 years, Franklin Electric has compounded dividends at a rate of 8.2%. Over the last 10 and 20 years, the company’s dividend growth rate has been 7.3% and 11.0%, respectively.

Franklin Electric has split its stock 3 times in the last quarter century, each time 2-for-1. The stock split in March 2002, June 2004 and, most recently, in March 2013. A single share purchased 15 years ago would have now split into 8 shares.

Over the 5 years ending on December 31, 2014, Franklin Electric Company stock appreciated at an annualized rate of 22.16%, from a split-adjusted $13.68 to $37.21. This outperformed the 13.0% compounded return of the S&P 500 index, the 14.0% compounded return of the Russell 2000 Small Cap index, and the 15.9% compounded return of the S&P Small Cap 600 index over the same period.

Franklin Electric’s Direct Purchase and Dividend Reinvestment Plans

Franklin Electric does not have a direct purchase or dividend reinvestment plan. In order to invest in Franklin Electric stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Franklin Electric’s Investor Relations Website

Current quote and financial summary for Franklin Electric (finviz.com)