General Dynamics' Electric Boat Division builds the new Virginia-class fast attack submarine. Photo courtesy Marion Doss/flickr.com.

About General Dynamics Corporation

General Dynamics Corporation is one of the largest defense and aerospace contractors in the United States, with business areas in military and business aviation, combat vehicles, shipbuilding, weapons systems, and information technology systems. The company is headquartered in Virginia and has nearly 100,000 employees worldwide. As you would expect for a defense company, General Dynamics’ primary customer is the U.S. Government, which provided 58% of the company’s 2014 revenues. General Dynamics’ business operations are divided across four business groups: Aerospace, Combat Systems, Information Systems and Technology, and Marine Systems.

The Aerospace business segment includes Gulfstream business jet operations, including associated aircraft services, and Jet Aviation operations which provide finishing services (e.g., interior outfitting, paint and avionics) for Gulfstream and other business jets. There are currently 2500 Gulfstream aircraft in operation worldwide, and 60% of Gulfstream’s backlog is from non-U.S. customers. The company continues to introduce new business jet models; in 2014 General Dynamics announced three new models: the G500, the G600 and the G650ER, all of which will enter service between 2018 and 2019. 28% of General Dynamics’ total revenues came from the Aerospace business segment.

The Combat Systems business segment designs, engineers and manufactures combat and tactical combat vehicles, including the Abrams main battle tanks and Stryker combat vehicle. This business segment also manufactures the heavy machine guns and grenade launchers that are in standard use throughout the U.S. Army, and munitions subsystems used on U.S. Navy ships. In addition to the delivery of the hardware, the Combat Systems segment is also responsible for executing contracts to provide maintenance, logistics and sustainment services. This segment provided 18% of General Dynamics’ 2014 revenues; 50% of this came from wheeled combat vehicles and another 30% came from weapons systems and munitions.

The Information Systems and Technology segment designs, builds and operates secure information technology networks and systems for federal, state and local government customers, and for commercial wireless network and healthcare providers. This segment also designs intelligence and reconnaissance sensors and payloads used on space systems and underwater systems. This segment provided 30% of total company revenues in 2014.

Finally, the Marine Systems business segment designs, builds and provides support services to submarines and surface ships for the U.S. Navy. The Marine Systems segment is currently producing the Zumwalt-class guided missile destroyers, the Virginia-class nuclear powered submarines, and the Arleigh Burke-class guided missile destroyers for the U.S. Navy. The three classes of ships are in the process of being delivered and are scheduled for delivery through 2019, 2022 and 2028, respectively. While 95% of the segment revenues come from the U.S. Government, the company is also designing and producing liquefied natural gas (LNG) powered ships for commercial customers; the company currently has contracts for 10 of these ships which are scheduled for delivery through 2017. The Marine Systems segment provided 24% of total company revenues in 2014, with the majority of the revenue coming from contracts for nuclear powered submarines.

General Dynamics’ full company revenues for 2014 were $30.9 billion, which was down about 1% from 2013. Diluted EPS were $7.42, up over 11% year-over-year, giving General Dynamics a 2014 dividend payout ratio of 37.2% (based on an annualized dividend rate of $2.76). The company’s backlog increased nearly 60% to $72.4 billion from 2013 to the end of 2014. This was primarily due to a near doubling of the Marine Systems segment’s backlog and a tripling of the Combat Systems segment’s backlog.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol GD.

As a member of the S&P 500 index, Standard & Poor’s should designate General Dynamics as an S&P 500 Dividend Aristocrat once the company has raised dividends for 25 consecutive years. I believe that General Dynamics will continue to raise dividends going forward, which means that it should become an S&P Dividend Aristocrat at the beginning of 2017.

General Dynamics Corporation’s Dividend and Stock Split History

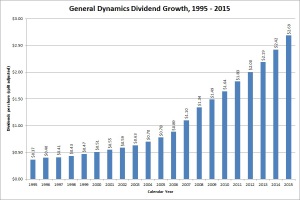

General Dynamics – which should become a Dividend Aristocrat at the beginning of 2017 if it keeps increasing its dividend – has compounded its dividend payout by over 13% over the last decade.

General Dynamics has increased its dividend year-over-year since 1992. The company traditionally announces dividend increases at the beginning of March, with the stock going ex-dividend at the beginning of April. In March 2015, General Dynamics announced a 7-cent, or 11.3% increase to the quarterly dividend, giving the company an annualized payout of $2.76. I expect General Dynamics to announce its 25th annual dividend increase in March 2016. As noted above, General Dynamics should become a member of the Dividend Aristocrats at the end of 2016 or beginning of 2017.

General Dynamics has a good record of dividend growth, with year-over-year increases running between 8 – 15% since 1999. The company’s 5-year compounded annual dividend growth rate (CADGR) is a healthy 10.40%, and the 10-year CADGR is an even better 13.18%. Over the last 20 years, General Dynamics has compounded its dividend growth at a rate of 10.49%.

Since beginning its record of annual dividend increases in 1992, General Dynamics has split its stock 2-for-1 three times: in April 1994, April 1998 and March 2006. For each share of stock you purchased in 1991, you would now have 8 shares. Prior to this, General Dynamics split its stock 5-for-2 in February 1979 and 2-for-1 in November 1980, which means that a single share of stock purchased before February 1979 would have multiplied by a factor of 40.

Over the 5 years ending on December 31, 2014, General Dynamics stock appreciated at an annualized rate of 18.17%, from a split-adjusted $59.15 to $136.30. This significantly outperformed the 13.0% annualized return of the S&P 500 during this time.

General Dynamics Corporation’s Direct Purchase and Dividend Reinvestment Plans

General Dynamics does not have a direct purchase or a dividend reinvestment plan. In order to invest in General Dynamics’ stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

General Dynamics Corporation’s Investor Relations Website

Current quote and financial summary for General Dynamics Corporation (finviz.com)