General Mills is the maker of a wide variety of the popular cereal Cheerios. Photo: Flickr.com/Mike Mozart

About General Mills

General Mills manufactures and markets branded foods to over 130 countries worldwide. The company owns many well-known brand names including Pillsbury, Betty Crocker, Annie’s, Haagen-Dazs, Old El Paso, Progresso, and Gold Medal. The company also has 50% interests in two ventures that market foods outside the United States. General Mills employs over 39,000 people and is headquartered in Minneapolis, Minnesota.

The company has three business segments: U.S. Retail, International and Convenience Stores and Foodservice. Across these segments, General Mills focuses on five categories of foods: (1) Ready-to-eat cereal, (2) Convenient meals, (3) Snacks, (4) Yogurt, and (5) Super-premium ice cream. Other significant categories of foods include baking mixes and ingredients, and refrigerated and frozen dough. General Mills’ primary customers are retailers such as grocery stores, mass merchandisers and convenience stores. In particular, Wal-Mart accounts for nearly 20% of the company’s net sales.

The company is a member of the S&P 500 index and trades under the ticker symbol GIS.

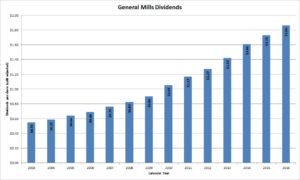

General Mills’ Dividend and Stock Split History

General Mills has paid dividends since at least 1983 and grown them since 2004. The company generally announces dividend increases in mid-March, with the stock going ex-dividend in early April. In 2016, however, General Mills increased the dividend by about 4% in both the 2nd and 3rd quarters; the current annualized payout rate is $1.92, 8.7% above 2015.

General Mills has a very good record of dividend growth, with most year-over-year increases in the high single digits or low double digits. Over the last 5 years, General Mills’ dividend growth rate has been 10.0% and over the last 10 years the dividend growth rate has been 10.5% on average.

Since 1986, General Mills has split its stock 2-for-1 four times. The splits occurred in November 1986, November 1990, November 1999 and, most recently, July 2010. You’d now have 16 shares of General Mills stock for each share you purchased prior to 1986.

Over the 5 years ending on December 31, 2015, General Mills stock appreciated at an annualized rate of 13.54%, from a split-adjusted $29.91 to $56.43. This outperformed the 10.20% compounded return of the S&P 500 index over the same period.

General Mills’ Direct Purchase and Dividend Reinvestment Plans

General Mills has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. For new investors, the minimum initial investment is $250, either in a single purchase or a minimum of 5 automatic debits of at least $50. Follow on direct investments have a minimum of $100. The dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans are very favorable to investors, as the company picks up all costs of purchasing stock. New investors will pay an enrollment fee of $15. There are no other fees for purchasing stock, either directly or through dividend reinvestment. When you go to sell your shares, you’ll pay a transaction fee of $15, $25 or $30 depending on the type of sell order, plus a transaction fee of 12 cents per share. There’s a $5 fee to have the monies directly deposited into your account. All fees will be deducted from the sales proceeds.

Helpful Links

General Mills’ Investor Relations Website

Current quote and financial summary for General Mills (finviz.com)

Information on the direct purchase and dividend reinvestment plans for General Mills