Helmerich & Payne provides contract drilling services all over the world. Photo courtesy TDLucas5000/flickr.com.

About Helmerich & Payne, Inc.

Helmerich & Payne is the holding company for Helmerich & Payne International Drilling Company, which provides contract-drilling operations on the landmasses of offshore regions of the United States, South America, Africa and the Middle East. The company is headquartered in Tulsa, Oklahoma and has nearly 12,000 employees around the world. The company also has commercial real estate properties in the Tulsa area and a portfolio of securities that were valued approximately $222 million at the end of the company’s fiscal year 2014 (which ended September 30, 2014).

The company was formed in 1920 as a partnership between Walt Helmerich II and Bill Payne. During the Great Depression, Helmerich & Payne moved away from drilling their own fields to contract drilling for other companies. In 1944, the company merged with White Eagle Oil, an exploration and production company, a business arrangement that would last for 15 years. After White Eagle dissolved in 1959, Helmerich & Payne continued operations as an independent company. The company continued to expand through organic growth and acquisitions and, in 2011 became the largest land driller in the world based on market capitalization.

The company earns income through contracts with exploration and production companies. During fiscal 2014, all the contracts were “daywork” contracts – that is, customers were charged a fixed rate per day based on the location, depth and the complexity of the well.

In 1998, Helmerich & Payne introduced the “FlexRig” line of drilling rigs, which are particularly useful for horizontal drilling in shale formations and have allowed the company to take advantage of the boom in shale oil production in the United States. The company’s FlexRig variants can support wells between 4,000 and 25,000 feet.

Helmerich & Payne Business Operations

Helmerich & Payne reports its operations through three business segments: U. S. Land Drilling (U. S. Land), Offshore Drilling (Offshore) and International Land.

The U. S. Land segment is responsible for leasing rigs to exploration and production companies within the landmass of the United States. The segment provides 83% of Helmerich & Payne’s total revenues, with of $3.1 billion in FY14, up 11.3% from FY13. Segment income in FY14 was $1.0 billion, up 10.0% from FY13. This was due to an increase in the number of rigs available to customers (329, up from 302 in FY13) and an increase in rig utilization (86%, up from 82%).

The Offshore segment supports operations primarily in the Gulf of Mexico and Equatorial Guinea. The segment has a total of 9 rigs, all of which were in operation in the first quarter of FY15. Revenues were $250.8 million and income was $69.8 million in FY14, up 13.0% and 31.6% respectively from FY13.

The International Land segment operates 36 rigs in seven locations around the world. The $355.5 million in FY14 represented 10% of total company revenues. Total income was $36.4 million, down 18.3% from FY13.

Helmerich & Payne earned $708.7 million on revenues of $3.72 billion in FY14. Income was down nearly 4% due to a nearly $120 million reduction in capital gains realized on investments. Earnings per share were down 5% to $6.46, giving the company a payout ratio of 43%.

At the end of fiscal year 2014, the company had a backlog of $5.0 billion, up from $2.9 billion at the end of 2013. The company expects that less than 37% of the current backlog will be fulfilled in 2015. Helmerich & Payne has not provided EPS guidance for 2015, but in the first two quarters of the fiscal year saw an increase in EPS of 1% from $3.18 to $3.22.

Helmerich & Payne, Inc. is a member of the S&P 500 index and trades under the ticker symbol HP.

Helmerich & Payne’s Dividend and Stock Split History

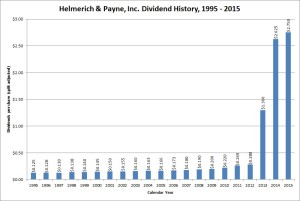

Helmerich & Payne’s dividend has shot up nearly 10-fold since 2012. (2015 annual dividend based on 2nd quarter dividend.)

Helmerich & Payne has increased dividends year-over-year since 1973. Prior to 2011, the company would increase dividends every 2 years, with the dividend increase coming in the 3rd quarter of the calendar year of alternating years. From 1989 through 2009, the company grew its dividend payout slowly, usually in the low single digit percentages. Since then, Helmerich & Payne have strongly increased the dividend, with 5 (through the 2nd quarter of 2015) jumps between the middle of 2011 and 2015. The rate of increase has been dramatic – the quarterly payout has gone up nearly 10-fold, from 7 cents to 68.75 cents a share.

A look at the recent dividend growth history clearly shows the fast growth:

| Calendar Year | Quarter | Quarterly Dividend |

|---|---|---|

| 2012 | 1st | 7 cents |

| 2013 | 1st | 15 cents |

| 2013 | 3rd | 50 cents |

| 2014 | 1st | 62.5 cents |

| 2014 | 3rd | 68.75 cents |

Given the irregular dividend increases, it is difficult to predict the next payout hike.

The compounded annual dividend growth rate (CADGR) figures show the rapid rise, although shorter term CADGRs are skewed by the recent increases. For the 5 years ending in 2014, the CADGR was 67.4%; the 10-year CADGR is 32.0%, and the 20- and 25-year CADGRs are 16.6% and 13.7%, respectively.

Over the last 3 ½ decades, the company has split its stock three times, each time 2-for-1. The most recent split was in July 2006; prior to that, the company split its stock in October 1980 and January 1998.

Over the 5 years ending on December 31, 2014, Albemarle stock appreciated at an annualized rate of 12.46%, from a split-adjusted $36.75 to $66.12. This slightly underperformed the 13.0% annualized return of the S&P 500 index during this time.

Helmerich & Payne’s Direct Purchase and Dividend Reinvestment Plans

Helmerich & Payne does not have a direct purchase or dividend reinvestment plan. In order to invest in the company’s stock, you’ll need to purchase it through a broker; most will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Helmerich & Payne’s Investor Relations Website

Current quote and financial summary for Helmerich & Payne, Inc. (finviz.com)