John Wiley began as a small publishing company in 1807. Photo courtesy John Wiley & Sons bicentennial web page.

About John Wiley & Sons, Inc.

John Wiley & Sons is a publisher and content provider of materials used in education, research and professional development. John Wiley also owns other well-known brands, including the J. K. Lasser brand of tax and financial guides, Frommer’s travel guides, CliffNotes study guides, the For Dummies series, and Betty Crocker and Weight Watchers brands of cookbooks.

John Wiley has three core businesses: Research, Professional Development and Education. The Research business segment publishes scholarly and research journals and books in various scientific and technical fields, including the physical sciences, engineering, health sciences, social sciences and humanities fields. The Research segment generates about 60% of total revenue.

The Professional Development segment develops and publishes information and content for business, engineering and scientific professionals. The focus of the content is to help people with their career development and to assist companies in growing the skills of their workforces. The Professional Development segment generates about 20% of total company revenues.

The Education segment produces educational content including course management tools for instructors. The content format includes traditional print books along with content delivered online; combined, these two formats account for 52% of segment revenue. The Education segment accounts for about 20% of total company revenue.

The history of John Wiley dates back to 1807, thirty-one years after the American Revolution and during the presidency of Thomas Jefferson, when Charles Wiley founded a small printing shop on Reade Street in lower Manhattan. Over the past two centuries, control of the company has been handed down through the Wiley family. Today, the 7th generation of the Wiley family works at John Wiley & Sons. The Wiley family controls the company through the B class shares, which are not publicly traded.

A complete history of John Wiley & Sons and its relationship to the publishing industry is available on Amazon.com (full disclosure: affiliate link).

The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol JW-A. (JW-A is the ticker symbol on finviz.com. On certain financial platforms, the ticker may be JW.A, JW/A or JWa.)

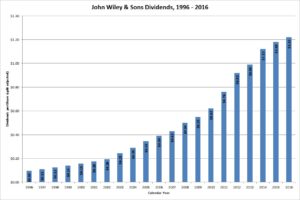

John Wiley & Sons’ Dividend and Stock Split History

John Wiley has grown its dividend payout on its Class A shares annually since 1994. The company traditionally announces dividend increases in mid-June, with the stock going ex-dividend at the end of June. In 2016, John Wiley & Sons increased the quarterly dividend by 163.1 from 30 cents to 31 cents per share, for an annualized rate of $1.24 per share. I expect the company to announce its next dividend increase in June 2017.

John Wiley & Sons has a record of strong dividend growth, but has recently slowed annual increases. The company has a 5-year compounded annual dividend growth rate (CADGR) of 9.93%, having increased dividends from 76 cents per share in 2011 to $1.22 per share in 2016. The company’s 10-year and 20-year CADGRs are 12.08% and 13.50%, respectively, demonstrating the company’s rapid dividend growth.

John Wiley & Sons, Inc. has split its stock 4 times since beginning its record of dividend growth in 1994. Each of these splits was 2-for-1. The most recent stock split was in May 1999 and prior to that the company split its stock in July 1994, October 1995 and October 1998. You would now have 16 shares of John Wiley stock for each one you purchased in mid-1994.

Over the 5 years ending on December 31, 2015, John Wiley & Sons stock appreciated at an annualized rate of 1.75%, from $41.02 to $44.74. This dramatically underperformed both the 10.2% annualized return of the S&P 500 and the 9.0% annualized return of the S&P Mid Cap 400 index over the same period.

John Wiley and Sons’ Direct Purchase and Dividend Reinvestment Plans

John Wiley & Sons does not have a direct purchase or dividend reinvestment plan. In order to invest in John Wiley stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

John Wiley & Sons, Inc.’s Investor Relations Website

Current quote and financial summary for John Wiley & Sons, Inc. (finviz.com)

A History of John Wiley & Sons and the Publishing Industry: “Knowledge for Generations: Wiley and the Global Publishing Industry, 1807-2007” (affiliate link)