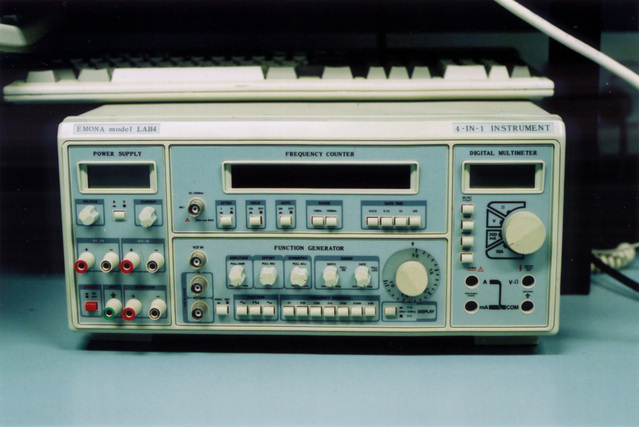

McGrath RentCorp rents electrical equipment to businesses in the communications and semiconductor industries. Photo: Freeimages.com/Tyniuz C.

About McGrath RentCorp

McGrath RentCorp provides business-to-business rental services of relocatable buildings, storage tanks, and electronic test equipment throughout the United States and in certain international locations. The company was founded in 1979, employs nearly 1,000 people and has its headquarters in Livermore, CA.

The company has three rental divisions: (1) Relocatable modular buildings, (2) Electronic test equipment and (3) Liquid and solid containment tanks and boxes.

The relocatable modular building division, under the Mobile Modular and Enviroplex subsidiaries, rents out modular buildings that are designed for use in a variety of applications including as temporary offices, construction field offices, health clinics and classrooms. Most initial rental periods range from 12 – 24 months, but can be as short as 1 month or as long as several years. The terms of the contracts usually require the customer to prepare the site, transport and install the building, and return it at the end of the rental period.

After the useful rental life of the modular building is exhausted (which the company assesses to be about 18 years), the used building is sold to partially recover the cost of the building and increase profits. The relocatable modular building division provides approximately 50% of McGrath RentCorp’s total revenues.

A significant part of the division’s revenues comes from rentals and sales to K-12 public schools. About a third of rental revenues and nearly half of sales revenues came from public schools, making this division reliant of public education spending. (While Mobile Modular’s business includes rentals and sales to public schools, Enviroplex exclusively markets buildings for sale to California public school districts.)

The electronic test equipment division operates under the TRS – RenTelco subsidiary; this division rents and sells test equipment throughout the United States, Canada and India. (Other countries are served to a limited extent.) This equipment is used in the aerospace and defense, communications, manufacturing and semiconductor industries. Nearly half of the division’s equipment serves the communications industry. Rentals are usually for 1 – 6 months. This division provides about 30% of total company revenues.

Finally, Adler Tanks is the subsidiary under which McGrath RentCorp provides storage tanks for rental and sale. The tanks are used for the storage of both solid and liquid products, and are used in the energy, petrochemical and chemical, wastewater treatment and waste management industries. The tanks range in size from 8,000 gallons to 21,000 gallons. Most contracts have rental terms of between 1 – 6 months, although the periods can range up to a year or more. Like the modular building division, the equipment is sold once its rental lifetime (about 25 years) is exhausted. Adler Tanks provides about a quarter of total company revenues.

In general, the company recovers the cost of acquiring its products relatively quickly. McGrath estimates that on modular buildings the total cost is recovered after 6 years of rentals, on electronic test equipment in 3 years, and on containment tanks and boxes in 4 years. The amount of revenue that the company generates is directly tied to the amount of equipment it rents out each year and the condition of the overall economy. As noted above, the company is also highly reliant on public school spending with roughly 16% of total company revenues coming from rentals and sales of modular buildings to public school districts.

The company is a member of the Russell 2000 index and trades under the ticker symbol MGRC.

McGrath RentCorp’s Dividend and Stock Split History

McGrath RentCorp has increased dividends since 1992. Since 2010, the company has announced its annual dividend increase at the end of February, with the stock going ex-dividend in mid-April.

McGrath RentCorp has compounded its payout at an average rate of 6.0% over the last 5 years and 5.1% over the last 10 years.

Since 1983, McGrath RentCorp has split its stock 3 times. The 2-for-1 stock splits occurred in April 1991, April 1997 and March 2005. A single share of stock purchased before April 1991 would now be 8 shares.

McGrath RentCorp’s Direct Purchase and Dividend Reinvestment Plans

McGrath RentCorp does not have a direct purchase or dividend reinvestment plan. In order to invest in McGrath RentCorp stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

McGrath RentCorp’s Investor Relations Website

Current quote and financial summary for McGrath RentCorp (finviz.com)