Photo courtesy Luis LuCheng/flickr.com.

About Middlesex Water Company

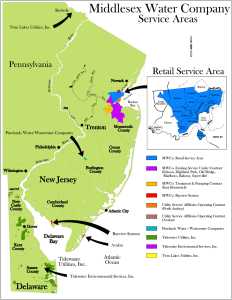

Middlesex Water Company provides water and wastewater services to over 450,000 people across parts of New Jersey, Delaware and Pennsylvania. The company began operating water utility services in New Jersey in 1897 and recently expanded to Delaware in 1992 and Pennsylvania in 2009. The company also received approval to operate in Maryland in 2007, but does not have any business there.

Image from Middlesex Water Company’s website.

Middlesex Water Company provides water and wastewater services to over 450,000 people across parts of New Jersey, Delaware and Pennsylvania. The company began operating water utility services in New Jersey in 1897 and recently expanded to Delaware in 1992 and Pennsylvania in 2009. The company also received approval to operate in Maryland in 2007, but does not have any business there.

Middlesex Water divides its operations into two business segments – regulated and unregulated. Like most utilities, most of the company’s business comes from its regulated segment; the regulated business provides around 90% of the company’s revenues and income. The Unregulated business segment covers Middlesex’s service in Perth Amboy, NJ; Avalon, NJ; and portions of Delaware.

The company trades under the ticker symbol MSEX.

Middlesex Water Company’s Dividend and Stock Split History

Middlesex Water has paid dividends continuously since 1912 and increased them annually since 1973. The company pays out its quarterly dividends at the beginning of March, June, September, and December. Annual dividend increases are announced around the 20th of October, with the stock going ex-dividend in mid-November.

Like most utilities, Middlesex Water has grown dividends slowly but steadily. The company has compounded its payout at an average rate of 2.9% over the last 5 years and 2.2% over the last 10 years.

The company has split its stock 4 times since beginning its record of annual dividend growth. 2-for-1 splits occurred in December 1984 and September 1992; a 3-for-2 split occurred in January 2002; and a 4-for-3 split occurred in November 2003. Prior to 1973, Middlesex Water split its stock 5-for-1 in October 1927; 3-for-2 in October 1959; and 2-for-1 in December 1967. A single share of Middlesex Water stock purchased in 1973 would have split into 8 shares.

Middlesex Water Company’s Direct Purchase and Dividend Reinvestment Plans

Middlesex Water Company has both direct purchase and dividend reinvestment plans. You do not need to be a current investor to participate. New investors must purchase at least $500 of Middlesex Water stock and are required to reinvest dividends on at least 10 shares of stock. Subsequent purchases of stock must be at least $25.

The fee structure of the plan is favorable for investors, with the company picking up all fees on stock purchases. When you sell your shares, you’ll pay a sales commission of $15 plus associated brokerage fees. All fees are deducted from the sales proceeds.

Helpful Links

Middlesex Water Company’s Investor Relations Website

Current quote and financial summary for Middlesex Water Company (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Middlesex Water