MSA Safety manufactures firefighting helmets and self-contained breathing devices. Note the MSA logo on the firefighter's air tank on the left. Photo courtesy Lee Cannon/flickr.com.

About MSA Safety Incorporated

MSA Safety Incorporated develops, manufactures and sells health and safety products for use in multiple markets, including by the energy, fire service, mining and construction industries. John T. Ryan Sr. and George H. Deike formed Mine Safety Appliances in 1914 in response to a West Virginia mining accident that had killed 80 miners two years earlier. The company core products include respiratory protection devices, fixed gas and flame detection items, portable gas detection devices, and industrial head and fall protection devices. In all but the fall protection market, the company holds a #1 or #2 market position. MSA Safety has 5,000 employees worldwide, including 2,100 in the United States, Canada and Mexico.

The respiratory protection products include SCBA (Self-Contained Breathing Apparatus) devices, air-purifying respirators, escape respirators, and portable and fixed gas detection instruments that are used to determine whether the atmosphere in a confined space is safe for humans and/or contains flammable gases.

MSA Safety groups its business into three separate segments, grouped by geography: North America, Europe and International. In North America, nearly all sales are made through distributors like Airgas, W. W. Grainger, Fastenal and Hagemeyer. In addition, MSA Safety formed Safety Works, LLC to distribute its products to the do-it-yourself and contractor markets through retail channels like United Rentals, The Home Depot and TrueValue.

North American segment sales in 2014 totaled $547.7 million, up 2.7% from 2013, and represented 48.3% of total company sales. European and International segment sales are made through indirect and direct sales channels, supported by a sales and distribution team of 800 employees. European business segment sales were up 9.7% to $321.6 million (28.4% of total company numbers) on higher sales of helmets to the military market in Southern Europe and to the firefighting market across the continent. International segment sales were down 7.5% to $264.5 million, and represented 23.3% of MSA Safety’s total 2014 sales. The drop in sales was attributed to lower sales in Latin America and Australia. Currency effects also impacted the company to the tune of $20.3 million in 2014; the bulk of this was in the International segment where impacts of the Argentine and Chilean peso and Brazilian real negatively impacted segment sales by $17.5 million.

Altogether, MSA Safety sales were up 2.0% to $1.13 billion. This was due to good results across several of MSA Safety’s product lines, including fixed gas and flame detection (up 10%), portable gas detection instruments (up 9%), fall protection devices (up 5%), and head protection devices (up 5%). While this was offset by sales of breathing apparatus devices, which were down 7%, the biggest hit appeared to be from currency effects from international sales. Including currency effects, the 2% increase in net sales translated into an increase of $21.8 million; without currency effects, the increase in sales would have been $42.1 million – nearly twice as much.

MSA Safety’s 2015 1st quarter results were also impacted by weaker foreign currencies. Revenues were down 3% from the 1st quarter of 2014, but up 4% in local currencies.

The company’s 2014 income was $88.5 million, up $1.5 million from 2013. A drop in the International segment income was the greatest impact to the company’s income. International segment income was down 44% on lower sales and currency effects. In contrast, North American segment and European segment income was up 18% and 10%, respectively. Full company income per share was $2.33 in 2014, roughly flat with 2013’s numbers. MSA Safety’s current annualized dividend of $1.28 gives the company a payout ratio of 55%.

MSA Safety continues to deleverage from its acquisition of flame and gas detection manufacturer General Monitors in 2010. From a high of $367.1 million at the end of 2010, the company reduced long-term debt to $245.0 million at the end of 2014.

Finally, one issue of possible concern to investors is the company’s exposure to lawsuits. MSA Safety reported in its 2014 annual report that it was named as a defendant in over 2,300 lawsuits resulting from exposures to harmful substances (e.g., asbestos, silica, coal dust) from products manufactured by MSA Safety or a predecessor or acquired company. In 2014, over 1,000 lawsuits were settled and 542 new ones were filed against the company. More than half of the lawsuits have a minimal amount of activity over the last 5 years, but any of them could become active at any time. MSA Safety maintains product liability insurance and has nearly $75 million in a liability reserve.

The company is a member of the S&P Mid Cap 400 and Russell 2000 Small Cap indices and trades under the ticker symbol MSA.

MSA Safety Incorporated’s Dividend and Stock Split History

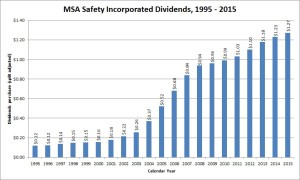

Despite the recent 3% dividend increase, MSA Safety has compounded dividends at nearly 10% over the last decade.

MSA Safety has paid dividends continuously since 1916 and increased them annually since 1972. The company pays out quarterly dividends around the 10th of March, June, September and December. Annual dividend increases are announced in May, with the stock going ex-dividend at the end of the same month. In May 2015, MSA Safety announced its 44th annual dividend increase – a 3.2% increase to an annualized rate of $1.28. I expect MSA Safety to announce its 45th annual dividend increase in May 2016.

After a period of fast dividend growth from 2001 – 2008, MSA Safety has slowed its dividend growth. Since 2009, year-over-year dividend growth has been in the low to mid-single digits, resulting in a 5-year compounded annual dividend growth rate (CADGR) of 5.1%. Longer term, the CADGRs are better, with 10 , 20 and 25-year average growth rates of 9.3%, 12.6% and 11.1%, respectively.

In recent years, MSA Safety has split its stock twice. Both stock splits, which occurred in May 2000 and January 2004, were 3-for-1 splits. Each share that you owned at the beginning of 2000 would have split into 9 shares.

Over the 5 years ending on December 31, 2014, MSA Safety stock appreciated at an annualized rate of 18.28%, from a split-adjusted $22.62 to $52.37. This outperformed the 13.0% annualized return of the S&P 500 index, the 14.9% annualized return of the S&P Mid Cap 400 index, and the 14.0% compounded return of the Russell 2000 Small Cap index over the same period.

MSA Safety Incorporated’s Direct Purchase and Dividend Reinvestment Plans

MSA Safety does not have a direct purchase or dividend reinvestment plan. In order to invest in the company’s stock, you’ll need to purchase it through a broker; most will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

MSA Safety’s Investor Relations Website

Current quote and financial summary for MSA Safety (finviz.com)