Photo: Freeimages.com/Vee TEC

About Murphy Oil Corporation

Murphy Oil Corporation is a global oil and natural gas exploration and production company. The company was originally incorporated in 1950 as Murphy Corporation. It went through two reorganizations as emerged in 1983 as Murphy Oil Corporation, a holding company for its various subsidiaries. Murphy Oil is headquartered in El Dorado, Arkansas and employed over 1,700 people at the end of 2014.

Murphy Oil divides its exploration and production activities by geography into 4 segments. In the United States, the company produces petroleum products from fields in the Eagle Ford Shale area of South Texas and in deepwater in the Gulf of Mexico through its subsidiary, Murphy Exploration & Production Company – USA. Over 90,000 barrels of oil equivalent (BOE) per day – nearly 43% of the company’s total oil production over the first 9 months of 2015 – came from Murphy Oil’s U.S. business.

In Canada the company’s subsidiary, Murphy Oil Company Ltd., owns interests in 2 areas in offshore Newfoundland and 1 onshore area in northern Alberta. The company also has a 5% interest in Syncrude Canada Ltd, which produces synthetic crude oil from oil sands deposits.

All other operations are run by the Murphy Exploration & Production Company – International subsidiary and are divided into the remaining two geographical segments covering Malaysia and the remaining parts of the world. In Malaysia, Murphy Oil has divested itself of 30% of its oil and gas assets, booking a $321.4 million after-tax gain. The remaining interests include shallow water and deepwater areas. In other countries, specifically Australia, Indonesia, Brunei, Vietnam, Suriname, Cameroon, Equatorial Guinea, Namibia, and the Republic of the Congo, Murphy Oil has various exploration permits and is in the early stage of the exploration process. In most of these cases, the company is performing geophysical studies to determine the viability of these areas.

Over the last few years, Murphy Oil has transitioned from an integrated oil company to focus on exploration and production activities. The transition process included spinning off the company’s fuels business in August 2013. This business – now Murphy USA, Inc. – trades on the NYSE under the ticker symbol MUSA. Murphy Oil also shut down and abandoned an oil refinery at Milford Haven, Wales after unsuccessfully attempting to sell the facility.

The company’s profitability is heavily driven by oil and natural gas prices. The nearly 25 to 30% drop in the price of these commodities since the beginning of the year has hit Murphy Oil hard. Over the first 9 months of 2015, Murphy Oil posted a net loss of $9.55 per share. Nearly all of this loss came from the company writing down the value of its oil and gas properties. The company is responding to these losses by reducing general and administrative expenses by 18% and staffing by 23% from 2014 levels.

Due to the losses this year, the company’s dividend payout ratio is not meaningful. Murphy Oil has not given guidance on when it expects to return to profitability – much of which depends on what happens to commodity prices going forward. The company’s proven reserves expanded 10% to 756 million BOE

The company is a member of the S&P 500 index and trades under the ticker symbol MUR.

As a member of the S&P 500, once Murphy Oil Corporation has increased dividends for 25 consecutive years S&P will classify the company as an S&P Dividend Aristocrat. If Murphy Oil is able to continue to grow its dividend each year and to remain a member of the S&P 500, it would be able to be classified as a Dividend Aristocrat at the beginning of 2025.

Murphy Oil’s Dividend and Stock Split History

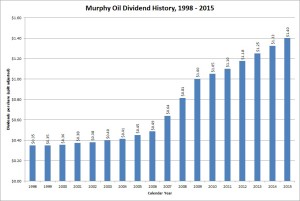

Murphy Oil Corporation has paid dividends since at least 1987 and increased them since 2000. The company announces dividend increases on an irregular schedule, but last increased the dividend in the 3rd quarter of 2013. In order to maintain its record of year-over-year dividend increases, Murphy Oil could wait as late as the 4th quarter of 2016 before increasing its dividend. If it does, 2016 would be the company’s 17th straight year of dividend growth.

Historically, Murphy Oil has increased dividends in the mid-single digits; the company’s 5-year dividend growth rate is 5.92%. However from 2006 – 2009, the company doubled its dividend. This ends up increasing the longer term dividend growth rate – over the last decade, Murphy Oil has compounded dividends an average of 12.02% annually and since 2000, the compounded dividend growth rate is 9.05%.

Murphy Oil Corporation has split its stock twice since beginning its record of dividend growth. The splits, both 2-for-1, occurred in December 2002 and June 2005. A single share purchased prior to December 2002 would have split into 4 shares.

Over the 5 years ending on June 30, 2015, Murphy Oil Corporation stock has been nearly flat, appreciating at an annualized rate of 2.75% from a split-adjusted $35.49 to $40.65. This drastically underperformed the 15.0% compounded return of the S&P 500 index over the same period.

Murphy Oil’s Direct Purchase and Dividend Reinvestment Plans

Murphy Oil does not have a direct purchase or dividend reinvestment plan. In order to invest in Murphy Oil stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Murphy Oil Corporation’s Investor Relations Website

Current quote and financial summary for Murphy Oil Corporation (finviz.com)