National Fuel Gas produces, markets and sells natural gas to customers in wester Pennsylvania and New York State. Photo from National Fuel Gas' 2014 Annual Report.

About National Fuel Gas Company

National Fuel Gas, headquartered in Williamsville in upstate New York, is a diversified energy company that develops, produces, markets, and ships natural gas to customers primarily in northwestern Pennsylvania and western New York State. The company has extensive holdings in and is centered in the Marcellus Shale basin in the Appalachian region of the United States. National Fuel also develops oil reserves, primarily in California. National Fuel Gas was first incorporated in 1902 and as of September 30, 2014 had 2,000 employees.

National Fuel Gas breaks its operations into 5 business segments: Exploration & Production, Pipeline & Storage, Gathering, Utility, and Energy Marketing.

The Exploration & Production segment is run by National Fuel’s wholly owned subsidiary, Seneca Resources Corporation, and is responsible for the development of natural gas and oil reserves in Appalachia, California and Kansas. This segment provided over 40% of National Fuel’s 2014 fiscal year (ending September 30, 2014) net income.

The Pipeline & Storage segment, operating under the two subsidiaries National Fuel Gas Supply Corporation and Empire Pipeline, is responsible for the company’s interstate natural gas transportation and storage services. The subsidiaries own an integrated gas pipeline system, with 250 miles of pipeline, running from southwestern Pennsylvania to the New York – Canadian border and then back into central Pennsylvania. The pipeline system delivers natural gas for other National Fuel business segments, as well as industrial companies and power producers. This segment has full or partial ownership in 31 underground natural gas storage facilities. Currently, the storage capacity is fully under contract; the company expects that about 2% of the storage capacity is under contracts that will end in 2015. The Pipeline and Storage segment provided about 25% of National Fuel’s 2014 net income.

The Gathering business segment is run by the company’s subsidiary National Fuel Gas Midstream Corporation, which builds, owns and operates natural gas processing and pipeline gathering facilities in Appalachia. This segment provided 11% of National Fuel’s 2014 net income.

The Utility segment is run by subsidiary National Fuel gas Distribution Corporation. This wholly owned subsidiary sells or provides natural gas transportation services to nearly 750,000 customers throughout western NY and northwestern PA. Included in the service area are the cities of Buffalo, Niagara Falls and Jamestown, NY and Erie, PA. The Utility segment provided about 21% of National Fuel’s 2014 net income.

Finally, the Energy Marketing segment performs the marketing function for National Gas through wholly owned subsidiary National Fuel Resources, Inc. This segment’s market includes industrial, wholesale, municipal and residential customers in western NY and northwestern PA. The segment provided about 2% of the company’s 2014 net income.

National Fuel saw strong income growth in fiscal year 2014, with net income up 15.2% to nearly $300 million. Earnings per share were $3.52, an increase of 14.3%, and shareholder’s equity was $2.4 billion, up nearly 10% from 2013. The company also spends extensively to ensure the continued production of natural gas and its continuing ability to deliver it to customers. 2014 capital expenditures were up 30% in 2014 to $914 million. The capital expenditures are expected to grow over the next two years and then decrease slightly, as the company projects the expenditures to be $1.2 billion, $1.4 billion and $1.1 billion in 2015, 2016 and 2017, respectively.

The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol NFG.

National Fuel Gas Company’s Dividend and Stock Split History

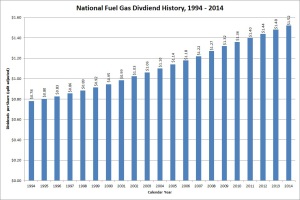

National Fuel Gas and its predecessor companies have paid dividends since 1902; the company has increased them since 1972. The company has announced its annual dividend increase in mid-June with the stock going ex-dividend at the end of June. I expect National Fuel Gas to announce its 44th consecutive annual dividend increase in June 2015. In June 2014, the company’s announced a 2.7% dividend increase to an annualized rate of $1.52.

Since 2009, National Fuel Gas has increased the dividend payout by 4 cents a year, resulting in a 5-year compounded annual dividend growth rate (CADGR) of 2.9%. As a general rule, National Fuel Gas grows its dividend by between 4 – 6 cents a year, meaning the compounded dividend growth over longer periods is slightly larger – the 10-year, 20-year and 25-year CADGRs are 3.3%, 3.4% and 3.45%, respectively. At the current rate of growth, you’ll double your yield-on-cost in 38 years.

National Fuel Gas has split its stock 3 times since beginning its record of annual dividend increases in 1972. Each of these splits – which occurred in May 1984, June 1987 and September 2001 – was 2-for-1. National Fuel Gas also paid a 10% stock dividend in conjunction with the May 1984 stock split. For each share of stock you purchased prior to the first stock split, you’d now have 8.8 shares of National Fuel Gas stock.

Over the 5 years ending on December 31, 2014, National Fuel Gas stock appreciated at an annualized rate of 9.47%, from a split-adjusted $43.95 to $69.08. This dramatically underperformed both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time.

National Fuel Gas Company’s Direct Purchase and Dividend Reinvestment Plans

National Fuel Gas has both direct purchase and dividend reinvestment plans; you do not need to be a current shareholder to participate in the direct purchase plan. As a registered shareholder, you can choose to reinvest all or only a part of your dividends. New plan participants will pay an enrollment fee of $15. The minimum direct purchase amount for new investors is $1000; for existing plan participants, the minimum is $100.

Overall, these plans are favorable to investors. There are no fees on direct purchases or dividend reinvestments – the only fees you’ll pay are when you sell your shares. At that time, you’ll pay a trading fee of between $15 – 30 (depending on the type of sell order you request) plus a commission of 12 cents per share. You’ll also pay $5 to have the proceeds deposited directly into your account.

Helpful Links

National Fuel Gas’ Investor Relations Website

Current quote and financial summary for National Fuel Gas (finviz.com)

Information on the direct purchase and dividend reinvestment plans for National Fuel Gas