National Health Investors specializes in investments of senior living facilities, like assisted living facilities. Photo: Flickr.com/Brett VA

About National Health Investors

National Health Investors is a REIT specializing in the sale-leaseback and financing of senior housing and medical investments. The company has interests in more than 200 properties across 32 states. More than half of these are senior housing properties, like Independent Living Facilities, Assisted Living Facilities, Senior Living Campuses and Retirement Communities. The rest of the properties are medical properties, such as Skilled Nursing Facilities, Hospitals and Medical Office Buildings.

In general, National Health enters into agreements with lessees through 10 – 15 year leases with one or more 5-year renewal options. The agreements are triple net leases, where the lessee is responsible for all expenses resulting from the operation of the properties. Most also include annual rental increases.

The company is a member of the Russell 2000 Small Cap index and trades under the ticker symbol NHI.

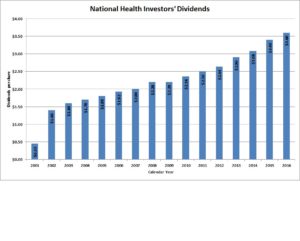

National Health Investors‘ Dividend and Stock Split History

National Health Investors has paid dividends since its formation in 1991 and grown them since 2010. The company pays dividends in March, June, September and December and announces annual dividend increases in February, with the stock going ex-dividend in March. In February 2016, National Health announced a 5.9% increase in the dividend to an annualized rate of $3.60.

National Health’s dividend growth record is decent, with a 5-year average growth rate of 7.61% and a 10-year average growth rate of 6.49%.

National Health has never split its stock.

National Health Investors’ Direct Purchase and Dividend Reinvestment Plans

National Health Investors has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. The initial investment must be at least $500, either in a single purchase or in 10 monthly purchases of $50 each. Additional purchases have a minimum of $50. Participants are allowed to reinvest all or only a portion of their dividends.

Due to the fees associated with the plans, they are not favorable for investors. There is a $10 enrollment fee for new investors. In addition, when purchasing shares you’ll pay a fee of $5 for purchases by check or one-time purchases by debit, or $2.50 for recurring purchases by debit. When reinvesting dividends, there is a 5% fee, up to a maximum of $3. Finally, there is also a commission of 5 cents per share on all purchases. When you sell your shares in the plan, you’ll pay a fee of $15 for batch sell orders or $25 for other types of sell orders along with a 12-cent per share commission. Finally, if you place your sell order through a customer service representative on the phone, you’ll pay another $15 fee. All fees will be deducted from the sales proceeds.

Helpful Links

National Health Investors’ Investor Relations Website

Current quote and financial summary for National Health Investors (finviz.com)

Information on the direct purchase and dividend reinvestment plans for National Health Investors