Leases to LA Fitness locations were the 5th largest source of rent in 2014 for National Retail Properties, providing nearly 4% of the company's annual base rent. Photo courtesy Mike Mozart/flickr.com.

About National Retail Properties

National Retail Properties invests in and develops properties that are leased primarily to retail tenants. These triple net leases are usually for 15 – 20 years and generally require the tenant to pay all the property operating expenses including insurance, utilities, repairs and taxes. As of the end of 2014, National Retail had over 2,000 properties across 47 states. The company manages its portfolio with only 64 employees.

The company leases properties to a variety of retail establishments, with nearly 23% of the annual base rent coming from the five largest tenants, including Mister Car Wash, 7-11 Stores, and LA Fitness. Geographically, a large part of annual rents are generated in the southern part of the U. S. with over 20% coming from Texas and another 10% from Florida. As noted above, the vast majority of the leases are for 15-20 years; at the end of 2014, there were 12 years left on the average remaining lease, with one-fifth of the leases ending by 2020 and a total of 37% of the lease terms concluding by 2024. The remaining 63% of the leases end in or after 2025.

The history of National Retail Properties dates back to 1984 when Golden Corral Realty Corporation went public in an IPO. In 1994, the shares were first listed on the New York Stock Exchange. Ten years later, the company was included in the S&P Small Cap 600 index and seven years after that, in 2011 the company joined the S&P Mid Cap 400 index.

The company has an aggressive acquisition strategy. Over the three years ending in 2014, National Realty purchased 232, 275 and 221 properties respectively, investing a total of almost $2 billion with an average initial cash yield of 7.5% – 8.3%. These acquisitions were funded through cash on hand, long-term loans and the sale of some of the company’s properties. From 2012 – 2014, National Realty sold nearly 100 properties.

National Realty reported total assets at the end of 2014 of $4.9 billion, up 10.6% from the end of 2013. Earnings per share from operations in 2014 were $1.24, up 18.1% year-over-year, and funds from operations – a measure of REIT income – was up 13.7% to $261.0 million in 2014.

The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol NNN.

National Retail Properties’ Dividend and Stock Split History

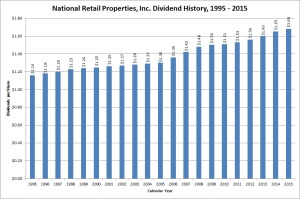

National Retail Properties has increased dividends each year since 1990. The company usually announces its annual dividend increase in mid-July, with the stock going ex-dividend at the end of July. I expect National Retail to announce its next dividend increase (its 25th straight year) in July 2015; the company’s last increase in July 2014 was 3.7% to an annualized rate of $1.68.

National Retail has had very slow but steady dividend growth for 24 years. The company usually increases the quarterly dividend by between half a cent and two cents per share per year. From 2009 – 2014, National Retail has a compounded annual dividend growth rate (CADGR) of 2.16%, and from 2004 – 2014 the company’s CADGR is 2.60%. Over the last two decades, National Retail’s CADGR is less than 2%.

National Retail Properties has not split its stock since coming public in 1984.

Over the 5 years ending on December 31, 2014, National Retail Properties stock appreciated at an annualized rate of 19.43%, from a split-adjusted $16.05 to $38.99. This outperformed both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time.

National Retail Properties’ Direct Purchase and Dividend Reinvestment Plans

National Retail has both direct purchase and dividend reinvestment plans; you do not need to be a current shareholder to participate in the direct purchase plan. As a registered shareholder, you can choose to reinvest all or only a part of your dividends. The minimum amount for direct purchases is $100.

Overall, these plans are very favorable to investors. There are no fees on direct purchases or dividend reinvestment purchases, nor are there initial setup or account maintenance fees. Most importantly, National Retail Properties is one of only a few companies that offer a discount on shares purchased through dividend reinvestment. The discount can vary between 0 and 5%. Currently, the discount is 1%.

There are fees for selling share. When you sell your shares, you’ll be assessed a $15 service fee and a 10 cent per share commission.

Helpful Links

National Retail Properties’ Investor Relations Website

Current quote and financial summary for National Retail Properties (finviz.com)

Information on the direct purchase and dividend reinvestment plans for National Retail Properties