New Jersey Resources provides natural gas and related services to over 500,000 customers on the Jersey Shore and surrounding areas. Photo: New Jersey Resources Corporation's 2014 Annual Report

About New Jersey Resources Corporation

New Jersey Resources Corporation is an energy services holding company, whose primary business is the sale and distribution of natural gas to over 500,000 customers in the northern and central New Jersey. The company was formed in the early 1980s through the 1-for-1 exchange of New Jersey Natural Gas shares into the new holding corporation. In addition to the regulated natural gas business, New Jersey Resources offers other energy services to its customers and invests in midstream assets. The company’s operating area has a population of roughly 1.5 million people. (Note that one customer account usually serves more than one individual.)

The company’s has four reporting business segments, which are organized roughly around its subsidiaries. The New Jersey Natural Gas Company subsidiary runs the natural gas distribution business segment, which is responsible for the regulated part of New Jersey Resources’ business: the distribution and sale of natural gas to retail customers.

The Energy Services segment primarily consists of NJR Energy Services Company and is responsible for New Jersey Resources’ unregulated wholesale energy operations. The segment is also responsible for providing wholesale energy operations to other natural gas companies and energy producers.

The Clean Energy Ventures segment is run by NJR Clean Energy Venture Corporation. This segment is responsible for investments in solar and onshore wind investments. This segment has a clean energy portfolio of more than 147 MW in electrical generation capacity.

Finally, the Midstream segment is responsible for all of New Jersey Resources’ investments in natural gas transportation and storage facilities.

NJR reports “net financial earnings” (NFE) as its primary profitability metric. NFE is the company’s earnings adjusted for commodity derivative and hedging contracts. For the 2015 fiscal year (which ended September 30, 2015), although New Jersey Resources earned $2.12 per share under generally accepted accounting principles, which was up 25% from 2014, NFE per share was $1.78, down 15.2% from the 2014.

New Jersey Resources seeks to increase NFE per share by 5 – 9% a year and the dividend 6 – 8% a year long-term. With the current dividend of 96 cents, the payout ratio is 54%, below the company’s target range of 60 – 65%. Accounting for the company’s guidance of 2016 NFE per share of $1.55 – $1.65, next year’s expected payout ratio is roughly 60%, before any increase.

New Jersey Resources has an active share repurchase program and has repurchased 16.8 millions shares since September 1996. In FY 2015, the company repurchased 348,200 shares. 2.7 million shares remain on the existing authorization, which represents 3.15% of the outstanding stock.

The company is a member of the S&P 600 Small Cap and Russell 2000 indices and trades under the ticker symbol NJR.

New Jersey Resources’ Dividend and Stock Split History

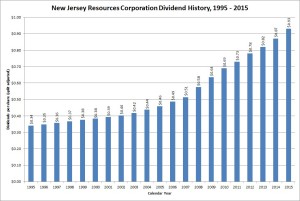

New Jersey Resources has paid dividends since at least 1988 and increased them since 1995. The company announces annual dividend increases in early to mid-September, with the stock going ex-dividend about two weeks later. In September 2015, New Jersey Resources announced a 6.7% dividend increase to an annualized rate of 96 cents a share. The company should announce its 22nd consecutive annual dividend increase in September 2016.

As noted above, New Jersey Resources aims to increase dividends by 6 – 8% a year, and targets a payout ratio of between 60% and 65%. The company has met its dividend growth target over the last decade – the 5-year and 10-year dividend growth rates are 6.15% and 7.29%. Over the last 20 years the company has fallen short of the goal, with the dividend compounded at 5.16% annually.

New Jersey Resources has split its stock three times since beginning its record of annual dividend increases. The company split its stock 3-for-2 in March 2002 and March 2008. Most recently the company split its stock 2-for-1 in March 2015.

Over the 5 years ending on June 30, 2015, New Jersey Resources stock appreciated at an annualized rate of 13.4%, from a split-adjusted $14.58 to $27.31. This underperformed the 15.0% compounded return of the S&P 500 index, the 17.2% return of the S&P Small Cap 600 index and the 15.7% return of the Russell 2000 index over the same period.

New Jersey Resources’ Direct Purchase and Dividend Reinvestment Plans

New Jersey Resources has both direct purchase and dividend reinvestment plans. You don’t need to be a current shareholder to participate in the plans –you can make your initial purchase in the plan. The minimum investment for the initial direct purchase is $100 and $25 for follow-on direct purchases. The dividend reinvestment plan allows for full or partial reinvestment of dividends. The company occasionally offers shares at up to a 3% discount through the direct purchase plan.

The plans’ fee structures are favorable for investors. The company picks up the costs of buying shares through the both the direct purchase and dividend reinvestment plans. The only fees you pay through the plans are when you sell your shares. You’ll pay a commission of between $15 and $30, depending on the type of sell order, plus a transaction fee of 10 cents per share. You’ll also pay $5 to have the proceeds (net of any fees) directly deposited to your account.

Helpful Links

New Jersey Resources Corporation’s Investor Relations Website

Current quote and financial summary for New Jersey Resources Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for New Jersey Resources Corporation