The Nike "swoosh" is one of the most recognized logos in business. Photo: Flickr.com/Josh Hallet

About Nike

Nike Incorporated designs, develops, markets and sells athletic footwear, apparel and accessories worldwide. Nike owns several well known brands, including the eponymous Nike brand, and the Hurley and Converse brands. The company sells products through its own and other retail outlets, and through independent distributors and licensees around the world. Most of Nike’s products are manufactured outside the United States, with significant contract manufacturing facilities located in Vietnam, China and Indonesia. The company’s revenues are split evenly between sales within the United States and in the rest of the world. Nike is headquartered in Beaverton, Oregon.

The company is a member of the S&P 500 index and trades under the ticker symbol NKE.

Nike’s Dividend and Stock Split History

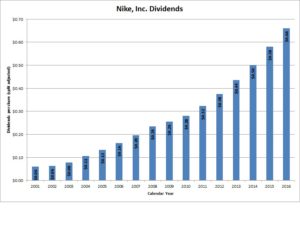

Nike has paid dividends continuously since 1987 and grown them every year since 2001. Nike stock goes ex-dividend in February, May, August and December. The company generally announces dividend increases in November, for the December payment. In November 2016, Nike announced a 12.5% increase to its payout to an annual rate of 72 cents per share.

Nike has an excellent record of dividend growth. The company has compounded its dividend by 15.40% over the last 5 years and 15.05% over the last 10 years. Since starting its dividend growth streak in 2001, Nike has compounded the dividend an average of 17.33% annually.

Nike has split its stock 2-for-1 seven times, most recently in December 2015. The company also split its stock 2-for-1 in January 1983, October 1990, October 1995, October 1996, April 2007 and December 2013. A single share of stock purchased prior to the first stock split would now be 128 shares.

Nike’s Direct Purchase and Dividend Reinvestment Plans

Nike has both direct purchase and dividend reinvestment plans. If you are not a current shareholder, you can participate in the plan with an initial purchase of $500, either in one purchase or through 10 consecutive monthly investments of $50. Once you are a plan participant, the minimum investment is $50. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

Due to fairly significant fees, the plans are not favorable to investors. There is an enrollment fee of $10 to open a plan account. When you purchase shares directly, you’ll pay a transaction fee of $2 (for ongoing purchases by direct debit), $3 (for a single purchase by direct debit) or $5 (for purchases by check), plus a 3-cent per share commission. When you reinvest dividends, you’ll pay a transaction fee of 5% of the amount invested, up to $3, plus a 3-cent per share commission.

When you go to sell your shares, you’ll pay a transaction fee of either $15 or $25 (depending on the type of sell order), plus a transaction fee of 12 cents per share. There’s a $15 fee to place the sell order by telephone, instead of online. All fees will be deducted from the sales proceeds.

Helpful Links

Nike’s Investor Relations Website

Current quote and financial summary for Nike (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Nike