Northrop Grumman Corporation receives nearly all of its revenues through contracts from the U.S. Government, including for the development of the X-47 UAV. Photo: Flickr.com/USS Theodore Roosevelt (CVN 71)

About Northrop Grumman Corporation

Northrop Grumman Corporation is one of the major defense contractors in the United States. The company has a wide portfolio of capabilities and technologies that range from underwater to space to cyber space. The company is headquartered in Falls Church, Virginia and employs more than 65,000 people.

The company originated as Northrop Aircraft in Hawthorne, California in 1939; it was later reincorporated in Delaware as Northrop Corporation. Northrop business lines are grouped into three sectors: Aerospace Systems (NGAS), Mission Systems (NGMS) and Technical Services (NGTS). Roughly 85% of the company’s revenues are generated from within the United States and 15% are generated internationally. Overall, about 25% of revenues comes from operations and maintenance work, 30% of revenues comes from research and development work and the remaining 45% comes from production contracts.

NGAS develops advanced platforms across three broad groups: Autonomous Systems, like the Global Hawk UAV and X-47B Unmanned Combat Air System; Manned Aircraft Systems, like the B-2 and B-21 long range bombers; and Space Systems, like the James Webb Space Telescope. NGAS generates about 40% of Northrop’s annual revenues.

NGMS develops sensors, like the F-16, F-22 and F-35 fire control radars; cyber capabilities, like those required by the United States Computer Emergency Readiness Team; and other advanced capabilities, like the launch and propulsion systems for Virginia-class fast attack submarines. NGMS also generates about 40% of Northrop’s annual revenues.

Finally, NGTS provides high-end services – like global logistics and modernization programs for existing platforms – to its customers and generates 20% of Northrop’s annual revenues.

The company is a member of the S&P 500 index and trades under the ticker symbol NOC.

Northrop Grumman’s Dividend and Stock Split History

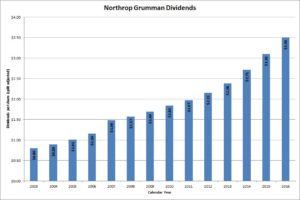

Northrop Grumman has paid dividends continuously since 1954 and grown them since 2004. The company generally announces dividend increases in May, with the stock going ex-dividend in June. In May 2016, the company announced a 12.5% increase to an annual rate of $3.60.

Northrop Grumman has an excellent record of dividend growth, with many years of double digit increases. Over the last 5 years, the company has compounded the dividend an average of 12.18% annually. Over the last decade, the dividend growth rate has averaged 11.68%.

Since 2000, Northrop Grumman has split its stock only once, a 2-for-1 split in May 2004. Prior to that, the company split its stock 3-for-1 in August 1984, 2-for-1 in May 1977, 3-for-2 in December 1975, and 2-for-1 in December 1961 and November 1954. The company also issued a 10% stock dividend in March 1954.

Over the 5 years ending on December 31, 2015, Northrop Grumman Corporation stock appreciated at an annualized rate of 29.62%, from a split-adjusted $51.17 to $187.22. This dramatically outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Northrop Grumman’s Direct Purchase and Dividend Reinvestment Plans

Northrop Grumman has both direct purchase and dividend reinvestment plans. However, to participate in either plan, you must be a current shareholder. That means that you must own shares in your own name and not that of your brokerage (i.e., “in street name”). If you do own shares in a brokerage account, you’ll have to have them transferred into your name and then deposited into the plan to begin participating. The minimum initial investment in the plans is $100. The plans allow for full or partial dividend reinvestment.

The plans are very favorable for investors, as the company picks up most of the fees for purchases. There is no enrollment fee and the only fee on purchases is a $2 fee on each automatic debit. There is a 3-cent per share commission on all purchases. When welling your shares in the plan, you’ll pay a fee of $15 per transaction plus a 12-cent per share commission. All fees will be deducted from the sales proceeds.

Helpful Links

Northrop Grumman Corporation’s Investor Relations Website

Current quote and financial summary for Northrop Grumman Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Northrop Grumman Corporation