Raven's Aerostar division manufactures high-altitude research balloons, including the one shown here which was used for NASA's Barrel mission. Photo courtesy NASA Goddard Space Flight Center/flickr.com.

About Raven Industries

Raven Industries is a technology and engineering company that serves customers in a variety of industries, including the agricultural, energy, construction, and military and aerospace markets. Raven started in 1956 as a manufacturer of high-altitude research balloons and since then has diversified into other products that extended from technologies and production methods from this original business. The company is headquartered in Sioux Falls, South Dakota and employs over 1,200 people.

Raven organizes its business into three divisions: Applied Technology, Engineered Films, and Aerostar. The Applied Technology Division develops precision location and information management products for agricultural customers. These products include field computers, GPS guidance and assisted-steering systems, planter controls and harvest controls. The Applied Technology Division also provides high-speed in-field internet connectivity and cloud-based data management for agricultural customers. The division provided 38% of Raven’s net sales in fiscal year 2015 (which ended January 31, 2015).

The Engineered Films Division produces high-performance plastic films and sheeting for the agricultural, construction, industrial and energy markets. Examples of these products include containment membranes for the energy and environmental industries, fumigation barriers for farmers, gas and oxygen barriers, and pit liners for the energy industry.

The Aerostar Division manufactures high-altitude balloons and tethered aerostats, along with parachutes and protective wear. The division primarily serves the aerospace and security markets for law enforcement agencies and the U. S. Government. It also provides contract-manufacturing services, but is moving away from contract manufacturing in favor of proprietary products. Sales of proprietary products in FY 2015 were $49.1 million, up 25% from FY 2014 while contract manufacturing sales were down 38% to $31.7 million in FY 2015.

Raven Industries has suffered from a decrease in commodity prices in the markets that it serves. Lower oil prices have reduced demand for the company’s pit liners and a drop in corn prices have depressed investment by agricultural producers. This has taken a toll on sales and earnings – for FY 2015, net sales were down 4.2% to $378.2 million and net income was down 26% to $31.7 million. Earnings per share were 86 cents giving the company a payout ratio of 60.5%, based on the company’s current dividend of 52 cents a share. Income was down 39% for the Applied Technology Division, which offset increases in the Engineered Films Division (up 20%) and Aerostar Division (up 15%). The Applied Technology Division suffered from lower sales, while the Engineered Films Division was able to pass along pricing increases to its customers. And Aerostar continued to see a decline in sales due to the move from contract manufacturing to proprietary products but was able to show an earnings increase due to a reduction in capital expenditures.

In the 1st quarter of FY 2016, the sales and income decline continued across all business divisions. Sales were down 31% and income was down 56% from the same quarter in FY 2015, as commodity prices continued to be depressed in the quarter. Raven is not projecting a change to its bottom line until agricultural prices reverse. However, the company is continuing its cost reductions and claims it still has a long-term target of 10 – 12% growth in operating income as a goal. The company recently implemented a $13 million cost reduction plan on top of the previously announced $7 million reduction in the Applied Technology Division and the $2.5 million reduction in the Engineering Films Division.

In November 2014, the Raven board approved a $40 million share buyback program and, as of the end of April 2015, had repurchased 150,000 shares of common stock with a total cost of roughly $3 million. Assuming an average share price of $20, the remaining $37 million on the program gives the company the ability to repurchase 5.3% of the total outstanding shares.

The company is a member of the Russell 2000 index and trades under the ticker symbol RAVN. As of mid-July, RAVN stock yielded 2.6%.

Raven Industries’ Dividend and Stock Split History

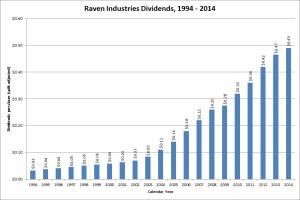

Despite slowing dividend growth in 2014, Raven Industries compounded its dividend over 12% from 2009 – 2014.

Raven Industries has increased dividends since 1987. Until 2012, the company increased dividends in the first quarter of the calendar year. Since then, however, Raven has increased dividends every 5 – 6 quarters – the last dividend increase was 8.3% to an annualized 52 cents in October 2014. Because of the irregular dividend increase pattern, it is difficult to predict the next increase announcement.

Despite the current difficulties that the company is now facing, Raven has an excellent long-term dividend growth history. In the 5 and 10 years ending in 2014, Raven grew the dividend at a compounded rate of 12.3% and 16.1%, respectively. From 1994 – 2014, the company compounded the dividend at 14.5% annually.

Since its incorporation in 1959, Raven has split its stock 9 times. The most recent stock split was 2-for-1 in July 2012. Beginning in 1959, Raven split its stock in September 1963 (5-for-1), December 1966 (2-for-1), December 1967 (2-for-1), July 1989 (2-for-1), October 1992 (3-for-2), July 2001 (3-for-2), January 2003 (2-for-1) and October 2004 (2-for-1). The company also issued six 5% stock dividends from May 1980 to January 1983.

Over the 5 years ending on December 31, 2014, Raven Industries stock appreciated at an annualized rate of 11.86%, from a split-adjusted $14.01 to $24.54. This underperformed the 13.0% compounded return of the S&P 500 index, and the 14.0% compounded return of the Russell 2000 Small Cap index over the same period.

Raven Industries’ Direct Purchase and Dividend Reinvestment Plans

Raven Industries has both direct purchase and dividend reinvestment plans. You must already be an investor in Raven Industries to participate in the plans. If you own shares of Raven stock in your brokerage account, you’ll have to have them transferred into your name in order to join the plans. The minimum investment for the direct purchase plan is $100 and the dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans’ fee structures are favorable for investors, with the company picking up all costs on stock purchases. When you sell your shares, you’ll pay a transaction fee of between $15 and $30, depending on the type of sell order you request, plus a commission of 12 cents per share. There’s an additional $5 fee to have the proceeds directly deposited to your account. All fees are deducted from the sales proceeds.

Helpful Links

Raven Industries’ Investor Relations Website

Current quote and financial summary for Raven Industries (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Raven Industries