SCANA generates about 25% of the electricity from nuclear power plants. Photo: Flickr.com/Peretz Partensky

About SCANA Corporation

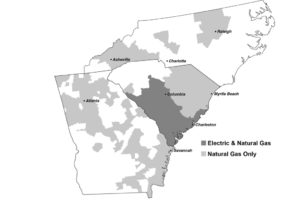

SCANA Corporation provides natural gas and electricity service to about 1.5 million customers throughout South Carolina, North Carolina and Georgia. The company is headquartered in Cayce, South Carolina and employs over 5,800 people.

SCANA was created in 1984 as a holding company for three regulated and two non-regulated companies. The three regulated companies are:

- South Carolina Electric & Gas (SCE&G), which generates, transmits, distributes and sells electricity to nearly 700,000 customers and natural gas to about 350,000 customers. SCE&G services 35 counties in central, southern and southwestern South Carolina.

- South Carolina Generating Company (GENCO), which owns the Williams Nuclear Power Station. The electricity generated by GENCO is sold exclusively to SCE&G.

- Public Service Company of North Carolina (PSNC Energy), which purchases, sells and transports natural gas to about 500,000 customers across 28 counties in North Carolina.

The two non-regulated companies under SCANA are:

- SCANA Energy Marketing, Inc. (SEMI), which competitively markets natural gas to about 450,000 customers in Georgia, as well as providing energy-related services.

- SCANA Services, which provides administrative and management services to the other companies under SCANA.

SCANA’s subsidiaries serve customers throughout South and North Carolina, and Georgia. (Source: SCANA Annual 10-K Filing.)

More than 90% of SCANA’s net income comes from the company’s regulated subsidiaries, with less than 10% of the net income from the non-regulated subsidiaries. About 70% of SCANA’s net revenues and operating income comes from its SCE&G subsidiary.

SCE&G’s electricity supplies are generated from a balance of coal (about 40%), nuclear (24%), natural gas & oil (33%), hydroelectric (3%), and biomass/solar (2%). More than half of SCE&G’s customers are residential, about 33% are commercial customers and roughly 17% are industrial customers.

Both SCE&G and PSNC Energy conduct natural gas operations for SCANA. Combined, the natural gas customer base is roughly the same as for the electricity operations.

The company trades under the ticker symbol SCG.

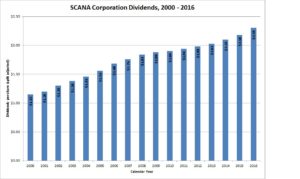

SCANA’s Dividend and Stock Split History

SCANA Corporation has paid dividends since at least 1988 and grown them since 2000. The company generally announces dividend increases in February, with the stock going ex-dividend in March. In 2016, SCANA announced a 5.5% increase to its dividend, to an annual rate of $2.30.

SCANA Corporation has a history of slow but consistent dividend growth. Over the last 5 and 10 years, SCANA has compounded its dividend at rates of 3.46% and 3.19% respectively. Since 2000, the company has compounded its dividend at an average rate of 4.43%.

The company has split its stock just once – a 2-for-1 split in May 1995.

Over the 5 years ending on December 31, 2015, SCANA Corporation stock appreciated at an annualized rate of 12.84%, from a split-adjusted $32.772 to $59.96. This outperformed the 10.20% compounded return of the S&P 500 index over the same period.

SCANA’s Direct Purchase and Dividend Reinvestment Plans

SCANA Corporation has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in either plan – you can make your first investment through the direct purchase plan with an initial purchase of $250. Once you are a plan participant, you can make additional investments of at least $25. The dividend reinvestment plan allows for partial reinvestment of dividends.

The plans’ fee structures are favorable for investors; there are no fees on purchases in the plans, either directly or when reinvesting dividends, as long as the shares are purchased directly from the company. If the shares are purchased on the open market by the plans, you’ll pay a commission of 6 cents per share. When you go to sell your shares in the plan, you’ll pay a fee of between $15 and $30 plus a commission of 10 cents per share. You’ll also pay a $5 fee to have the sales proceeds directly deposited into your account.

Helpful Links

SCANA Corporation’s Investor Relations Website

Current quote and financial summary for SCANA Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for SCANA Corporation