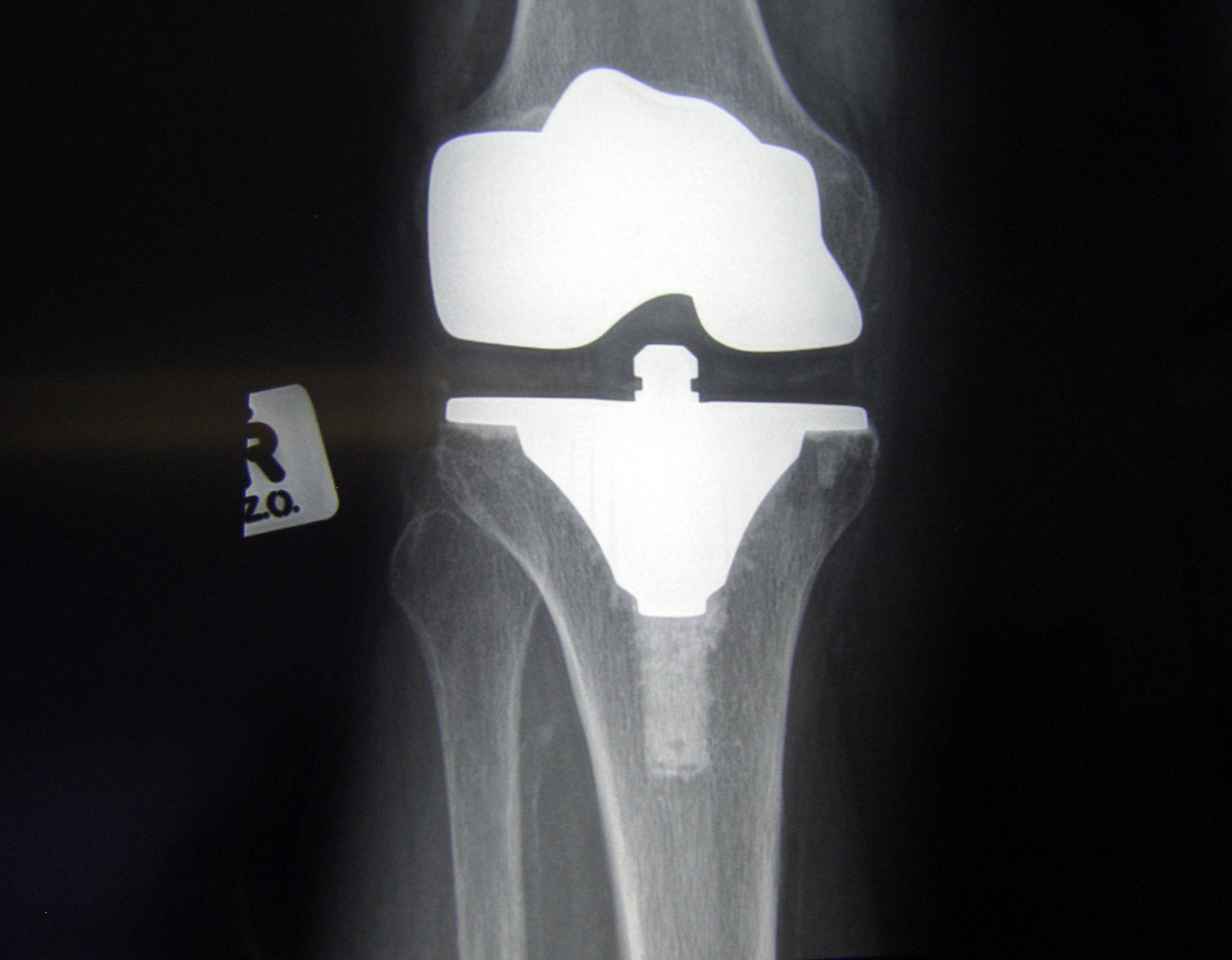

Stryker Corporation manufactures products used in a variety of surgical procedures, including knee replacements. Photo: Freeimages.com/Lesli Lundgren

About Stryker Corporation

Stryker Corporation designs, manufactures and markets medical products to healthcare facilities, hospitals and individual doctors. Although about two-thirds of Stryker’s revenues come from within the United States, the company owns more than 1,900 U.S. patents and 3,400 international patents, and sells products in over 100 countries around the world through company-owned subsidiaries and third party dealers and distributors. Stryker. Its products are used in a variety of orthopaedic and surgical procedures, and to handle and move patients. The company is headquartered in Kalamazoo, Michigan and employs over 26,000 people.

The company has three reportable segments: (1) Orthopaedics, (2) MedSurg, and (3) Neurotechnology and Spine. The Orthopaedics segment manufactures products used in hip and knee joint replacements, and in trauma and extremities surgeries. Roughly 45% of Stryker’s total net sales come from this segment, with the segment’s sales almost evenly divided between uses in knee replacements, hip replacements and trauma/extremities surgeries.

The MedSurg segment, which generates almost 40% of Stryker’s net sales, manufactures surgical equipment and surgical navigation systems, patient handling equipment, and endoscopic systems. Nearly 40% of the segment’s sales each come from medical instruments and endoscopic instruments, while the remaining 20% comes from patient handling and emergency medical equipment.

The Neurotechnology and Spine segment manufactures neurosurgical and neurovascular devices, which are used for brain and spinal implant surgeries, bone graft procedures, and hemorrhagic stroke treatments. The segment generates roughly 20% of Stryker’s net sales, with 55% of segment revenues from sales of Neurotechnology products and 45% from sales of Spine treatment products.

The company was founded in 1941 and incorporated in 1946 by Dr. Homer H. Stryker, who invented several medical products. Dr. Stryker’s first invention was the turning frame, used to position hospital patients while keeping them immobile. His next major invention was the oscillating saw, which was used to quickly remove plaster casts without cutting the skin underneath.

After expanding within the United States, Stryker’s first international expansion was to Canada in 1972. In 1979, Stryker held their initial public offering and opened its first office in Germany, and later opened additional offices in Australia (1986), Belgium (1989), Latin America (1992), and China (1994).

The company is a member of the S&P 500 index and trades under the ticker symbol SYK.

Stryker Corporation’s Dividend and Stock Split History

Stryker Corporation has grown dividends since 1993. However, there is a discrepancy with Stryker’s dividend growth history. Until 2008, Stryker paid dividends annually, with a record date in December and a payout date in January. Beginning in November 2009, Stryker moved to quarterly dividend payments, with record dates at the end of March, June, September and December, and payout dates a month later. Annual increases are announced with the December dividend.

Stryker has compounded its payout at an average rate of 14.1% over the last 5 years and 18.1% over the last 10 years.

Stryker Corporation has split its stock nine times since coming public in 1979. From 1979 to 1991, Stryker split its stock roughly every 2 – 3 years, with 3-for-2 splits in October 1980, October 1982, August 1985, and May 1991, and 2-for-1 splits in May 1987 and May 1989. Beginning in 1991 and through 2004, Stryker split its stock about every 4 – 5 years; the company had 2-for-1 splits in May 1996, May 2000 and May 2004. A share of stock purchased at Stryker’s IPO in 1979 has split into 162 shares. A single share of stock purchased when Stryker began its dividend growth record in 1993 has split into 8 shares of stock.

Stryker Corporation’s Direct Purchase and Dividend Reinvestment Plans

Stryker Corporation does not have a direct purchase or dividend reinvestment plan. In order to invest in the company’s stock, you’ll need to purchase it through a broker; most will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Stryker Corporation’s Investor Relations Website

Current quote and financial summary for Stryker Corporation (finviz.com)