Photo: Flickr.com/Chris Price

About Thomson Reuters Corporation

Thomson Reuters provides business news and information for financial, legal and corporate customers. The company operates in over 100 countries around the world. Thomson Reuters is a Canadian company based in Ontario; its U.S. headquarters are in New York City. The company employs over 52,000 people worldwide.

The company operates three distinct business units not including the Intellectual Property & Science business, which it plans on divesting by the end of 2016. The Financial & Risk unit, which generates roughly 55% of the company’s revenues, provides news, information and analytics to investment, financial and corporate professionals; and provides information and solutions for regulatory and operational risk activities to corporate compliance and risk management professionals.

The Legal unit provides information and decision tools, software and services to support corporate legal departments, legal professionals, judges, court and law firm staff, and law students. The Legal unit provides nearly 30% of the company’s total revenues.

Finally, the Tax & Accounting unit provides information, software and services to support corporate finance, accounting and tax compliance departments, law firms, and government organizations. This unit generates roughly 13% of Thomson Reuters’ total revenues.

The remaining 2% of revenues is generated by the Reuters news and information service, which serves newspapers, radio stations, and television and cable networks.

Across all the company’s units, selling electronic content and services, usually on a subscription basis, generates the bulk of revenues. Geographically, more than 60% of the company’s revenues are generated in North, South and Central America; about 30% of revenues are generated in Europe, the Middle East and Africa; and the remaining 10% of revenues are generated in the Asia-Pacific region.

The company trades under the ticker symbol TRI.

Thomson Reuters’ Dividend and Stock Split History

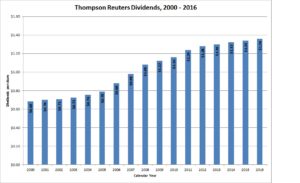

Thomson Reuters has paid dividends since at least 1989 and has increased them since 1994. The company announces annual dividend increases with the release of full year earnings in mid-February, with the stock going ex-dividend about a week later. In February 2016, Thomson Reuters announced a 1.5% increase in its dividend to an annualized rate of $1.36. I expect Thomson Reuters to announce its 24th year of dividend growth in February 2017.

Thomson Reuters has generally grown dividends very slowly, with annual dividend increases of less than 4 cents a year. Over the last 5 years, the company has compounded dividends at less than 2% a year; over the last 10 years, the compounded dividend growth rate has been 4.5%. Over the last two decades, the compounded dividend growth rate is 4.6%.

To date, Thomson Reuters has not split its stock.

Over the 5 years ending on December 31, 2015, Thompson Reuters stock appreciated at an annualized rate of 3.97%, from $30.61 to $37.19. This significantly underperformed the 10.2% compounded return of the S&P 500 index over the same period.

Thomson Reuters’ Direct Purchase and Dividend Reinvestment Plans

Thomson Reuters has a dividend reinvestment plan, but not a direct purchase plan. Information on the dividend reinvestment plan is available at the link below. In order to participate in the dividend reinvestment plan, you must already own shares of Thomson Reuters stock and have them transferred into the plan. Thomson Reuters picks up all costs and fees related to the dividend reinvestment plan – there is no charge to you if you participate in the plan.

Helpful Links

Thomson Reuters’ Investor Relations Website

Current quote and financial summary for Thomson Reuters Corporation (finviz.com)

Information on the dividend reinvestment plan for Thomson Reuters Corporation