Valspar is a world-leading manufacturer of paints, varnishes and other types of coatings. Photo courtesy Charles & Hudson/flickr.com.

About Valspar Corporation

Valspar Corporation is a global manufacturer and distributor of paints, coatings and associated products. The company has its headquarters in Minneapolis, Minnesota and at the end of October 2014 employed nearly 10,500 people worldwide. Valspar has manufacturing plants located around the world, including in Australia, China, Vietnam, and in multiple countries in Europe. In fiscal year 2014 (which ended October 31, 2014), 46% of Valspar’s consolidated sales came from outside the United States.

Valspar’s heritage dates back to 30 years after the American Revolution when Samuel Tuck founded the Paint and Color paint dealership in 1806 on Broad Street in Boston. In 1832, the company merged with a Cambridge, Massachusetts varnish producer and was renamed Stimson & Valentine. In addition to the varnish production, the merged company had a retail and import business in paints, oils, glass and beeswax. Around 1860, brothers Lawson and Henry Valentine became the sole partners of the business and it was renamed Valentine & Company. Soon thereafter, Valentine & Company hired their first chemist and began development of new products.

In 1906, Lawson Valentine’s grandson, L. Valentine Pulsifer – a Harvard-trained chemist – invented Valspar, the first clear varnish. The popularity of the new product permitted Valentine & Company to expand and after acquiring a few additional companies in the early 20th century, Valentine & Company began operating as a subsidiary of the Valspar Corporation, which had been formed in 1932.

Valspar continued to expand through acquisitions and mergers; two of the most significant were the merger with the Rockcote Paint Company in 1958 and the merger with then-privately held Minnesota Paints in 1970. The most recent acquisition was the purchase for $210 million of Inver Group, and Italian-based industrial coatings company serving customers in Europe.

Valspar has two business segments. The Coatings Segment manufactures protective coatings, like primers and varnishes, for the original equipment manufacturers of metal, wood and plastic products. The segment serves a variety of markets including appliances, furniture, agricultural and construction equipment, and metal fabrication. Valspar’s products are also used to coat metal food containers and beverage cans, aerosol cans, and paint cans.

The Paints Segment manufactures consumer and automotive paints and refinishes for the do-it-yourself and professional markets. In general, these products are distributed through home centers, hardware stores and other retailers, and company-owned stores.

Valspar is dependent on a few large customers and distribution chains for a significant part of its revenue. More than 10% of the company’s sales came through Lowe’s stores, and the 10 largest customers accounted for more than a third of Valspar’s 2014 sales. The concentration of sales is more pronounced in the Paints segment, with the 5 largest customers accounting for about 55% of segment sales.

For Valspar’s 2014 fiscal year, the company reported net sales of $4.5 billion, up more than 10% from 2013. Net income was up nearly 20% to $345.4 million and earnings per share were $4.01, up more than 25% year-over-year. An active share repurchase program powered the large EPS increase – Valspar purchased 4.7 million of its shares in 2014. In November 2014, the company replaced the existing program with a new $1.5 billion repurchase program. Assuming an average price of $85, this new program will allow Valspar to repurchase nearly 17.6 million shares (more than 20% of the outstanding shares) going forward.

One area of risk is the company’s large debt load. Although long-term debt was down 8.4% year-over-year to $950 million, Valspar still had over $1.5 billion in total debt at the end of October 2014.

The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol VAL.

Valspar Corporation’s Dividend and Stock Split History

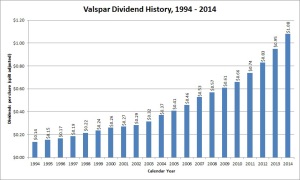

With a long term record of 11% annual dividend growth, Valspar has doubled its dividend payout about every 6 – 7 years.

Valspar has increased its dividend payout year-over-year since 1978. For the last two decades, Valspar has announced dividend increases around Thanksgiving, with the stock going ex-dividend in early December. In November 2014, Valspar announced a 15% increase in the dividend, which gives the company a current annualized dividend of $1.20. We should see Valspar announce its 38th year of dividend growth in November 2015.

Valspar has established a very good record of dividend growth. With only a few exceptions, the company has given investors year-over-year dividend increases of more than 10% over the last two decades. Valspar has averaged annual dividend growth of 12.1% over the last 5 years and 11.3% over the last 10 years. Over the last two decades, Valspar has averaged annual dividend growth of 11.0%.

Valspar Inc has split its stock 2-for-1 five times. These splits occurred in March 1984, March 1987, March 1992, March 1997, and – most recently – in September 2005. A single share of stock purchased prior to March 1984 would have split into 32 shares.

Over the 5 years ending on December 31, 2014, Valspar stock appreciated at an annualized rate of 28.85%, from a split-adjusted $24.84 to $86.18. This dramatically outperformed both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time.

Valspar Corporation’s Direct Purchase and Dividend Reinvestment Plans

Valspar has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the direct purchase plan, but your initial investment must be a single purchase of at least $1000. The minimum investment for additional investments is $100.

The fee structure of the plans is not favorable to investors. If you are not currently participating in the plan, you will need to pay an initial setup fee of $5 when you enroll. When purchasing shares under the direct purchase plan, you’ll pay a transaction fee of $5 and a commission of 5 cents per share unless you set up regular automatic debits from your checking or savings account. In that case, the transaction fee is reduced to $3. (All other fees stay the same.) Praxair pays all fees when you purchase shares through dividend reinvestment.

When you go to sell your shares in the plan, you’ll pay a transaction fee of between $15 and $25 and a commission of 12 cents per share. You’ll also be charged an additional fee of $15 for making the request through a phone representative. Unfortunately, these are standard fees for Computershare-run direct purchase and dividend reinvestment plans.

Helpful Links

Valspar Corporation’s Investor Relations Website

Current quote and financial summary for Valspar Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Valspar Corporation