Photo: Flickr.com/Tim Dickey.

About Westamerica Bancorp

Westamerica Bancorp is a bank holding company headquartered in the San Francisco suburbs of San Rafael, CA. The company has 92 bank branches that provide banking services to individual and corporate customers in 21 counties in Northern and Central California, but the company’s focus is on serving small businesses. Westamerica Bancorp also owns Community Banker Services Corporation, which provides the company with data processing and other services. Westamerica Bancorp employs approximately 850 people.

The company has one reporting segment, as its revenues come nearly exclusively from the banking operations. In 2014, Westamerica Bancorp had net income of $60.6 million, which was down nearly 10% from 2013’s net income. Full year earnings per share (EPS) were $2.32, down 7.8%. This gives the company a payout ratio of 67.2% based on the annualized dividend of $1.56. The company’s loan portfolio was $1.7 billion, down 7% from 2013. Over 65% of the loan portfolio came from commercial and commercial real estate loans; another 25% came from consumer installment (e.g., credit card, auto, etc.) loans. The drop in earnings was caused by a drop in the loan portfolio and a compression of the interest rate spread between bank deposits and loans. With the Federal Reserve keeping rates low, over the last three years the net interest margin has dropped from 4.79% at the end of 2012 to 3.70% at the end of 2014.

For the first 3 quarters of 2015, EPS and income was flat as compared to the same period in 2014.

In July 2014, Westamerica Bancorp authorized the repurchase of 2 million shares; the program was good until September 2015. The company repurchased 482,000 shares on this program – approximately 1.9% of the company’s outstanding shares. There is no information on whether the company will authorize a new repurchase program.

The company is a member of the S&P Small Cap 600 and Russell 2000 indices and trades under the ticker symbol WABC.

Westamerica Bancorp’s Dividend and Stock Split History

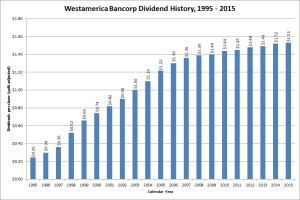

Westamerica Bancorp has compounded dividends at less than 2% over the last 5 years and less than 2.5% over the last decade.

Westamerica Bancorp has paid quarterly dividends since being formed in 1972 and began increasing dividends in 1993. Since 2008, the company has announced dividend increases every other October. The stock goes ex-dividend at the end of October. The company’s most recent increase was in October 2015 when the annualized dividend rate increased by less than 1% to $1.56. Because the bi-annual dividend increase is in the 4th quarter, Westamerica is able to show consecutive year-over-year dividend growth. I expect Westamerica to announce its next dividend increase in October 2017.

After rapidly increasing its dividend from 1993 – 2005, the company slowed its growth rate dramatically. Over the last 5 and 10 years, the dividend has compounded at an average rate of 1.2% and 2.3%, respectively. The 20-year dividend compounded rate is 9.6%; this reflects the rapid growth in the 1990s.

Westamerica Bancorp has split its stock only once in its history – a 3-for-1 split in February 1998.

Over the 5 years ending on December 31, 2014, Westamerica Bancorp stock compounded at a rate of less than 1% a year, from a split-adjusted $46.34 to $47.79. This dramatically underperformed the 13.0% compounded return of the S&P 500 index, the 15.9% compounded return of the S&P Small Cap 600 index and the 14.0% compounded return of the Russell 2000 Small Cap index over the same period.

Westamerica Bancorp’s Direct Purchase and Dividend Reinvestment Plans

Westamerica Bancorp has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. The minimum purchase amount for the direct investment program is $100, and the dividend reinvestment plan allows for full or partial reinvestment of dividends.

The fees for the dividend reinvestment plan are somewhat favorable – the company picks up the total cost of reinvesting dividends, but you will pay a $10 fee to establish an account. In addition, the fees for the direct purchase program are significant. When directly purchasing shares, you’ll pay a per share commission of 5 cents per share plus a transaction fee of $5 for check or one time debits or $1.50 for recurring automatic purchases. When you sell your shares, you’ll pay a commission of 10 cents per share plus a transaction fee of either $5 or $25, depending on the type of sell order.

Helpful Links

Current quote and financial summary for Westamerica Bancorp (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Westamerica Bancorp