Weyco Group produces footware under a variety of brand names including Florsheim. Photo courtesy deejayqueue/flickr.com.

About Weyco Group Inc.

Weyco Group distributes footwear under the brands Florsheim, Nunn Bush, Stacy Adams, BOGS, Rafters and Umi. The company was originally incorporated in 1906 as the Weyenberg Shoe Manufacturing Company. 84 years later, the company changed its name to Weyco Group. The company had historically focused on mid-priced leather dress shoes and casual footwear mainly for men, but in 2011, Weyco acquired the BOGS and Rafters brands and expanded into outdoor boots, shoes and sandals. The company purchases shoes from outside suppliers, mostly in China and India, and resells them around the world. Weyco has its headquarters in Milwaukee, Wisconsin and employs 640 people.

Weyco Group has three business segments: North American Wholesale, North American Retail and “Other”. The North American Wholesale segment sells footwear to retail outlets, using a cadre of salespeople that interact directly with over 10,000 shoe, clothing and department stores. As the orders are taken, the product is shipped directly to the stores from the company’s distribution outlet in Glendale, Wisconsin. This segment provided 76% of total company sales in 2014. Five of the company’s six brands (Stacy Adams, Nunn Bush, Florsheim, and BOGS/Rafters, which are tracked together) had between 21 and 27% of the segment sales each, with the Umi brand and licensing providing the remaining sales.

The North American Retail segment covers the company’s 16 retail stores and its e-commerce business. An increase in e-commerce sales in 2014 offset the closing of 7 retail stores, resulting in flat sales but a 9% increase in earnings. The segment provided 7% of Weyco’s total sales.

The “Other” segment includes all of Weyco’s overseas business, specifically in Europe (Florsheim Europe), Australia (Florsheim Australia), South Africa and the Asia-Pacific region. This segment provided the remaining 17% of company sales, which were up 5% year-over-year because of higher sales in Europe and Australia. The effects of the strong U. S. dollar were notable here, with Australia sales up 10% in the local currency but only up 3% in the U. S. dollar.

In 2014, Weyco Group reported earnings of $19.0 million on total sales of $320.5 million. These figures were up 8.1% and 6.7% from 2013. Earnings per share were up 8.0% to $1.75, giving the company a payout ratio of 45.7% using the current annualized dividend rate of 80 cents per share. Much of the growth came from the integration and higher sales of BOGS brand merchandise. The growth continued in the 1st quarter of 2015, with earnings per share of 33 cents, up 13.8% from 29 cents in the same period in 2014.

Weyco has an active share repurchase program that it has expanded over the years. Between April 1998 and December 2014, Weyco repurchased nearly 3.2 million shares of stock. There are 330,000 shares remaining on the current share repurchase program, which represents about 3% of the outstanding shares.

Weyco group currently has total debt of $5.4 million, representing about 3% of the company’s equity.

The company is a member of the Russell 2000 index and trades under the ticker symbol WEYS. At the beginning of August 2015, WEYS stock yielded around 2.95%.

Weyco Group’s Dividend and Stock Split History

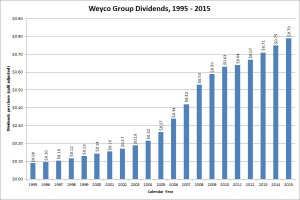

Weyco Group began growing its dividend in 1982. Since 2004, with one exception (2011), the company has increased its dividend in the 2nd quarter of the calendar year. Weyco announces dividend increases at the beginning of May, with the stock going ex-dividend at the end of June. Weyco’s most recent dividend increase was a 5.3% increase to an annualized rate of 80 cents a share. I expect Weyco to announce its 35th year of dividend increases in May 2016.

Following a period of rapid dividend growth from 1998 – 2009, with annual increases usually in excess of 10%, Weyco slowed dividend growth to the low to middle single digits. The company compounded its dividend at 5.3% from 2010 – 2015, but over the 10 and 20-year periods ending in 2015, the Weyco board grew the dividend at an compounded rate of 11.5%.

Over the last 25 years, Weyco Group has split its stock 4 times. It’s been a decade since the most recent stock split – a 2-for-1 split in April 2005. Prior to that, the company split the stock first in July 1990 (a 2-for-1 split), then in October 1997 (3-for-1) and also in October 2003 (3-for-2). A single share of Weyco Group stock purchased prior to July 1990 would now be equivalent to 18 shares.

Over the 5 years ending on December 31, 2014, Weyco Group Inc. stock appreciated at an annualized rate of 7.43%, from a split-adjusted $20.45 to $29.26. This significantly underperformed both the 13.0% compounded return of the S&P 500 index and the 14.0% compounded return of the Russell 2000 Small Cap index over the same period.

Weyco Group’s Direct Purchase and Dividend Reinvestment Plans

Weyco Group does not have a direct purchase or dividend reinvestment plan. In order to invest in the company’s stock, you’ll need to purchase it through a broker; most will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Weyco Group’s Investor Relations Website

Current quote and financial summary for Weyco Group (finviz.com)