Xilinx designs and develops programmable logic devices. Photo: Flickr.com/walknboston

About Xilinx

Xilinx designs and develops programmable logic devices (PLDs); these are integrated chips that are programmable and re-programmable, rather than being hardwired for a specific function. Included among these devices are Field Programmable Gate Arrays and System on Chips. Xilinx products are manufactured by the Taiwan Semiconductor Manufacturing Company. The company also generates revenues from field engineering services, design services, customer training and technical support.

The company sells its hardware through direct sales to original equipment manufacturers and through independent domestic and foreign distributors. These chips are used in a variety of markets, including wired and wireless communications, industrial, scientific and medical, aerospace and defense, audio, video and broadcast, and automotive markets.

Major competitors to Xilinx are Intel Corporation, Lattice Semiconductor Corporation, Microsemi Corporation, Broadcom Corporation, Marvell Technology Group, and Texas Instruments Incorporated. Some of these companies produce PLDs, while others produce Application Specific Integrated Circuits and Application Specific Standard Products, which compete with Xilinx’s products.

The company is a member of the S&P 500 index and trades under the ticker symbol XLNX.

Xilinx’s Dividend and Stock Split History

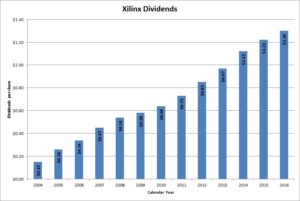

Xilinx has paid and grown dividends since 2004. The company generally announces dividend increases in early March, although in 2016 Xilinx announced its annual dividend increase at the end of April. The stock goes ex-dividend in mid-May. In 2016, Xilinx announced a 6.5% dividend increase to an annualized rate of $1.32 per share.

Xilinx has an outstanding record of dividend growth, although the dividend growth has slowed recently. In the past, however, dividend increases have generally been more than 10% and often in the mid-teens. The company has compounded the dividend at more than 12% a year over the last 5 years and by more than 14% over the last decade.

Xilinx has split its stock 3 times since 1995 – in August 1995, March 1999 and December 1999. Each of the splits was a 3-for-1 split. A single share of stock purchased prior to August 1995 would now be 27 shares of stock.

Over the 5 years ending on December 31, 2015, Xilinx Corporation stock appreciated at an annualized rate of 12.68%, from a split-adjusted $25.49 to $46.31. This outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Xilinx’s Direct Purchase and Dividend Reinvestment Plans

Xilinx does not have a direct purchase or dividend reinvestment plan. In order to invest in Xilinx stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Xilinx’s Investor Relations Website

Current quote and financial summary for Xilinx (finviz.com)