We saw 9 Dividend Aristocrats and High Yield Dividend Aristocrats announce dividend payments. And a future Dividend Aristocrat increased dividends for the 23rd straight year.

S&P 500 Dividend Aristocrats

Industry: Electric Utilities

Dividend Payment: 65 cents per share – up 3.2% from prior level of 63 cents

Dividend Paid On: 3/15

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 2/13

Number of Years of Dividend Increases: 41

Current Forward Yield: 3.76%

Industry: Specialty Chemicals

Dividend Payment: 67 cents per share

Dividend Paid On: 3/12

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 2/18

Number of Years of Dividend Increases: 43

Current Forward Yield: 1.16%

The Procter & Gamble Company (PG)

Industry: Consumer Goods – Personal Products

Dividend Payment: 64.36 cents per share

Dividend Paid On: 2/17

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 1/21

Number of Years of Dividend Increases: 58

Current Forward Yield: 2.82%

Industry: Retail Stores

Dividend Payment: 52 cents per share

Dividend Paid On: 3/10

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 2/13

Number of Years of Dividend Increases: 43

Current Forward Yield: 2.78%

Industry: Drug Stores

Dividend Payment: 33.75 cents per share

Dividend Paid On: 3/12

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 2/13

Number of Years of Dividend Increases: 39

Current Forward Yield: 1.78%

S&P 500 High Yield Dividend Aristocrats

AptarGroup, Inc. (ATR)

Industry: Packaging & Containers

Dividend Payment: 28 cents per share

Dividend Paid On: 2/18

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 1/26

Number of Years of Dividend Increases: 21

Current Forward Yield: 1.74%

Eaton Vance (EV)

Industry: Asset Management

Dividend Payment: 25 cents per share

Dividend Paid On: 2/10

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 1/28

Number of Years of Dividend Increases: 34

Current Forward Yield: 2.57%

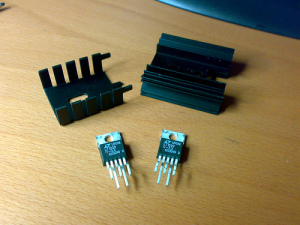

Linear Technology Corporation (LLTC)

Linear Technology, which manufactures digital hardware like these regulators, has increased dividends for 23 years. The company is poised to become an S&P Dividend Aristocrat in 2017.

Photo courtesy meteotek08/flickr.com.

Industry: Semiconductor Manufacturing

Dividend Payment: 30 cents per share – up 11.1% from prior level of 27 cents

Dividend Paid On: 2/25

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 2/11

Number of Years of Dividend Increases: 23

Current Forward Yield: 2.65%

National Retail Properties, Inc. (NNN)

Industry: REIT

Dividend Payment: 42 cents per share

Dividend Paid On: 2/17

Stock Goes Ex-Dividend (own the stock before this date to collect the dividend): 1/28

Number of Years of Dividend Increases: 25

Current Forward Yield: 3.85%

Next Week’s Ex-Dividend Stocks:

Tuesday, January 20:

None.

Wednesday, January 21:

The Procter & Gamble Company (PG)

Colgate-Palmolive Company (CL)

Thursday, January 22:

Friday, January 23:

None.

Monday, January 26:

AptarGroup, Inc. (ATR)

There are over 50 S&P 500 companies that have increased dividends for more than a quarter century. See the full list of S&P Dividend Aristocrats.