Note: This page contains affiliate links for certain services and products. I may receive compensation when you click on these links.

If you are a dividend investor, it can be overwhelming deciding where to start. The universe of equity stocks and ETFs is immense – there are over 6,500 US stocks and ETFs traded on all the exchanges.

Try to narrow that down to U.S. stocks listed on the New York Stock Exchange and it gets no better: of the nearly 2,000 U.S. stocks listed on the NYSE, more than 1,200 of them pay dividends.

What about the tech-heavy NASDAQ exchange? There are more than 2,200 U.S. stocks traded on the NASDAQ, and nearly 800 of them pay dividends.

So most of us take the easy way out – we start with large, well-known stocks, like those on the S&P 500 Dividend Aristocrats list. And that’s usually where we stay.

This is not a bad thing. The companies in the S&P 500 index are large, usually stable, and pretty much reliable. They are the classic “buy-and-hold” companies.

But when it’s time to go beyond the basic list of Dividend Aristocrats, where do we start?

I bring this up because I recently read a blog post from Dividend Growth Investor about using Yahoo! Finance to screen for dividend growth stocks. He did a nice job with the post, but it got me to thinking about the tools that I use to scan through the universe of stocks and ETFs for dividend and dividend growth investments.

By far, my favorite tool for stock screening is finviz.com.

There’s really two great things about finviz.com: first, it has a lot of different parameters – both fundamental and technical – that I can screen stocks for and, second, most of the features are free (although they do offer additional features to Elite subscribers).

I generally use the tool in one of two ways: (1) looking for companies that I might not be aware of by scanning for dividend stocks with good fundamental and technical parameters and (2) looking at known dividend growth stocks with the site’s portfolio tool. I’ll step through how I do the first of these two – screening for dividend stocks that I might find worthwhile to invest in:

Scanning Across the Entire Universe of Stocks With Finviz.com

Step 1: Log into finviz.com (or create an account if you don’t have one).

While you can use the site without creating an account, I recommend creating a free account. You’ll have access to a lot more tools if you’re logged on, including the ability to save multiple stock portfolios. And while the site will display advertisements (which you can get rid of by upgrading to a paid Elite account), you won’t get spammed by the site. In the 5+ years I’ve had an account, I think I’ve gotten less than 5 e-mails from them, usually with information about site upgrades.

(Click on any of the images below to enlarge them.)

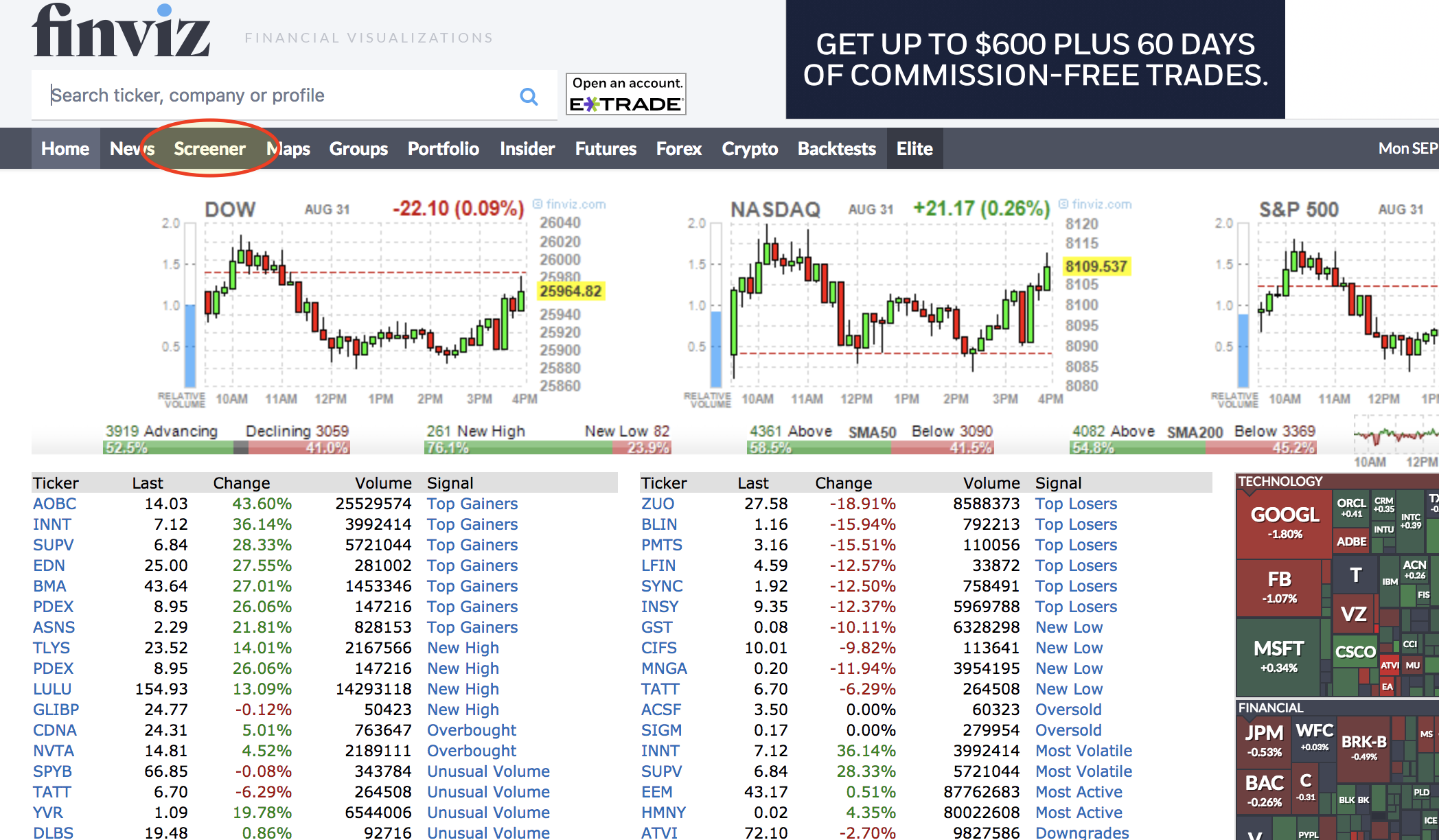

Step 2: Go to the Screener Tool

Step 2: Go to the Screener Tool

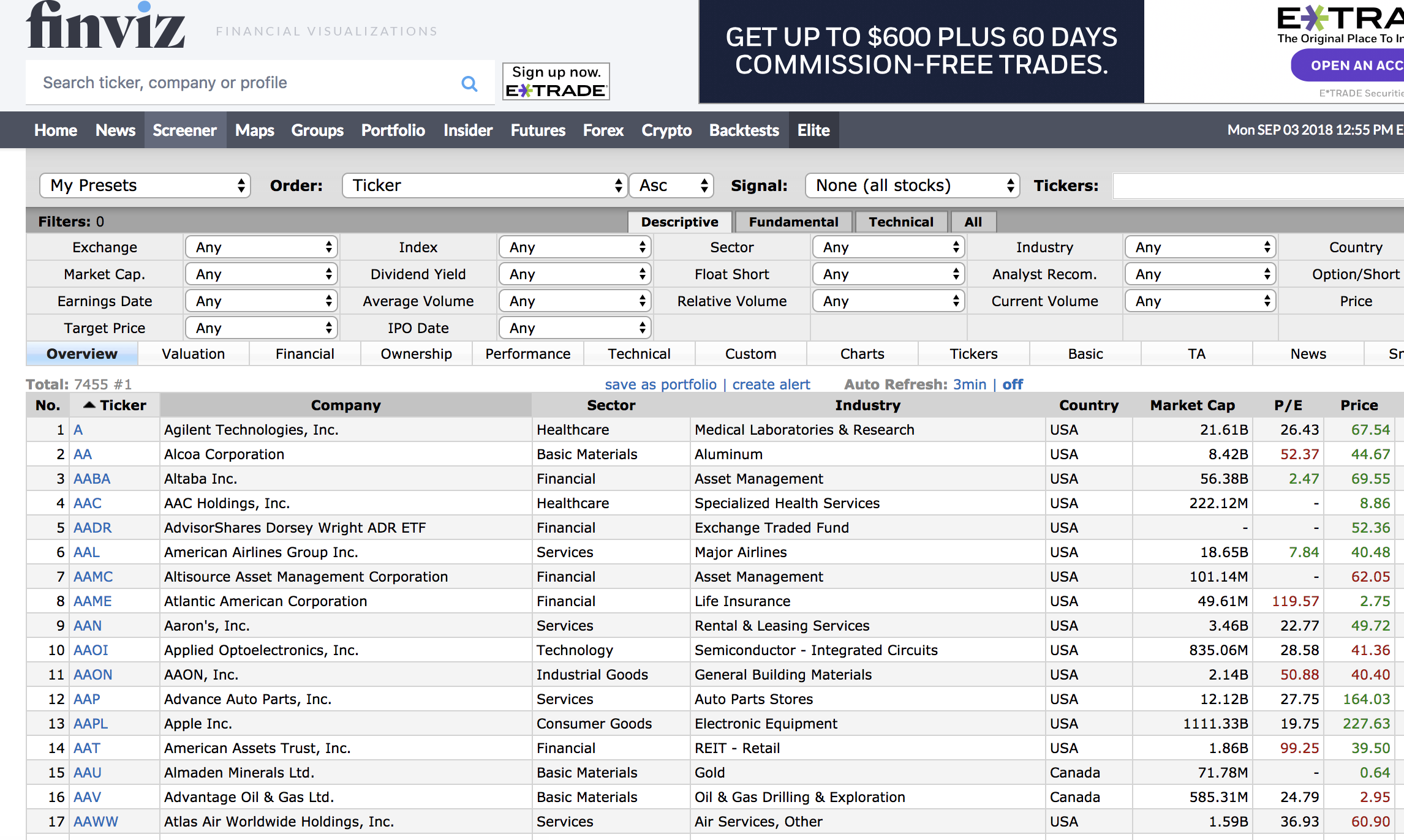

Once you’ve created your account, go to the screener tool. You’ll see a section with a series of filters and further below, another section with the first 20 stocks and ETFs (of the 7,500+ that are available) displayed.

Now it’s time to start narrowing down the list of stocks.

Step 3: Use the Available Parameters to Create Your Focus List of Dividend Stocks

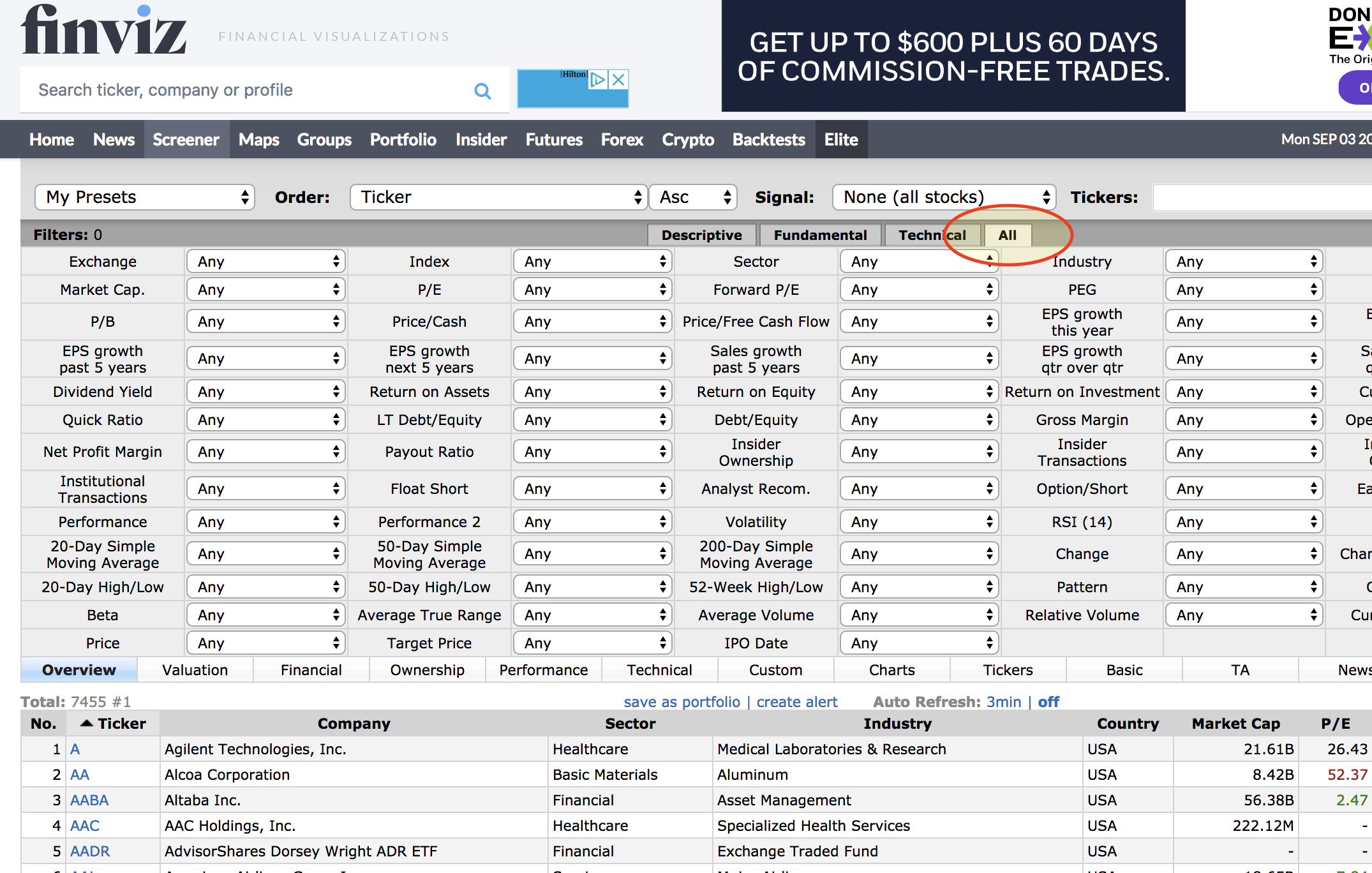

Right below the bar where you clicked on “Screener”, you’ll see four tabs labeled Descriptive, Fundamental, Technical, and All. I like to work from one screen, so I click on All:

Step 4: Apply Filters to Screen for Dividend Stocks

Now comes the fun part: applying the filters to narrow the list of stocks worth looking at.

Each of the filters has a drop-down menu. If you click on any one of them, you’ll see the preset parameters. Some of them also have a custom option – you’ll need a paid subscription to use this but, in most cases, the preset parameters are good enough.

Here are the filters that I use for a first screening for dividend stocks:

We’re looking at stocks, not ETFs, so I’ll screen for stocks only:

- Industry: Stocks only (ex-Funds)

In the current environment, I want to look for dividend yields of at least 3%:

- Dividend Yield: Over 3%

I also want to look at companies with room to grow their dividends, so I’ll apply a filter on the payout ratio:

- Payout Ratio: Under 60%

And I want to look at companies with growing earnings:

- EPS growth this year: Positive (>0%)

I also want to narrow down the list of stocks to those that have some size and liquidity:

- Market Cap.: +Small (over $300 mil)

- Average Volume: Over 200K

With these filters applied, I have about 76 stocks to look at, so I’ll apply a filter to screen out stocks with a lot of debt:

- LT Debt/Equity: Under 0.5

That leaves me with 27 stocks to look at today – your results will differ based on when you run the screen.

If you aren’t sure what some of the filters are, just hover the cursor over the filter name and a pop-up box will appear with a brief description.

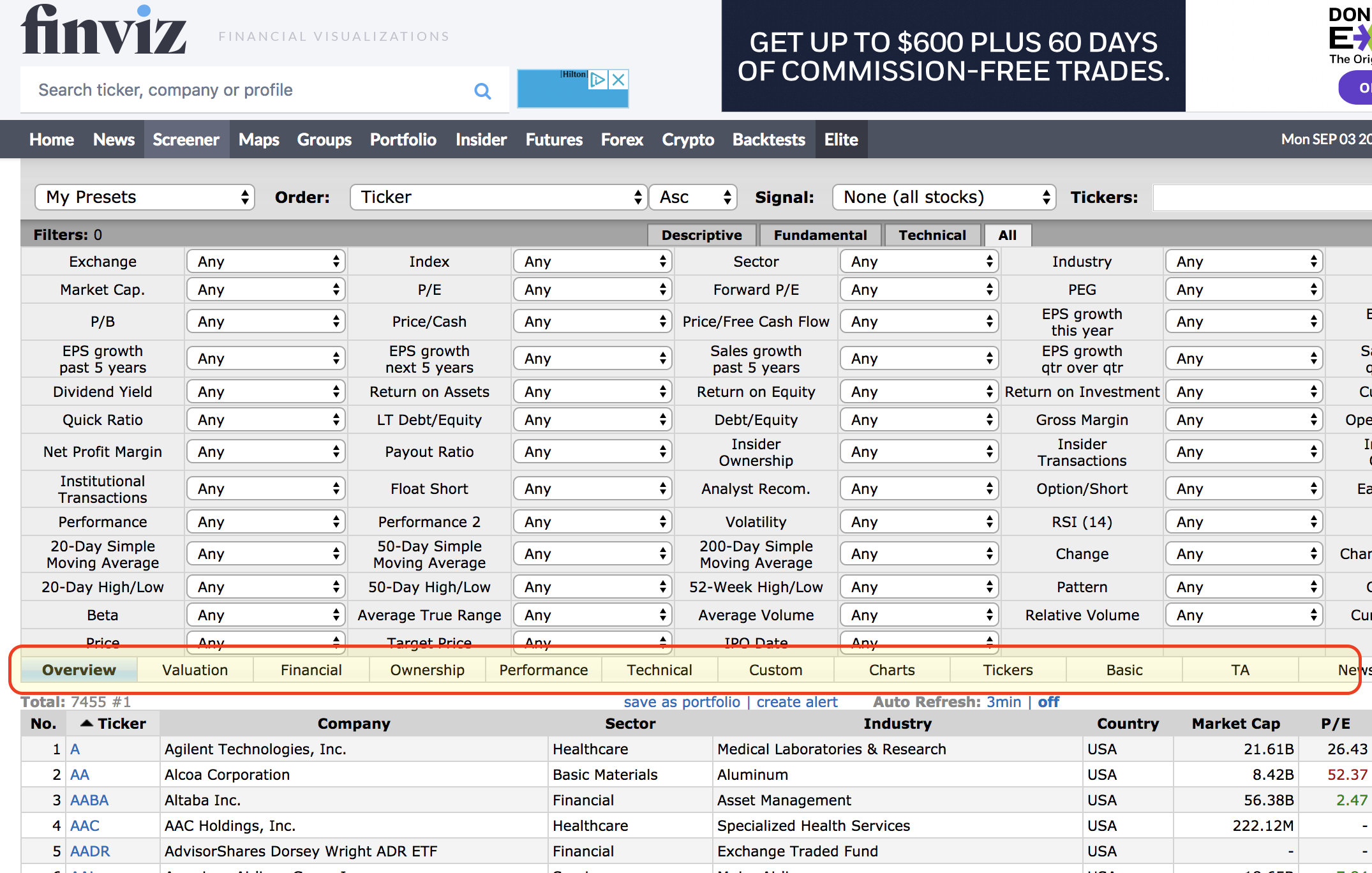

You can see the dividend yields for each of these stocks by clicking on the “Financial” tab in the row between the filters and stock list. Then, if you click on any of the table headers you’ll sort the stock list by that parameter, from lowest to highest. Click on the same table header again and you’ll change the sort order so that the stocks show listed from highest to lowest.

For example, to sort the stock list from highest dividend yield to lowest, click on the “Financial” tab and then click on the “Dividend” table header twice.

Other stock parameters are available by clicking on the other tabs in the row between the filters parameters and list of stocks.

Step 5: (Optional & For Users with a Paid Subscription) Download Your Focus List

Finviz.com has several features that are only available to with a paid subscription. One of these is the ability to download the results of the screening tool in .csv format (which is compatible with many different spreadsheet programs). Once in Excel or another spreadsheet program, you can manipulate the screen results however you like.

Of course, the screen above is only one that I use. Feel free to adjust the screening parameters however you see fit. The flexibility of finviz.com is one of its most appealing features.

The other appealing feature is the vast amount of data inside finviz.com’s database. Both of these make it a very powerful tool for investors.

As a reminder: the screening process is a first step, not the last step in doing research. Once you have a list of stocks that meet your parameters, then it’s time to dig into your research.

I’ll cover other aspects of finviz.com that you will find useful (for example, the ability to create and track multiple portfolios) in a future blog post, but in the meantime, I encourage you to check out the site and try out finviz.com’s many features. Let me know what screens you build by commenting below!