Photo: Flickr.com/Bonnie Jeffs

About C. R. Bard

C. R. Bard, headquartered in Murray Hill, New Jersey, develops medical technologies and medical devices that help patients manage a variety of diseases. The company has four primary thrusts: (1) vascular, (2) urology, (3) oncology, and (4) surgical specialties. They market their products and services worldwide to hospitals, individual healthcare professionals and extended-care facilities.

Bard’s Vascular Division generates about 30% of Bard’s total sales. The vascular division develops and manufactures products for use in heart surgeries and treatments and includes drug delivery methods like drug coated vascular balloons.

The Urology Division develops solutions to patients’ continence and prostate disease problems, and provides about 25% of Bard’s sales.

The Oncology Division provides about 30% of sales for Bard. The oncology division develops medical devices for use in cancer treatments; examples of these include endoscopic instruments, colorectal stents and breast biopsy devices. The division also manufactures catheters for a variety of uses during cancer treatments.

The Surgical Specialties Division is the smallest of the divisions, with about 15% of Bard’s total sales. The division produces hernia repair products and breast reconstruction products, among other items.

Bard’s history dates back over 100 years. In New York City in 1907, Charles Russell Bard began importing a European cure-all called Gomenol to help relieve his tuberculosis – related symptoms of urinary discomfort. Charles Bard formally incorporated the company in 1923. Three years later, he sold the company to two employees: sales manager John F. Willits and accountant Edson L. Outwin for $18,000.

In 1934, the same year that Charles Bard died, C. R. Bard the company became the exclusive distributor of Foley catheters, which were being manufactured by Davol Rubber Company in Providence, RI. In 1940, Bard began to distribute the first American woven catheter, which was being manufactured by the U.S. Catheter & Instrument Corporation in Glenn Falls, NY. This began a 26-year relationship that culminated in the merger of the two companies in 1966. In between, Bard extended their business lines beyond urology to include cardiology, radiology and anesthesiology in 1961.

In 1968, Bard stock was listed on the New York Stock Exchange and the company entered a period of expansion through a variety joint ventures. The company expanded into the Japanese market in 1972 by forming Medicon, Inc. with the Kobayashi Pharmaceutical Company to import and market Bard products. Other joint ventures helped the company expand into Europe and Australia. Bard also acquired many companies during this period including the William Harvey Research Corporation, which expanded Bard’s access for cardiopulmonary products; Catheter Technology Corporation; Angiomed AG (biliary stent); IMPRA, Inc. (vascular prosthetics); Dymax, Inc. (ultrasound technology for placing catheters); Surgical Sense, Inc. (Kugel® patch product line); the assets of ONUX Medical (hernia and soft tissue repair); and the assets of Genyx Medical (technologies for treatment of stress urinary incontinence). Bard has continued to expand through acquisitions of other companies, including the 2012 acquisition of Neomend, Inc., which developed and supplied sprayable surgical sealants, and the 2013 acquisition of Rochester Medical, Inc. for its silicone urinary incontinence and urine drainage products.

The company is a member of the S&P 500 index and trades under the ticker symbol BCR.

C. R. Bard’s Dividend and Stock Split History

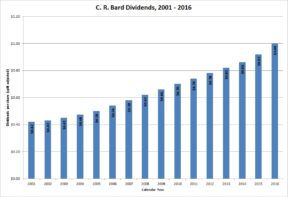

Medical device manufacturer C. R. Bard has grown its dividend at a rate of 6.4% over the last decade.

C. R. Bard started increasing dividends in 1972 and met the Dividend Aristocrat criteria of 25 consecutive years of increasing regular dividend payments in 1996. Since 2003, C. R. Bard has announced annual dividend increases in June, with the stock going ex-dividend in July.

C. R. Bard has compounded its payout at an average rate of 6.2% over the last 5 years and 6.4% over the last 10 years.

Since coming public in 1968, Bard has split its stock 5 times. Four of those splits, in 1972, 1986, 1988 and in May 2004, were 2-for-1. The fifth, in 1982, was 3-for-2.

C. R. Bard’s Direct Purchase and Dividend Reinvestment Plans

C. R. Bard has both direct purchase and dividend reinvestment plans. Investors interested in participating in either of these plans can find information at ComputerShare’s Investment Center website. The dividend reinvestment plan allows you to reinvest dividends in full or in part; you can also choose to have the dividends directly deposited into your checking account.

Bard covers some of the fees associated with the direct purchase and dividend reinvestment plans. First, Bard pays the enrollment fee for new investors, which is usually $10. Second, Bard pays the transaction and per share fees when reinvesting dividends, which means that the full amount of dividends will be used to purchase new shares. For one-time direct purchases, you’ll pay $5 plus 3 cents per share purchased whether by check or direct debit. If you set up ongoing automatic investments using direct debit, the transaction fee is reduced to $1 but you’ll still pay a 3 cents per share fee.

The minimum investment is $250 for a one-time purchase and $25 for ongoing automatic purchases.

When you sell your shares in the plan, you’ll pay 12 cents per share sold plus a transaction fee of between $15 and $25, depending on the type of sell order (batch, market or day limit order). If you enter your order through a customer representative versus online, you’ll pay an additional fee of $15.

Helpful Links

C. R. Bard’s Investor Relations Website

Current quote and financial summary for C. R. Bard (finviz.com)

Information on the direct purchase and dividend reinvestment plans for BCR