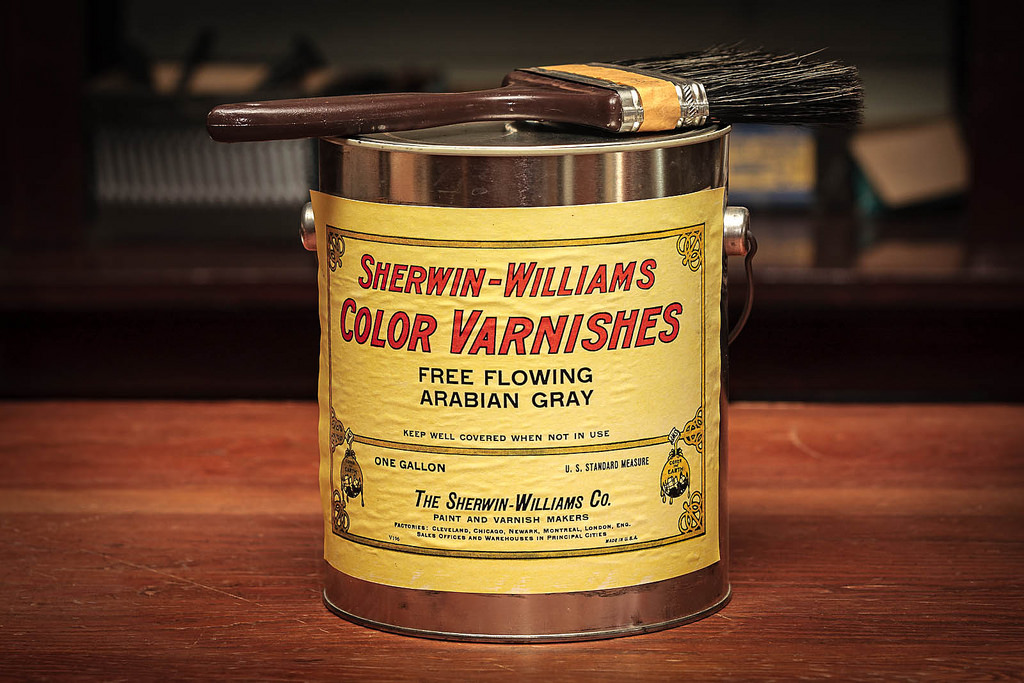

Photo: Flickr.com/gbrazzill

About The Sherwin-Williams Company

Sherwin-Williams is the largest manufacturer of paints and coatings in the United States and the third largest in the world. The company holds over 500 patents and a roster of well-known brand names including Dutch Boy, Krylon, Minwax, Thompson’s Water Seal, and of course the eponymous Sherwin-Williams paints.

The company traces its heritage back to right after the civil war. In 1866, Henry Sherwin became a partner in Truman, Dunham & Company, which specialized in selling paint ingredients, brushes and glass and other decorating products. The partnership dissolved in 1870, and on February 3rd, 1870 – with partner Edward Williams – Sherwin, Williams & Company was born.

For the next 15 years, the company developed new technologies including resealable tin cans and the first successful ready-mixed paint. Sherwin-Williams was incorporated in 1884 and issued its first dividend in 1885. The company continued to innovate and expanded internationally, beginning with Canada in 1895. Sherwin-Williams introduced varnish and insecticide in 1898 and linseed oil production in 1902. The company created an organic chemical business from scratch in 1915 when World War I resulted in the cut off of aniline oil and other chemicals used in paint production from Germany. Through the Depression, World War II and the post-war years, Sherwin-Williams continued to expand – right up until the 1970s.

Since 1885, Sherwin-Williams had paid a dividend to investors. However, during a period of rapid expansion in the 1970s the company took on a heavy debt load. This, combined with operating losses, forced the company to suspend its common stock dividend in 1977. Two years later, Sherwin-Williams reinitiated the dividend and the company has increased it every year since.

Sherwin-Williams is a member of the S&P 500 index and its stock trades under the ticker symbol SHW.

Sherwin-Williams’ Dividend and Stock Split History

Sherwin-Williams has increased dividends since 1979 and met the Dividend Aristocrat criteria of 25 consecutive years of dividend increases in 2003. The company traditionally announces annual dividend increases in early February, with the stock going ex-dividend later in the month.

Sherwin-Williams has compounded its payout at an average rate of 11.5% over the last 5 years and 9.4% over the last 10 years.

Sherwin-Williams has split its stock 5 times since 1981. The company split its stock 2-for-1 in January of 1981, 1983, 1986, 1991 and most recently in 1997.

Sherwin-Williams’ Direct Purchase and Dividend Reinvestment Plans

Sherwin-Williams has both direct purchase and dividend reinvestment plans. The plans are only open to existing shareholders of Sherwin-Williams stock. What this means is that if you do not currently own any Sherwin-Williams stock, you have to buy at least one share through a broker and then have the shares transferred into your own name. (When you own shares through a broker, from the company’s perspective the broker is the registered shareholder. The broker then keeps track of the various company stock that you own.) Investors interested in participating in either of these plans can find information at Wells Fargo’s ShareOwner Online Investment Plan site. If you’re interested in directly purchasing Sherwin-Williams stock, the minimum purchase is $10 whether investing by check or by automatic debit.

The plans are very friendly to investors, as Sherwin-Williams pays all of the purchase fees to encourage employees and investors to buy shares through the plan. There is no initial fee to start participating in the plans. You will pay fees when you sell your shares through the plan: between $15 to $30, depending on the type of sales order (batch, market, limit, or stop) plus 10 cents per share sold. You’ll also pay $5 to have the proceeds directly deposited to your savings or checking account.

Helpful Links

The Sherwin-Williams Company’s Investor Relations Website

Current quote and financial summary for The Sherwin-Williams Company (finviz.com)

Information on the direct purchase and dividend reinvestment plans for SHW

(Look for “The Sherwin-Williams Company” under Dividend Reinvestment Plans Companies.)