ABM Industries provides parking lot and garage management services to commercial, private and governmental customers. Photo courtesy Paul Sableman/flickr.com.

About ABM Industries

ABM Industries provides facility services for a variety of commercial and governmental customers throughout the United States and in the United Kingdom. These services include building maintenance, janitorial and landscaping services, and parking lot/garage management. The company is headquartered in New York City and employs over 118,000 people.

ABM reports its financial results in 6 distinct reportable segments: Janitorial, Facility Services, Parking, Security, Building & Energy Solutions, and “Other”.

The Janitorial segment provides contract cleaning services to office buildings and educational institutions across all 50 states, Puerto Rico and the District of Columbia. Most of the contracts are fixed-price, have periods ranging from 1 to 3 years and include automatic renewal clauses. In Fiscal Year (FY) 2014 (which ended October 31, 2014), this segment provided slightly more than half of the company’s revenues.

The Facility Services segment provides onsite engineering and technical services to office buildings, data centers, manufacturing facilities and other commercial buildings. The segment’s contracts cover customers in 42 states and the District of Columbia, along with some work in the United Kingdom. Most of the contracts are cost-plus, meaning that the customer pays ABM for all the fixed and variable costs, plus a percentage of the costs. The Facility Services segment provided 11.9% of ABM’s FY 2014 revenue.

ABM reports all its parking and transportation services work under the Parking segment, which covers customers in 41 states and D.C. The contracts in this segment come in one of three classes: (1) Managed Locations, in which ABM is paid a management fee; (2) Leased Locations, in which ABM leases the parking facilities from the owner and collects the profits; and (3) Allowance Locations, in which ABM is paid a fixed or hourly fee to provide parking services. The Parking segment provided 12.2% of ABM’s FY 2014 revenue.

Financial information from providing security services are reported under the Security segment. These services include staffing, mobile patrol and investigative services, electronic monitoring of fire or life safety systems, and security consulting services. The segment provided 7.6% of ABM’s FY 2014 revenues, and the largest portion of this came from filling private guard positions. Customers are billed on a per hour basis for the services provided.

The Building & Energy Solutions segment provides HVAC, electrical and general maintenance and repair services for commercial, healthcare and public customers, including military base operations. The segment also operates franchises under four brand names (Linc Network, CurrenSAFE, GreenHomes America, and TEGG). The segment provided 9.6% of ABM’s FY 2014 revenues.

Finally, aviation facility services like passenger assistance, aircraft cabin cleaning and shuttle bus operations are reported under the “Other” segment. This segment was formed when ABM acquired Air Serv in November 2012; it provides services in 24 states and the United Kingdom. 7.3% of ABM’s FY 2014 revenues came from this segment and, of these nearly half came from two customers (which the company does not identify).

In FY 2014, ABM posted revenues of $5.0 billion and income of $75.6 million, numbers that were up 4.6% and 3.7%, respectively. Earnings per share were up 1.5% to $1.32 and shareholders’ equity was up 5.6% to $968.8 million. The increase in revenues was due mostly to organic growth from new contracts. The segments with the strongest growth included Parking (up 12.4% due to a realignment in the operational structure that increased the segment’s margins) and Building & Energy Solutions (up 51.0%, mostly from acquisitions).

ABM has an active acquisition program. In 2014, the company completed 3 acquisitions with a total value of $52.7 million. These acquisitions expanded the company’s Janitorial segment business in the United Kingdom and Building & Energy Solutions business in the United States.

In September 2012, ABM’s board authorized a $50 million share repurchase plan. At the end of FY 2014, about $30 million was left to use on the current authorization, representing about 1.8% of the company’s current outstanding shares.

The company is a member of the S&P Small Cap 600 and Russell 2000 indices and trades under the ticker symbol ABM.

ABM Industries’ Dividend and Stock Split History

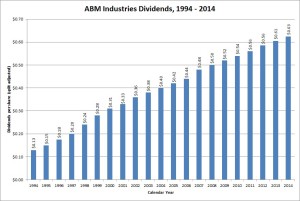

ABM Industries has increased dividends since 1967. Since 2012, ABM has announced its annual dividend increase in the 2nd week of December, with the stock going ex-dividend at the end of December. In December 2014, ABM announced a 3.2% dividend increase to an annualized rate of 64 cents. I expect ABM to announce its 49th year of dividend growth in December 2015.

Since 2002, ABM has increased the quarterly dividend by half a cent each year, resulting in slow but steady dividend growth. The company has compounded the dividend at an average rate of 3.75% over the last 5 years and 4.56% over the last 10 years. The longer-term dividend growth rates are higher, reflecting the strong growth from 1995 – 2000. Over the last 20 and 25 years, ABM has compounded dividends at 8.22% and 6.98%, respectively.

Since 1983, ABM has split its stock 4 times. The stock split 3-for-2 in February 1983 and 2-for-1 in July 1992, August 1996 and May 2002. A single share of stock purchased before February 1983 would now be 12 shares.

ABM Industries’ Direct Purchase and Dividend Reinvestment Plans

ABM Industries has both direct purchase and dividend reinvestment plans. You must already be an investor in ABM Industries to participate in the plans. If you own shares of Universal Health Realty Income Trust stock in your brokerage account, you’ll have to have them transferred into your name in order to join the plans. The minimum amount for additional direct purchases is $50. The dividend reinvestment plan allows for partial reinvestment of dividends.

The direct purchase plan is favorable to investors, as ABM covers the transaction and per share fees for additional purchases. On the other hand, when you purchase additional shares through the dividend reinvestment plan, you’ll pay a transaction fee of 5% up to $3. When you sell your shares, you’ll pay a transaction fee of between $15 and $25, depending on the type of sell order you request, plus a commission of 12 cents per share. You’ll also pay an additional $15 to place your sell order by phone (as opposed to online or by mail). All fees are deducted from the sales proceeds.

Helpful Links

ABM Industries’ Investor Relations Website

Current quote and financial summary for ABM Industries (finviz.com)

Information on the direct purchase and dividend reinvestment plans for ABM Industries