Photo courtesy Alan Cleaver/flickr.com.

ACE Limited acquired The Chubb Corporation in January 2016 and changed its name to Chubb Limited. You can read about Chubb Limited here.

About ACE Limited

ACE Limited is a Zurich-based holding company whose subsidiaries provide insurance and reinsurance services across 54 countries. In addition to covering the traditional insurance lines of home and automobile insurance, the company also covers niche markets like aviation and energy, and provides liability insurance to high-net-worth individuals and families. At the end of 2014, ACE had total assets of $98 billion and employed about 21,000 people worldwide.

ACE divides its business into 5 distinct segments: Insurance – North American Property & Casualty, Insurance – Overseas General, Insurance – Agriculture, Global Reinsurance, and Life.

The North American Property & Casualty Insurance business segment generated $6.1 billion in net premiums in 2014, up 6.7% from 2013 and 35% of ACE’s total net premiums. This segment comprises ACE’s business in the United States, Canada and Bermuda, and two-thirds of the segment’s premiums came from retail insurance premiums in the U.S. The segment provides a variety of standard and niche insurance products, including general liability, workers’ compensation, commercial marine, professional and medical liability lines, and environmental risk liability.

The Overseas General Insurance segment generated 39% of ACE’s total 2014 premiums. Net premiums were up 7.5% to $1.5 billion in 2014. This segment provides insurance to the rest of the world; ACE has business in Europe, the Asia-Pacific region, Africa, and Latin America.

The Agricultural Insurance segment provides crop, “Rain & Hail”, and other specialized commercial insurance products geared towards farms and ranches. The segment generated net premiums of $1.5 billion in 2014, down over 9%, which comprised 9% of ACE’s total net premiums.

Finally, the Life and Global Reinsurance segments generated 11% and 6%, respectively, of ACE’s 2014 net premiums. The Life segment operates mostly in emerging markets, including China. Huatai Life Insurance Co., which operates in 14 provinces in China, is partially (36%) owned by ACE Limited.

ACE Limited generated $17.4 billion in net premiums in 2014, up nearly 5% from 2013. Operating income was up 3% to $3.3 billion, but due to the effect of rising interest rates on the company’s mark-to-market accounting, the company reported net income of $2.9 billion, which was down 24%. Correspondingly, earnings per share were down 23% to $8.42. Based on current annualized dividends of $2.68, this gives ACE Limited a payout ratio of 32%.

The company also has an active share repurchase program, having spent $1.4 billion to buy back 14 million shares in 2014 and another $211 million in the first two months of 2015 to buy back 1.9 million shares. The company has $1.3 billion remaining in the current repurchase program.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol ACE.

As a member of the S&P 500 index, Standard & Poor’s should designate ACE Limited as an S&P 500 Dividend Aristocrat once the company has raised dividends for 25 consecutive years. I believe that ACE Limited will continue to raise dividends going forward, which means that it should become an S&P Dividend Aristocrat at the beginning of 2019.

ACE Limited’s Dividend and Stock Split History

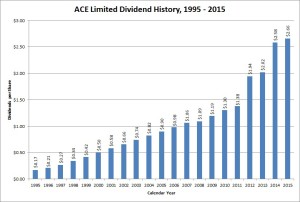

A growing insurance business has supported ACE Limited’s dividend growth of over 14% a year for the last 20 years.

ACE Limited has increased its dividend payout year-over-year since coming public in 1993. The company has an irregular pattern of announcing dividend increases, but generally does so every 2 to 4 quarters. Over the last three years, dividend increases were announced in the 2nd quarter of 2012, the 2nd quarter of 2013, the 4th quarter of 2013, the 2nd quarter of 2014, and the 2nd quarter of 2015. At the most recent dividend increase announcement, in May 2015, the company announced that it would pay the annual dividend in four quarterly installments. Hence, I estimate that ACE Limited will announce its next increase in May 2016, with the stock going ex-dividend at the end of June 2016.

ACE’s most recent dividend increase of 3.1% to an annualized rate of $2.68 was unusually small for the company. In general, annual dividend increases have ranged from the high single digit percentages to increases in excess of 20%. ACE’s 5-year compounded annual dividend growth rate (CADGR) is 15.40%, making ACE one of the few companies that have doubled its dividend over the last 5 years. Over the last 10 and 20 years, the company’s CADGRs are 11.45% and 14.85%, respectively.

With regards to stock splits, ACE Limited split its stock only once – a 3-for-1 split in March 1998.

Over the 5 years ending on December 31, 2014, ACE Limited stock appreciated at an annualized rate of 20.76%, from a split-adjusted $44.47 to $114.21. This significantly outperformed the 13.0% annualized return of the S&P 500 during this time.

ACE Limited’s Direct Purchase and Dividend Reinvestment Plans

ACE Limited has both direct purchase and dividend reinvestment plans. You will need to be a current shareholder to participate in the plans, which means that if you own shares through your broker, you’ll need to have them transferred into your name. Once enrolled, the minimum investment amount for the direct purchase plan is $25 per transaction, up to $3000 per month.

The fee structure of the plans is favorable to investors. There is no setup fee to join the plan and ACE covers all costs associated with share purchases. The only fees associated with the plan are when you sell your shares. When you do, you’ll pay a transaction fee of between $15 and $25 (depending on the type of sell order) and a commission of 12 cents per share.

Helpful Links

ACE Limited’s Investor Relations Website

Current quote and financial summary for ACE Limited (finviz.com)

Information on the direct purchase and dividend reinvestment plans for ACE Limited