About Aqua America

Aqua America provides water and wastewater services to 3 million customers across 8 states. Acquisitions have powered over 20 years of dividend growth.

Photo courtesy Jenn Durfey/flickr.com.

Aqua America is a holding company that, through its subsidiaries, provides water and wastewater utilities to 3 million customers across eight states. The company owns and operates over 1440 public water systems, and 187 wastewater treatment plants and collection systems. Aqua America originated as the Springfield Water Company in 1886 when a group of Swarthmore College professors were granted a charter to supply water to residents of Springfield Township, PA. Having started in Pennsylvania, half of Aqua America’s customers are in that state with the remaining customers distributed over Illinois, Indiana, New Jersey, North Carolina, Ohio, Texas and Virginia.

Aqua America’s strategic objective is to grow through the fragmented water utility industry through acquisitions. The company completed 13 acquisitions in 2014. The most recent acquisitions were the Caroline Water Company, which serves 3000 people in Caroline County, VA; Texas H2O which serves 3300 people in the suburbs of the Dallas-Fort Worth metropolitan area; and the Spartan Village water and wastewater systems – serving 650 people – from the New Jersey village government.

In 2013, the last year for which full year figures are currently available, Aqua America’s income was $221.3 million, up 12.6% from 2012; and its income per share was $1.25, up 11.6% from 2012. Aqua America’s customer base was up 1.3% to 941,000 customers.

One area of concern is the company’s high level of debt. At the end of 2013, Aqua America had $1.5 billion in long-term fixed-rate debt with an average interest rate of 5%. Another area of concern is the degree to which Aqua America’s organic income growth is dependent on rate increases granted by local and state regulatory authorities.

The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol WTR.

Aqua America’s Dividend and Stock Split History

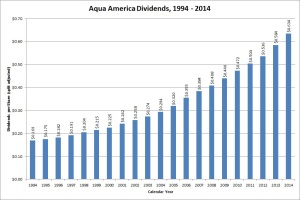

Aqua America has paid quarterly dividends since 1944 and increased dividends annually since 1992. Last year, Aqua America announced a dividend increase of 8.6%, from 15.2 cents to 16.5 cents per share, at the beginning of August. The stock went ex-dividend with the increased dividend in mid-August. I expect Aqua America to announce its next dividend increase in early August 2015.

Aqua America has a history of moderate dividend increases, with annual dividend growth in the mid-single digit percentages. From 2009 – 2014, Aqua America grew its dividend from 44 cents to 63.4 cents per share, for a 5-year compounded annual dividend growth rate (CADGR) of 7.58%. Aqua America’s 10-year and 20-year CADGRs are 7.99% and 6.83%, respectively.

Aqua America has split its stock eight times since 1986. In September 1986 and June 1996, Aqua America conducted 3-for-2 stock splits. This was followed by a 4-for-3 stock split in January 1998, and 5-for-4 stock splits in December 2000, December 2001, and December 2003. In December 2005, Aqua America split its stock again, this time 4-for-3. And most recently, the company split its stock 5-for-4 in September 2013.

Over the 5 years ending on December 31, 2014, Aqua America stock appreciated at an annualized rate of 16.93%, from $12.22 to $26.70. This beat both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time.

Direct Purchase and Dividend Reinvestment Plans

Aqua America has both direct purchase and dividend reinvestment plans. The company has created a very favorable pair of plans for investors. The company pays nearly all of the fees associated with purchasing stock, including through dividend reinvestment. There are no fees to setup an account, or to purchase stock – either directly or through dividend reinvestment. The minimum investment for new accounts is $500, either in a single purchase or in 10 monthly installments of at least $50 each. The plan permits both purchases by check or automatic debit.

The most attractive feature of Aqua America’s dividend reinvestment plan is the discount. The company currently offers a 5% discount on the purchase price of shares bought through the dividend reinvestment plan. This will reduce your cost basis and is taxable, but is extremely beneficial to you as an investor. Aqua America is one of a very few companies that offers shares purchased through dividend reinvestment at a discount to the market price.

Finally, when you go to sell your shares in the plan, you’ll pay a transaction fee of either $15 or $25, depending on the type of sell order you request. You’ll also pay an additional fee of 12 cents per share sold. Furthermore, if you place your sell order through a representative on the phone vice automatically on the plan website, you’ll pay an additional fee of $15.

Helpful Links

Aqua America’s Investor Relations Website

Current quote and financial summary for Aqua America (finviz.com)

Information on the direct purchase and dividend reinvestment plans for WTR

Want to find out about more great dividend growth stocks?

Check out the list of current S&P Dividend Aristocrats.