Community Bank Systems has nearly 190 bank branches in upstate NY and northeastern PA, including in Syracuse, NY. Photo of Syracuse University Building courtesy John Marino/flickr.com.

About Community Bank Systems

Community Bank Systems is a holding company with banking operations in Upstate New York, northern Pennsylvania, and upper New England. The company, with headquarters outside Syracuse in DeWitt, NY, prides itself on delegating decision-making to individual branches as an individual community bank might. The company was incorporated in April 1983 and employs 2,000 people.

The company focuses on banking services in smaller towns outside metropolitan areas and has a strong market position, with #1 or #2 deposit market share in nearly 75% of the towns where its branches are located. In addition to its banking subsidiary, the company also has a subsidiary that focuses on administering employee benefits. Benefit Plans Administrative Services, Inc. provides consulting services for employee benefits and administers business retirement plans.

Community Bank Systems has three reportable business segments: Banking, Employee Benefits Services, and Wealth Management. The Banking segment operates the company’s banking subsidiary, Community Bank, N.A., and is responsible of the company’s nearly 190 bank branches across 147 towns in upstate New York and northeastern Pennsylvania and has over $6 billion in deposits. This segment provided nearly 90% of the company’s total net income in 2014.

The Employee Benefits Services segment provides retirement plan and employee benefit administration, and actuarial, health and welfare consulting services to businesses. The segment serves 3,600 plan sponsors across the country and has $18 billion in assets under custody. This segment provided about 8% of the company’s total income in 2014.

Finally, the Wealth Management segment provides trust services, investment and insurance products and asset advisory services to individuals and trusts. This segment provided about 2% of Community Bank Systems’ total income in 2014.

Community Bank Systems had total income of $93.4 million in 2014, up 9.8% from 2013. Earnings per share were $2.26, up 9.2% from 2013, giving the company a current payout ratio of 55% based on the current dividend of $1.24. Income was up due to the lack of a net loss on the sale of investment securities, and the impact of acquisitions on the bottom line. Deposits were up 5.1% through a combination of acquisitions and organic growth. In general, the company seeks to grow by completing 1 – 2 acquisitions a year.

Community Bank Systems has an active share repurchase program. In December 2014, the company authorized the repurchase of 2 million shares by the end of 2015. To date, 1,735,000 shares remain to be repurchased on the program, representing over 4% of the total number of outstanding shares.

The company is a member of the S&P Small Cap 600 and Russell 2000 indices and trades under the ticker symbol CBU.

Community Bank Systems’ Dividend and Stock Split History

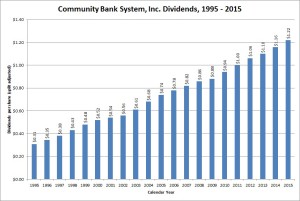

Community Bank Systems began increasing dividends in 1992. The company announces dividend increases in mid-August and the stock goes ex-dividend in the middle of September. In August 2015, Community Bank Systems announced a 3.33% increase to an annualized rate of $1.24. I expect Community Bank Systems to announce its 25th year of dividend increases in August 2016.

Community Bank Systems generally grows dividends year-over-year in the mid-single digit percentages. Over the last 5 years, the company has compounded its dividend at a rate of 5.35%. The dividend growth over longer periods is similar, with 10-year and 20-year annual compound rates of 5.13% and 7.13%, respectively.

Community Bank Systems has split its stock 4 times in the last quarter century, each time 2-for-1. The company split the stock in November 1984, May 1986, March 1997, and most recently in April 2004. A single share of stock purchased prior to the first split would now be 16 shares.

Over the 5 years ending on December 31, 2014, Community Bank Systems, Inc. stock appreciated at an annualized rate of 18.93%, from a split-adjusted $15.76 to $37.50. This outperformed both the 13.0% compounded return of the S&P 500 index and the 14.0% compounded return of the Russell 2000 Small Cap index and 15.9% annualized return of the S&P Small Cap 600 index over the same period.

Community Bank Systems’ Direct Purchase and Dividend Reinvestment Plans

Community Bank Systems has both direct purchase and dividend reinvestment plans. You do not need to already be an investor in Community Bank Systems to participate in the plans. For new investors, the minimum initial investment is $250. Follow on direct investments have a minimum of $25. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

The fee structures of the plans are favorable for investors – while there are fees associated with both the initial purchase and sale of shares, the fees are modest and there are no fees on reinvested dividends. For your initial purchase of stock through the plan, you will pay an enrollment fee of $2.50 plus a commission of 10 cents per share. Once you are enrolled in the plan, you won’t pay a fee on direct purchases or on purchases through reinvested dividends.

When you go to sell your shares in the plan, you will pay a fee of $7.50 per sell order plus a commission of 10 cents per share.

Helpful Links

Community Bank Systems’ Investor Relations Website

Current quote and financial summary for Community Bank Systems (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Community Bank Systems