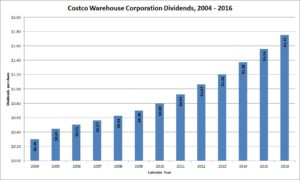

Costco Warehouse Corporation has grown dividends since 2004. Photo: Flickr.com/Mike Mozart

About Costco Warehouse Corporation

Costco Wholesale Corporation operates a chain of membership warehouse stores that offer members lower prices on a variety of nationally and privately branded products. The products tend to be sold in larger volume packaging than in grocery stores and other retailers. In addition, there tend to be a smaller number of products; the average store carries roughly 3,700 distinct products. The warehouses also include ancillary businesses – like food courts, photo processing centers, pharmacies and gas stations – to encourage members to visit more frequently. The company has more than 80,000 members worldwide, with nearly 700 warehouses in the United States, Canada, Mexico, the United Kingdom, Japan, South Korea, Taiwan, Australia, and Spain.

Approximately 20% of Costco’s worldwide sales come each from the sale of food products and sundries, with 15% of net sales coming each from electronics and large appliances, fresh foods, apparel and small appliances, and ancillary businesses.

The company is a member of the S&P 500 index and trades under the ticker symbol COST.

Costco’s Dividend and Stock Split History

Costco Wholesale Corporation has paid and grown dividends since 2004. The company generally announces dividend increases in mid-April, with the stock going ex-dividend at the end of April. In April 2016, the company’s announced an 12.5% increase to its payout, to an annualized rate of $1.80 per share.

Costco has an outstanding, if brief record of dividend growth. Annual year-over-year dividend growth has been no less than 10% each year since 2004. Costco has compounded the dividend at 13.6% over the last 5 years and at 13.2% over the last decade.

Costco has split its stock 3 times since coming public. The most recent split – a 2-for-1 split – was in January 2000. Prior to that, the company executed a 3-for-2 split in March 1992 and 2-for-1 in May 1991. A single share of stock purchased prior to the first split would now be 6 shares.

Over the 5 years ending on December 31, 2015, Costco stock appreciated at an annualized rate of 21.03%, from a split-adjusted $61.83 to $160.59. This dramatically outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Costco’s Direct Purchase and Dividend Reinvestment Plans

Costco has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. The minimum initial investment in the plans must be $250, either in a single purchase or through automatic debits of at least $25 each over at least 10 months. Partial dividend reinvestment is permitted for shareholders with at least 100 shares in the plan.

The plans are not favorable for investors, as the fees for purchases and sales are significant. There is a $15 enrollment fee for the plans. In addition, when purchasing shares you’ll pay a fee of $5 for purchases by check, $3.50 for one-time purchases by debit or $2.00 for recurring purchases by debit. For shareholders with more than 100 shares, there is a 5% fee on reinvested dividends, up to a maximum of $3. The company pays this transaction fee for shareholders with less than 100 shares. Finally, there is also a commission of 3 cents per share on all purchases. When you sell your shares in the plan, you’ll pay a fee of $15 for batch sell orders or $25 for other types of sell orders along with a 12-cent per share commission. Finally, if you place your sell order through a customer service representative on the phone, you’ll pay another $15 fee. All fees will be deducted from the sales proceeds.

Helpful Links

Costco Wholesale Corporation’s Investor Relations Website

Current quote and financial summary for Costco Wholesale Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Costco Wholesale Corporation