EOG Resources explores for and produces crude oil and condensates, and natural gas in various locations around the United States. Photo: Freeimages.com/Dani Simmonds

About EOG Resources

EOG Resources is an oil exploration and production company with operations in the United States, The Republic of Trinidad and Tobago, the United Kingdom and China. The company was organized in 1985, is headquartered in Houston, Texas and employs approximately 2,800 people.

While EOG Resources does operate internationally, the company’s operations are focused on the United States. Approximately 97% of EOG Resources’ reserves are located in the United States, with the vast majority of the remaining 3% located in Trinidad. Within the United States, the major operations are in the Eagle Ford and Permian basins in Texas. Other operations are located in the Rocky Mountain region and Pennsylvania.

More than 99% of EOG’s crude oil and condensates, and natural gas liquids reserves, and roughly 70% of the company’s natural gas volumes are in the United States. Of the company’s leased lands, nearly 90% are in the United States.

In addition to the exploration and production fields, EOG Resources also owns crude oil loading facilities near Stanley, ND; St. James, LA; and Stroud, OK. The company also owns sand mine and sand processing plants in Hood County, TX; Chippewa Falls, WI; and Loving, NM.

The company is a member of the S&P 500 index and trades under the ticker symbol EOG.

EOG Resources’ Dividend and Stock Split History

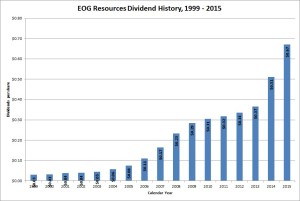

EOG Resources has paid dividends since at least 1990 and grown them since 1999. The company generally increases its dividend in the 2nd quarter of the year, but over the last few years has not followed this schedule. The last dividend increase was in the 4th quarter of 2014, when EOG increased the dividend by 34% to 67 cents a year. This was the second dividend increase that year, but the company skipped an increase in 2015.

EOG Resources has an excellent dividend growth record. Since beginning its year-over-year dividend increases in 1999, the company has compounded its dividend at a rate of more than 21%. Over the last 5 and 10 years, EOG Resources’ average annual dividend growth rates are 17.05% and 24.48%, respectively.

Since 1994, EOG Resources has split its stock three times, each time 2-for-1. These stock splits occurred in June 1994, March 2005 and, most recently, in March 2014.

Over the 5 years ending on December 31, 2015, EOG Resources stock appreciated at an annualized rate of 9.59%, from a split-adjusted $44.67 to $70.60. This performed comparably with the 10.20% compounded return of the S&P 500 index over the same period.

EOG Resources’ Direct Purchase and Dividend Reinvestment Plans

EOG Resources does not have a direct purchase or dividend reinvestment plan. In order to invest in EOG Resources stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

EOG Resources’ Investor Relations Website

Current quote and financial summary for EOG Resources (finviz.com)

Thanks for the review. Are you planning on buying shares of this stock?

Hi-

I don’t plan on buying EOG with this yield. Although the dividend growth is very fast, the sub-1% yield doesn’t interest me at this point. If the stock were to pull back some, I’d consider it.

Thanks for the comment!

Cheers,

Jason

I’ve owned shares of EOG for about 4.5 years and it’s been solid for me thus far. Even with the current low oil environment I’m still sitting on a 55% total return and 10% annualized return so I’m quite happy with it. The dividend yield doesn’t offer a whole lot and dividend growth has flamed out although I can’t blame management for putting things on pause. They’ve paid the same quarterly rate for 7 quarters in a row but the dividend growth streak is still in tact and they have until the end of this year to raise the dividend to keep it going. If management doesn’t raise the dividend I’ll be considering selling, although I’m already considering selling because it’s such a tiny position for me. Thanks for the overview on a not as followed company.

Hi JC-

Like most oil exploration companies, EOG is struggling. Past dividend growth has been quick, but the dividend yield here is too low for me.

Thanks for sharing your story – I’m glad the investment has worked out for you.

Cheers,

Jason